Bitget Daily Digest (6.13)|Israel Launches Strikes Against Iran, Market Dips in the Short Term, Major Unlocks for $IMX and $COOKIE Ahead

Today's Preview

-

The preliminary value for US one-year inflation expectations for June will be released today. Previous: 6.60%.

-

Immutable (IMX) will unlock about 24.52 million tokens today, accounting for 1.33% of circulating supply, worth approximately $12.8 million.

-

Cookie DAO (COOKIE) will unlock about 13.88 million tokens today, accounting for 2.54% of circulating supply, worth approximately $2.9 million.

Macroeconomics & Hot Topics

-

On June 13, according to market reports, alarms sounded throughout Israel as the country launched a preemptive strike on Iran. Israeli Defense Minister Gallant declared a national state of emergency, stating that after Israel’s strikes, missile and drone attacks against Israel and its civilians are expected in the near future.

-

The SEC and Ripple jointly request a $125 million fine settlement from the court, aiming to conclude years of litigation. Ripple and the US Securities and Exchange Commission (SEC) have filed a joint motion with the US District Court for the Southern District of New York, asking the court to lift the injunction against Ripple and agree on a $125 million penalty—$50 million of which would be paid to the SEC, with $75 million retained by Ripple. Both sides highlight the SEC’s shift in approach towards crypto since the previous chair stepped down, the rescinding of previous probes and charges, and the formation of a new working group to build a regulatory framework. They argue there are “special circumstances” for a revised ruling, which would help settlement, avoid appeals, and save resources. The motion marks the latest development in nearly five years of legal dispute.

-

US SEC delays approval decisions on Dogecoin, Hedera, and Avalanche spot ETFs. As reported by The Block, the SEC has postponed decisions on several crypto ETF filings, including Bitwise’s Dogecoin ETF, Grayscale’s Hedera Trust, and VanEck’s Avalanche ETF. The SEC stated that the delay does not indicate any conclusion on the issues, but a desire to collect more public input.

-

BlackRock incorporates crypto assets into its 2030 strategic vision. Yesterday, it was revealed that $11.5 trillion AUM giant BlackRock has made “becoming the world’s largest crypto asset manager” a core part of its 2030 vision. Its crypto division now manages over $50 billion, covering ETFs like IBIT and ETHA, handling Circle’s USDC reserves, and overseeing a $200 million BUIDL tokenization fund.

-

Trump Calls Powell an “Idiot”; Says 200 bps Rate Cut Would Save $600B Per Year. Trump said he has no plans to fire Fed Chair Jerome Powell, but called him an “idiot” for not cutting rates. In a White House event Thursday, Trump argued that a 200 basis point cut would save the US $600 billion annually. He criticized, “We spend $600 billion every year just because an ‘idiot’ is sitting here saying ‘I don’t see enough reason to cut rates yet.’” Trump added that if inflation rises, he supports a rate hike, “but with inflation falling now, I might have to take action.”

Market Updates

Institutional Views

News Updates

-

US President Trump suggests the Fed cut rates by 200 basis points.

-

Trump: Will build a clear regulatory framework to help the US lead in crypto innovation.

-

Bitcoin Era founder Huang Tianwei suspected of scamming fellow citizens of $20 million in crypto, arrested in Thailand.

-

Brazil’s parliament considers making Bitcoin a strategic reserve, targeting 5% of international reserves.

-

Japanese Prime Minister Shigeru Ishiba: Divisions remain, no rush to sign a deal with the US.

Project Developments

-

Morpho launches V2 with fixed-rate and fixed-term lending protocols.

-

WLFI adds Swap, lending, and APP modules to its official website (teaser status).

-

Trident announces a $500 million funding plan for the XRP vault and appoints a new strategic advisor.

-

SUN completes its 43rd token buyback and burn.

-

Data: TRON network saw a record $694.5 billion in USDT transfers in May, with large transactions accounting for nearly 60%.

-

Cailian Press: Tencent is exploring a $15 billion acquisition of game developer Nexon.

-

OpenSea will fully shut down OS1 on June 16; will remove features like “Deals” in OS2 update.

-

Gemini: Centralized entities now hold 31% of circulating Bitcoin, around $668 billion.

-

Ripple CEO: XRP Ledger could capture 14% of SWIFT’s liquidity within five years.

-

Solayer: Mega Validator selected as a Marinade Select validator.

X Highlights

-

Yond: Why Does Pendle Foster Voluntary User-Generated Content? A Triple-Win Narrative Pendle’s ongoing, organic content production is fueled by its PT/YT design, which connects user participation, strategy, and self-expression. For small investors, YT provides a low-barrier, high-return opportunity—essentially a yield-based launchpad—where every bet is worth breaking down and narrating. vePENDLE holders engage in voting and governance games via derivative protocols like Penpie and Equilibria, gaining both real rewards and community presence. Big players leverage PT and DeFi combinations to maximize capital efficiency, with each strategy review adding content value. Every group finds a “profitable and vocal” position in the ecosystem, making Pendle’s community-driven, interest-aligned content flywheel possible. Link

-

Mike S: Stop Calling Solana Just a Meme Chain—DeFi Data and Narratives Are Quietly Surging Many label Solana a “meme” or “casino” chain, but I focus on the real DeFi growth underneath: TVL nearing $9B, over $2.5B in lending, daily on-chain (spot + derivatives) volume close to $4B, stablecoin supply up 130% YTD, and active users and transaction counts climbing. Importantly, institutions are arriving—BlackRock expanded its $1.7B BUIDL fund to Solana, talk of a SOL ETF is heating up. That’s why I support new projects like @solayer_labs: native, highly-liquid SOL staking, an on-chain stable yield model (sUSD), and real-world use cases like the Emerald card. Solana’s DeFi story is far from over; more mid- to long-term opportunities are surfacing. Link

-

BroLeon: Stop Chasing “the Next Big Thing”—That’s Not Alpha, It’s a Mouse Trap Lately, BNB Chain is flooded with rugs. I’m now more cautious with new projects; I research thoroughly and don’t gamble just to “call the top pick” early in hopes someone else bags it later. If "insider news" has reached you, it’s probably already bait set by whales. Trust sources you’ve worked or traded with, ideally those who’ve both won and lost big—otherwise, test with small positions first. In the USD1 contest, the core players are already set; I only look at whether new contenders offer true early-stage high-multiplier potential, not adding heavy positions lightly. $EGL1, $Janitor, $Liberty, $Bulla are a few I’m watching closely for graduated positioning. Link

-

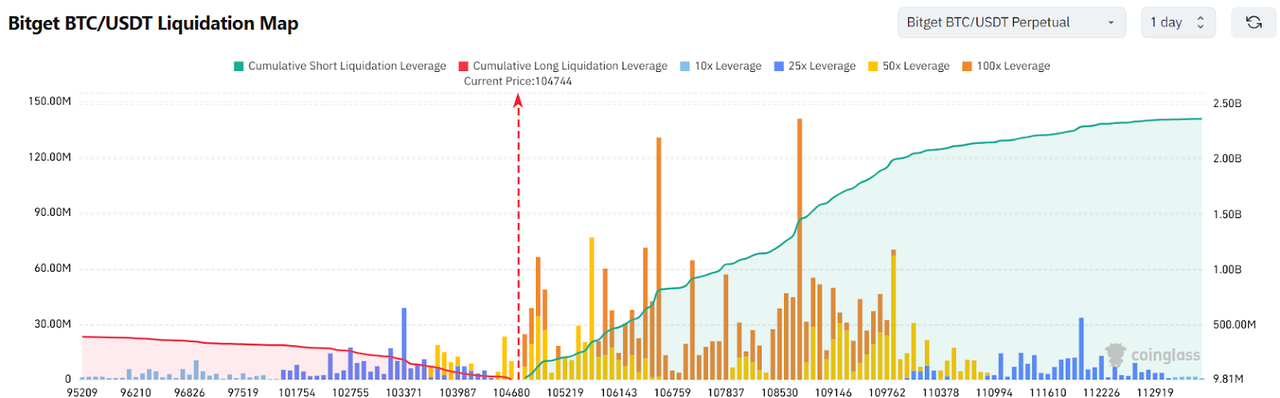

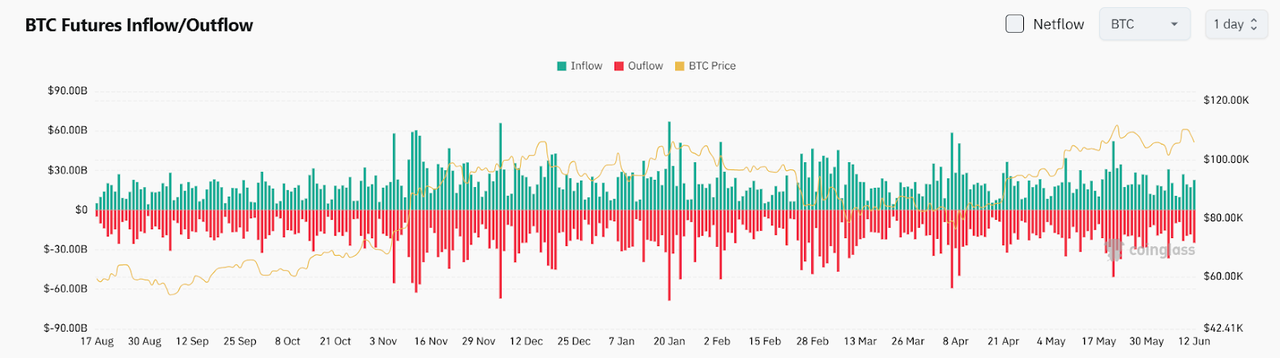

Phyrex: Trump Speaks, PPI Surprises, Geopolitics Unresolved—BTC in a Chaotic Long/Short Zone It’s an info-heavy market. Trump’s lengthy speech at a bill-signing covered US-China trade, his feud with Musk, Middle East tensions, and even mocked Powell—sending mixed but slightly bullish signals. The PPI beat boosted the market slightly, but with tariff policy uncertainties and unresolved geopolitical risks, the overall direction remains unclear. Bitcoin turnover was high in the last 24 hours, with short-term losses evident but the main structure intact. $93,000–$98,000 is still strong support, but volatility risk is elevated in the $100,000–$105,000 range. The long-short battle is fierce; it’s best to stay on the sidelines and wait for a clear signal. Link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

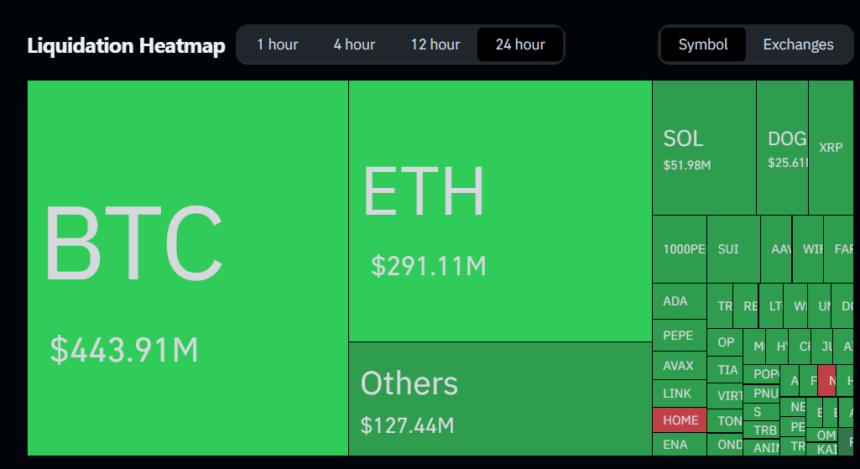

Traders Lose $1.1B in 24h Liquidation as Bitcoin, Ethereum Drop Sharply

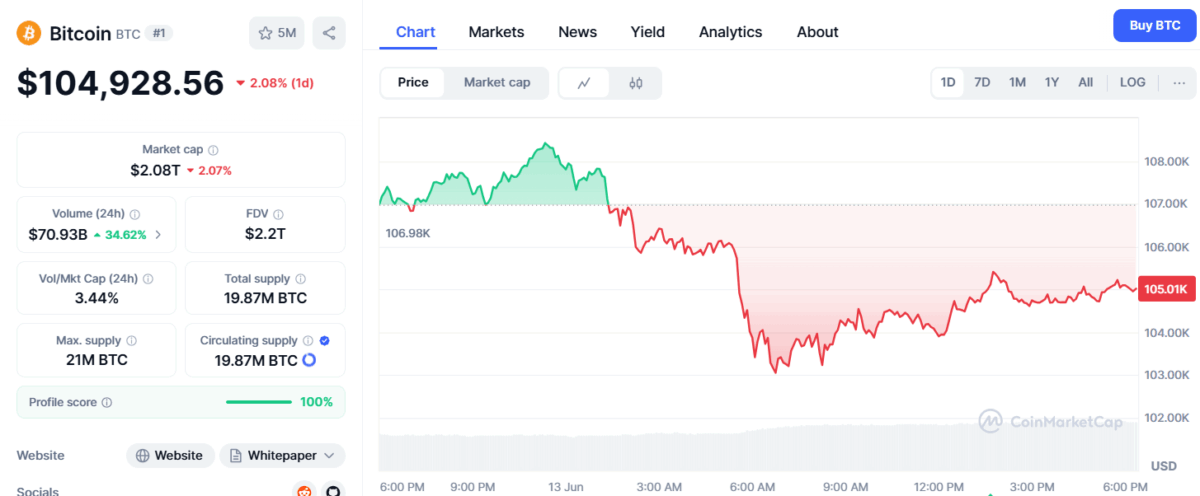

Crypto Price Today (June 13): Ethereum Drops 11%, Bitcoin Dips to $103K; Israel-Iran Tension Crashes Markets

Analysis: Bitcoin needs to stay above $100,000 to maintain its upward trend

Markets reel as Trump says Iran got attacked by Israel for rejecting his nuclear deal

Share link:In this post: Trump said Israel attacked Iran because it rejected his 60-day nuclear deal ultimatum. Iran responded by launching around 100 drones at Israel, triggering a state of emergency. Oil, gold, and the dollar surged while global stocks and crypto fell sharply.