-

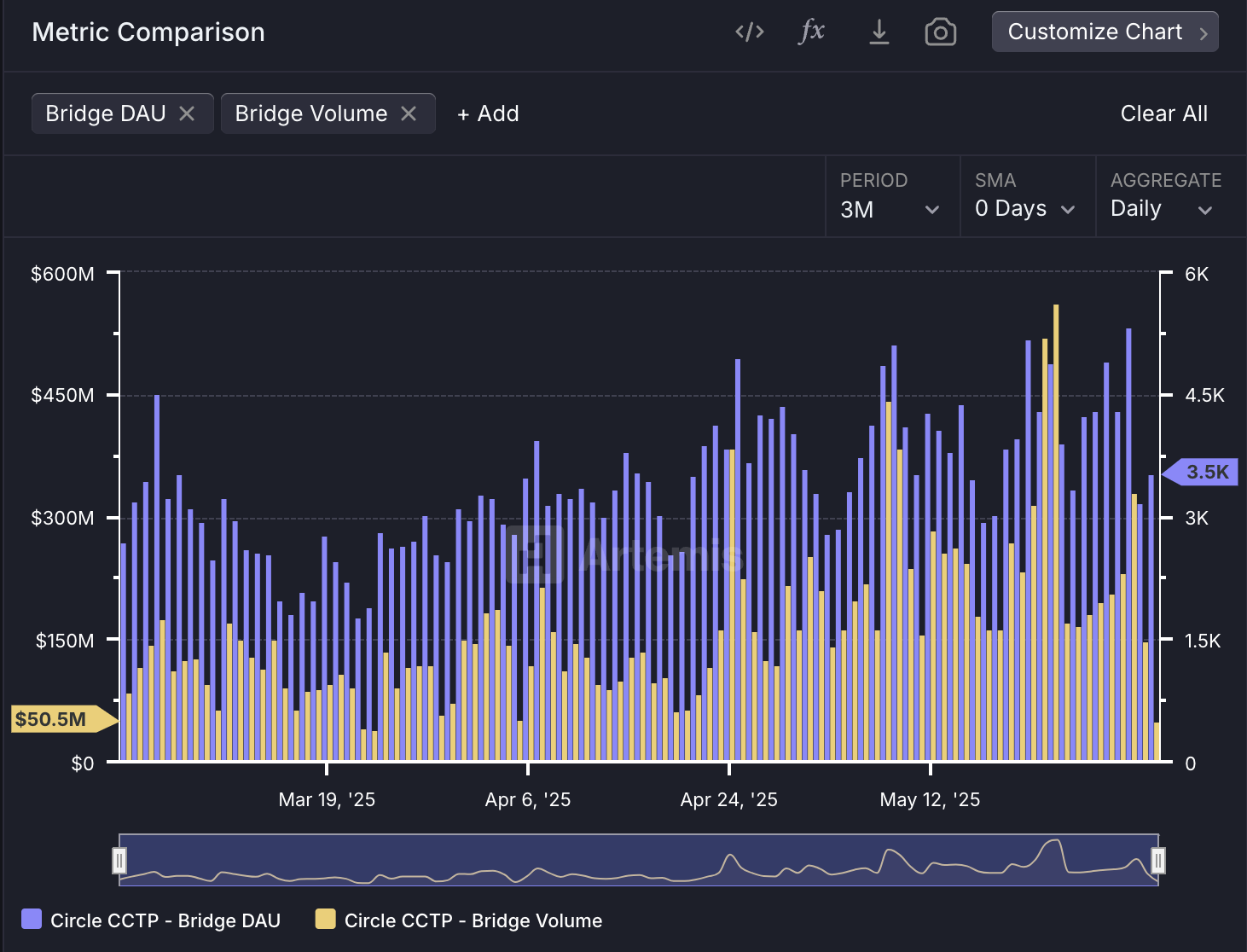

Circle’s Cross-Chain Transfer Protocol (CCTP) achieved a remarkable milestone, facilitating $7.7 billion in stablecoin bridging volume, marking an 83.3% increase from the previous month.

-

The company recently launched its IPO, rejecting a significant $5 billion buyout offer from Ripple in favor of maintaining its independence and expanding its capital base.

-

With the number of active stablecoin addresses reaching 33.1 million, Circle underscores the growing demand for its expanding payment ecosystem.

Circle’s CCTP has set new records, indicating a robust future for USDC with rising demand and a successful IPO launch.

Circle’s CCTP Breaks Volume Records

Circle, known as a leading stablecoin issuer, launched its Cross-Chain Transfer Protocol (CCTP) in 2023 to efficiently bridge USDC across various blockchains. The integration of this protocol with numerous prominent networks has significantly enhanced USDC’s interoperability. Recent blockchain analysis confirmed that CCTP reached an unprecedented high in bridging volume last month:

This achievement in CCTP volume is crucial for Circle, especially considering the surge in active stablecoin addresses, which reached a historic count of 33.1 million last month.

As the demand for stablecoins continues to grow, Circle aims to position its payments ecosystem as a viable and attractive option for users and investors alike.

The firm has been strategizing its IPO for several months, opting to turn down a substantial $5 billion offer from Ripple to retain its autonomy. Last week, Circle commenced its stock sale, looking to secure $624 million aimed at enhancing growth while maintaining independence.

The robust growth observed in CCTP suggests positive long-term potential for Circle in the marketplace, further enticing fresh investment capital. The company has even raised its IPO target to an ambitious $896 million, reflecting strong investor interest despite market volatility.

With active stablecoin addresses on the rise, it is noteworthy that major financial institutions are ramping up their engagement in the crypto sector. Citigroup, for example, forecasts the stablecoin market may reach an impressive $3.7 trillion by 2030, highlighting expansive growth opportunities within this segment.

Moreover, Circle isn’t alone in developing innovative cross-chain transaction solutions. The surge in USDC’s trading volume in April, coupled with CCTP’s outstanding growth, underscores the evolving dynamics of cryptocurrency usage.

Circle’s commitment to independence and market resilience positions it as a leading player in the stablecoin arena. To further solidify this position, the company needs to maintain the strong momentum evidenced by recent growth statistics in CCTP volume and active user engagement.

Future Outlook for Circle and the Stablecoin Market

As we look ahead, the stablecoin ecosystem is poised for significant expansion, driven by innovations in technology and a growing user base. Circle’s proactive measures to enhance its offerings through CCTP and other initiatives showcase its commitment to capturing market share.

With an increasingly favorable landscape for stablecoins, characterized by regulatory advancement and higher adoption rates, Circle may well emerge as a frontrunner in shaping the future of digital currencies. Stability, independence, and advanced transaction solutions will be pivotal in supporting this growth trajectory.

Conclusion

To summarize, Circle’s recent achievements with its CCTP highlight a promising future in the stablecoin space, further solidified by its strategic independence through the IPO launch. As stablecoin demand escalates, companies like Circle that focus on innovation and market engagement are likely to thrive. The ongoing evolution of the stablecoin market presents significant opportunities for growth, and Circle is well-positioned to capitalize on this momentum.