Ethereum (ETH) is taking center stage in the latest wave of institutional crypto adoption. SharpLink Gaming, a publicly traded U.S. company, is investing hundreds of millions into ETH, making it the firm’s primary treasury asset.

The company plans to allocate the bulk of the funds to purchase Ethereum (ETH) and hold it as its primary treasury asset, marking a rare move among public companies to choose ETH over Bitcoin.

Sponsored

The $425 million private share sale was led by Ethereum infrastructure firm Consensys and its CEO, Ethereum co-founder Joseph Lubin.

Major crypto investors, including Pantera Capital, Galaxy Digital, and Electric Capital, backed the deal, signaling growing institutional confidence in Ethereum’s long-term role in corporate finance.

SharpLink shares soared 600% following the announcement. Ethereum (ETH) price rose by a total of 8% on Tuesday, surpassing the $2,700 mark and reaching a $326 billion market cap, driven by renewed corporate interest and shifting market dynamics that favor ETH.

Altcoin Rotation Picks Up Speed

Bitcoin dominance, a key indicator of capital concentration in the crypto market, began to decline after being rejected at the 64.4% level—potentially signaling the start of a broader shift toward altcoins, especially Ethereum, according to crypto trader Astronomer.

While Bitcoin gained just 0.75%, Ethereum rose 4% at the time of the message, reflecting early signs of capital rotation.

Historically, a decline in BTC dominance, particularly when Bitcoin’s price remains steady, has triggered outsized gains in ETH. If the trend continues, Ethereum could be poised for significant upside.

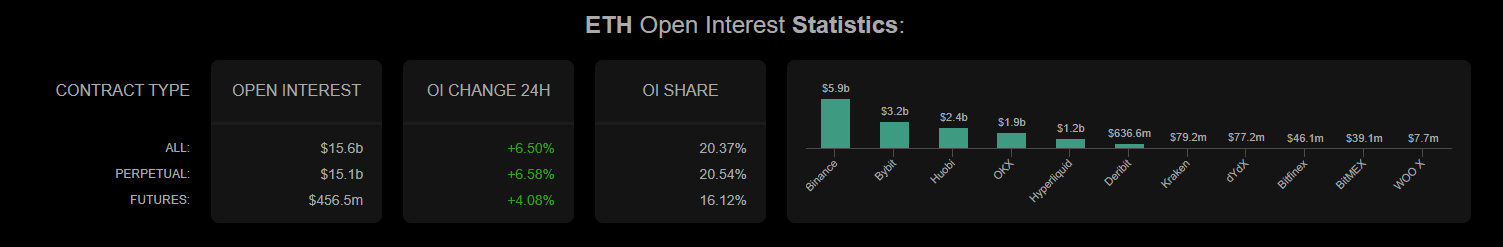

ETH Open Interest Surges

Ethereum is experiencing a surge in trading activity, with open interest in all ETH derivatives increasing by 6.5% over the past 24 hours. Perpetual contracts led the move with a 6.58% jump, while traditional futures followed with a 4.08% gain, according to data from Coinalyze.

The spike in open interest usually signals growing speculation and investor appetite for ETH, as more capital flows into leveraged trading products.

Ethereum’s Fragile Support Base

A large chunk of Ethereum’s market cap, around $123 billion, is held by investors who bought in the $2,300 to $2,500 range, putting them just slightly in profit, says blockchain analytics firm Glassnode in their recent X post.

That leaves ETH in a delicate spot. Even a modest pullback could push much of this supply into loss, potentially triggering fresh selling. Despite recent gains, Ethereum’s footing remains fragile, according to Glassnode.

Why This Matters

SharpLink’s move to adopt ETH as its main treasury asset, backed by major crypto investors, signals a shift in how public companies may approach crypto. With Bitcoin’s dominance falling and Ethereum’s trading activity rising, Ethereum could lead the next market leg, although near-breakeven holders may add volatility to any pullback.

Discover DailyCoin’s top crypto news:

GameStop Stock Reclaims 2022 Highs. Here’s Why

Ripple CTO Slams XRP Centralization Myth In Bitcoin Debate