Pi Coin Price Crash: From $3 Hype to $0.63 Reality

The notorious Pi Network token has experienced one of the most dramatic crashes in cryptocurrency history, plummeting from manipulated highs above $3 to a current price of just $0.6344. This collapse raises serious questions about the project that has been plagued by red flags since its inception.

The Controversial Beginning

Pi Network raised significant concerns when it first launched, with multiple warning signs that experienced crypto investors couldn't ignore. The project's questionable mining model and lack of transparency created skepticism from day one. Despite these red flags, the project managed to build a massive following through aggressive marketing and promises of easy wealth.

The mobile "mining" app attracted millions of users who believed they were accumulating valuable cryptocurrency simply by pressing a button daily. This gamification of crypto mining should have been the first major warning sign for investors.

The Manipulated Launch Spike

When Pi coin finally launched on exchanges, the price action was nothing short of suspicious. The token rocketed to astronomical heights, briefly touching levels above $3 according to the chart data. This initial price surge appeared to be heavily manipulated, with:

- Extremely low liquidity allowing small trades to move prices dramatically

- Coordinated buying from unknown sources

- Restricted trading on limited exchanges

- No legitimate price discovery mechanism

PI/USD 2-hours chart - TradingView

Current Pi Coin Price: Market Reality

Price Statistics

Looking at the current data, Pi coin paints a grim picture:

- Current Price: $0.6344 (down 79% from peak)

- Market Cap: $4.65 billion (down 2.65%)

- 24h Volume: $58.13 million (down 9.46%)

- Circulating Supply: 7.33 billion PI tokens

The market cap to volume ratio of 1.25% indicates extremely low liquidity, making the token vulnerable to massive price swings.

Pi Coin Technical Analysis: The Downtrend Continues

The 2-hour chart reveals a clear bearish structure:

- Broken Support: The token has broken below multiple support levels, with the 50-period SMA acting as dynamic resistance

- RSI Weakness: At 37.06, the RSI shows bearish momentum with no signs of reversal

- Volume Decline: Decreasing volume suggests waning interest from traders

- Price Target: The next major support lies around $0.50, representing another potential 20% drop

The blue moving average line clearly shows the downtrend acceleration, with price unable to reclaim this key level since the initial crash.

PI/USD 2-hours chart - TradingView

Why Pi Network Crash Was Inevitable

Several factors contributed to Pi's inevitable price collapse:

1. Unsustainable Tokenomics

With billions of tokens in circulation and minimal real utility, the supply-demand imbalance was always going to pressure prices lower.

2. Lack of Real Use Cases

Despite years of development, Pi Network has failed to deliver meaningful blockchain applications or partnerships that would drive organic demand.

3. Regulatory Concerns

The project's unconventional approach to token distribution and mining has attracted scrutiny from regulators worldwide.

4. Market Maturity

As the crypto market matures, investors are becoming more sophisticated and less likely to fall for projects with questionable fundamentals.

What's Next for Pi Coin?

The outlook remains bearish for several reasons:

- Continued Selling Pressure: Early "miners" looking to cash out will maintain downward pressure

- Limited Exchange Support: Major exchanges remain hesitant to list the token

- Credibility Issues: The project's reputation makes institutional adoption unlikely

- Technical Weakness: Chart patterns suggest further downside potential

Lessons for Crypto Investors

Pi Network's crash serves as a valuable lesson:

- DYOR (Do Your Own Research): Don't trust projects based on hype alone

- Red Flags Matter: When multiple warning signs appear, take them seriously

- If It's Too Good to Be True: Free money doesn't exist in crypto

- Liquidity Matters: Low liquidity tokens are easily manipulated

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk.

$PI $PICoin $PiNetwork

The notorious Pi Network token has experienced one of the most dramatic crashes in cryptocurrency history, plummeting from manipulated highs above $3 to a current price of just $0.6344. This collapse raises serious questions about the project that has been plagued by red flags since its inception.

The Controversial Beginning

Pi Network raised significant concerns when it first launched, with multiple warning signs that experienced crypto investors couldn't ignore. The project's questionable mining model and lack of transparency created skepticism from day one. Despite these red flags, the project managed to build a massive following through aggressive marketing and promises of easy wealth.

The mobile "mining" app attracted millions of users who believed they were accumulating valuable cryptocurrency simply by pressing a button daily. This gamification of crypto mining should have been the first major warning sign for investors.

The Manipulated Launch Spike

When Pi coin finally launched on exchanges, the price action was nothing short of suspicious. The token rocketed to astronomical heights, briefly touching levels above $3 according to the chart data. This initial price surge appeared to be heavily manipulated, with:

- Extremely low liquidity allowing small trades to move prices dramatically

- Coordinated buying from unknown sources

- Restricted trading on limited exchanges

- No legitimate price discovery mechanism

PI/USD 2-hours chart - TradingView

Current Pi Coin Price: Market Reality

Price Statistics

Looking at the current data, Pi coin paints a grim picture:

- Current Price: $0.6344 (down 79% from peak)

- Market Cap: $4.65 billion (down 2.65%)

- 24h Volume: $58.13 million (down 9.46%)

- Circulating Supply: 7.33 billion PI tokens

The market cap to volume ratio of 1.25% indicates extremely low liquidity, making the token vulnerable to massive price swings.

Pi Coin Technical Analysis: The Downtrend Continues

The 2-hour chart reveals a clear bearish structure:

- Broken Support: The token has broken below multiple support levels, with the 50-period SMA acting as dynamic resistance

- RSI Weakness: At 37.06, the RSI shows bearish momentum with no signs of reversal

- Volume Decline: Decreasing volume suggests waning interest from traders

- Price Target: The next major support lies around $0.50, representing another potential 20% drop

The blue moving average line clearly shows the downtrend acceleration, with price unable to reclaim this key level since the initial crash.

PI/USD 2-hours chart - TradingView

Why Pi Network Crash Was Inevitable

Several factors contributed to Pi's inevitable price collapse:

1. Unsustainable Tokenomics

With billions of tokens in circulation and minimal real utility, the supply-demand imbalance was always going to pressure prices lower.

2. Lack of Real Use Cases

Despite years of development, Pi Network has failed to deliver meaningful blockchain applications or partnerships that would drive organic demand.

3. Regulatory Concerns

The project's unconventional approach to token distribution and mining has attracted scrutiny from regulators worldwide.

4. Market Maturity

As the crypto market matures, investors are becoming more sophisticated and less likely to fall for projects with questionable fundamentals.

What's Next for Pi Coin?

The outlook remains bearish for several reasons:

- Continued Selling Pressure: Early "miners" looking to cash out will maintain downward pressure

- Limited Exchange Support: Major exchanges remain hesitant to list the token

- Credibility Issues: The project's reputation makes institutional adoption unlikely

- Technical Weakness: Chart patterns suggest further downside potential

Lessons for Crypto Investors

Pi Network's crash serves as a valuable lesson:

- DYOR (Do Your Own Research): Don't trust projects based on hype alone

- Red Flags Matter: When multiple warning signs appear, take them seriously

- If It's Too Good to Be True: Free money doesn't exist in crypto

- Liquidity Matters: Low liquidity tokens are easily manipulated

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk.

$PI $PICoin $PiNetwork

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BoE’s governor Bailey says he’s saddened by Trump’s attacks on his ‘friend’ Powell

Share link:In this post: Bailey publicly backed Powell, calling him a friend and criticizing Trump’s ongoing attacks. The Bank of England cut rates by 25bps after a split vote, pushing the pound up and the FTSE 100 down. Trump is actively looking to replace Powell, with Waller, Hassett, and Warsh in consideration.

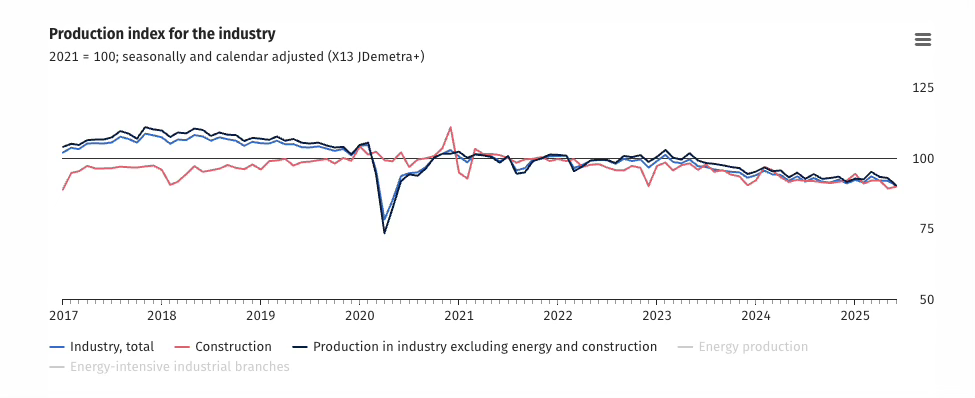

Germany’s production falls to its lowest since pandemic 2020

Share link:In this post: • Germany’s industrial output falls to pandemic lows. • Berlin’s foreign trade surplus drops below €15 billion in June. • German exports rise largely due to shipments to other EU nations.

Sony gets optimistic with annual profit forecast as tariff impact spares business

Share link:In this post: Sony has raised its annual profit forecast by 4% to ¥1.33T ($9B) due to less than anticipated impact from U.S. tariffs. Q1 operating profit rose 36.5% year-on-year to ¥340B ($2.3B), beating analyst estimates. Sony is preparing a partial spin-off of its financial business, reducing its stake to below 20% with a Tokyo listing planned for September 29 of this year.

America’s biggest auto maker GM to defy Trump tariffs, will import EV batteries from China

Share link:In this post: GM will import Chinese EV batteries from CATL for its new Chevrolet Bolt, despite 80% tariffs. The decision comes after the elimination of the $7,500 EV tax credit, which would have disqualified the Bolt due to its Chinese components. LFP batteries are about 35% cheaper than other alternatives.