Bitcoin Inflation Falls to 0.27% as Price Eyes $115K

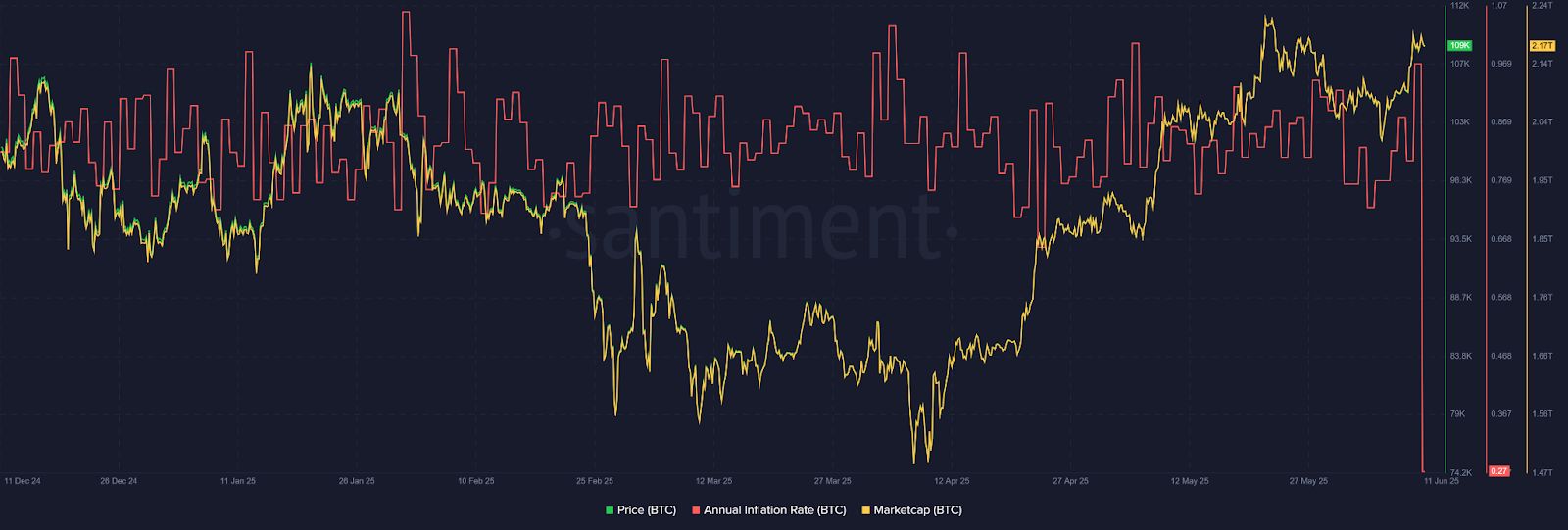

- Bitcoin’s annual inflation rate has dropped to 0.27%, marking its lowest level in 2025.

- The market cap holds strong above $2.17 trillion, with steady buying seen since April.

- Price action and data now support a likely move upward toward the $115,000 price zone.

Bitcoin held firm above $109,000 on June 11 after rebounding from the $106,170 support, aligning with the 20-day EMA and Fibonacci level. The price reached a high of $110,280 and remained stable as momentum indicators continued to signal strength. Additionally, on-chain data from Santiment confirmed a sharp drop in Bitcoin’s annual inflation rate to 0.27%, one of the lowest levels this year.

Source:

TradingView

Source:

TradingView

Market participants continued to defend the $109K–$110K region, keeping short-term volatility contained. Daily candlesticks displayed firm closes and shorter wicks, indicating reduced selling pressure. As this took place, the Relative Strength Index stood at 60.87, staying above the neutral 50 line and suggesting a slightly bullish momentum.

Technical setups aligned with a bullish trendline that emerged in early May, providing traders with increased confidence in the ongoing rally. The following resistance levels are at $111,917 and $115,043. Could Bitcoin maintain this momentum and hit the $115,000 mark?

Inflation Declines as Supply Pressure Weakens

According to Santiment, Bitcoin’s annual inflation rate declined to 0.27% by June 11. This followed several months of high volatility, where inflation had oscillated. The data reflects a considerable reduction in supply-side pressure, making fewer coins available in circulation.

Source:

Santiment

Source:

Santiment

Between December and late February, inflation showed unpredictable patterns while Bitcoin’s price moved between $83,000 and $98,000. However, the sharp drop in inflation coincided with the asset’s recovery in market value. A noticeable rebound began in mid-April, continuing steadily into June.

In addition to stability in price, this reduced inflation rate can also impact the liquidity of Bitcoin in terms of its supply on various exchanges. With the sluggishness in new issuance, scarcity could soon start to impinge upon price behavior.

Related: Bitcoin Devs Defend Relay Rules as Debate Over Spam Grows

Market Cap Reclaims Strength Above $2.17 Trillion

Bitcoin’s market capitalization now stands at $2.17 trillion, according to the latest chart data. This follows a recovery from early March lows, which clearly shows continued institutional and retail engagement.

The market cap declined steeply in Q1 but recovered consistently from late April through June. This turnaround occurred without major policy or macroeconomic shifts, indicating price movement was led by on-chain dynamics. Having a stable momentum, strong support, and cooling supply pressures, Bitcoin is in a good position to attempt the $115,000 mark.

The post Bitcoin Inflation Falls to 0.27% as Price Eyes $115K appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Block Inc. Increases Bitcoin Holdings Despite Q2 Revaluation Loss

Block Invests $12.6M, Bitcoin Holdings Surpass $1B

President Trump’s Crypto 401(k) Order Spurs Market Activity

Trump Signs Order to End Banking Bias Against Crypto