Bitcoin Exchange Reserves Hit Historic Lows Amid Broad Market Implications

- Market sees reduced BTC and ETH supply on exchanges.

- Potential bullish setup due to lower selling pressure.

- Institutional accumulation trends signal strong market engagement.

Bitcoin and Ethereum exchange reserves have reached historic lows as of June 1, 2025, according to Crypto Rover, a prominent crypto YouTuber.

Shift Toward Long-Term Holding

The historic low in Bitcoin exchange reserves indicates a significant reduction in available supply for trading. These levels, sitting at 2.5 million BTC, suggest a shift toward long-term holding by institutions and private investors. This trend often precedes major price movements and increased market confidence.

Crypto Rover, with 160K followers, observed these exchanges showing unprecedented reduction in BTC and Ethereum reserves. On-chain analytics platforms confirm that this movement reduces immediate selling pressure, indicating that holders prioritize long-term retention of these assets.

Market Dynamics and Implications

Immediate effects on the market include reduced supply on exchanges, suggesting a potential for price hikes if demand climbs. Both BTC and ETH show similar trends, reinforcing the likelihood of favorable price movement. Institutions driving these trends are seen withdrawing to private custody, aligning with bullish market outlooks.

Potential future outcomes may include increased volatility in the markets with historical trends showing such scenarios leading to significant price rallies. This shifts market dynamics toward greater institutional control and reduced reliance on exchange-held reserves. Understanding these shifts helps market participants better prepare for upcoming changes.

Both Bitcoin and Ethereum balances on major exchanges have reached historic lows as of June 1, 2025, indicating a significant reduction in available supply for spot trading, which can often precede sharp price movements or increased volatility. — Crypto Rover, Founder, Cryptosea

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

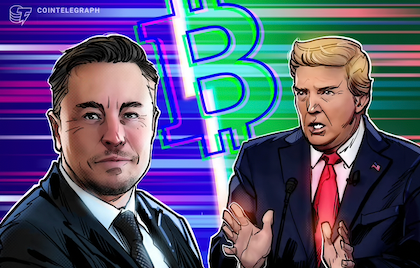

Trump-Musk spat sees Bitcoin tumble, liquidating $308M in longs

Bitcoin long traders took a hit over the past 24 hours amid Bitcoin’s price dwindling amid broader macroeconomic tension and continued sell-offs by long-term holders.

Tether Reduces Bitcoin Holdings by 14,000 BTC

Galaxy, Fireblocks Join Bitcoin Layer 2 Network Botanix

Trump Criticizes Musk’s Response to GOP Tax Bill