I made $1 Million on HyperEVM - Here's How

5个步骤教你积累HyperEVM上多个协议积分并赚取高收益

Original Title: The Exact Setup I'm Using to Make $1M+ from HyperEVM

Original Author: @PixOnChain, Bubblemaps Member

Original Translation: Crypto Deep

Editor's Note: This article shares the author's detailed setup to earn over a million dollars in the HyperEVM ecosystem through a capital-efficient, Delta-neutral strategy. The author researched 65 native protocols and recommends actions such as cross-chain with HyperUnit, staking $HYPE, providing liquidity, and hedging to accumulate points across multiple protocols while earning over 19% APY. Additional strategies include purchasing .hl domains, NFTs, and stablecoin operations, with a focus on @hyperunit and @prjx_hl, believing early participation can yield significant airdrop rewards.

Below is the original content (slightly reorganized for better readability):

Most people are still unaware of HyperEVM. I spent over 20 hours researching all 65 native protocols. If you play your cards right, I firmly believe you can receive airdrops in the six to seven figures.

Here is the complete strategy:

Step 1: Obtain On-Chain Funds (Capital Efficiency)

You need to have on-chain liquidity on HyperEVM. However, not all cross-chain bridges are the same.

The cross-chain bridges I use (all tokenless) are:

· @hyperunit

· @HyperSwapX bridge

· @HyBridgeHL

I primarily transfer assets through HyperUnit.

It bridges first to Hypercore (the transactional layer of Hyperliquid).

From there, it's just two steps to get to HyperEVM (see below).

Step 2: Yield Strategy (Delta Neutral, Low Risk)

I dislike impermanent loss. I pursue yield. Here is my specific setup:

1. Cross-chain through HyperUnit

2. Swap to $USDC, then spot buy $HYPE

3. Stake 20% of $HYPE in the HypurrCollective x Nansen validator

4. Transfer the remaining portion to HyperEVM (Portfolio > Balances > Transfer to EVM)

5. Stake $HYPE as $stHYPE on @0xHyperBeat

6. Provide $stHYPE to @HypurrFi and borrow $HYPE

7. Swap $HYPE for $stHYPE on @HyperSwapX

8. Provide $stHYPE to @hyperlendx

9. Hedge the $HYPE exposure through 1x short position (currently earning 35% APY through funding fees).

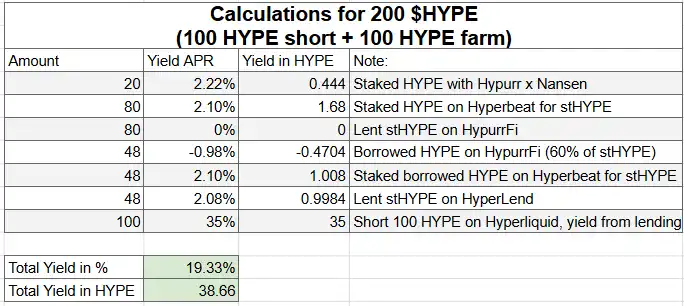

This setup forms a Delta-neutral position, allowing for passive income generation and accumulation of rewards across multiple protocols. Below is an example calculation of the strategy yield based on current rates:

Step 3: Strategies to Earn More Rewards

· Purchased several .hl domains from @hlnames

· Acquired an @HypioHL NFT on @drip__trade

· Provided UBTC + UETH on @HypurrFi and @hyperlendx (hedging when funding fees are positive, ~11% APY+)

Additionally, I utilized stablecoins within the ecosystem:

· Used USDC in HLP (Hyperliquid → Vaults → Protocol Vaults)

· Lent USDT0 on @HypurrFi and @felixprotocol

· Provided liquidity for USDT0/feUSD pair on @HyperSwapX (tight range, excellent APY)

· Providing feUSD on @felixprotocol

This setup covers almost every vertical of HyperEVM.

Step 4: Yield of This Setup

· Unit Points

· Hyperliquid Points

· Nansen Points

· Hyperbeat Points

· Drip Points

· Hypio Points

· Felix Points

· HypurrFi Points

· HyperSwap Points

· HyperLend Points

· HyperEVM Points

· HL Names Points

Additionally, my capital is also able to achieve an annualized yield of over 19%.

Some of these points systems are confirmed, while others are speculative. I'm all in.

Step 5: Hidden Plays

Currently, most protocols on HyperEVM have only 5,000 to 10,000 users. This is comparable to the user base before the Jito airdrop.

If you are reading this article, you are likely part of the top 1% early participants.

But there are a few plays that can bring higher asymmetric returns. I focus on the following two:

· @hyperunit

· @prjx_hl

Let's talk about Unit first.

This might be the most underestimated protocol in the entire HyperEVM ecosystem. It is already live, tokenless, and under the radar.

But if they achieve their goal—bringing real-world stocks on-chain—and then launch a token? This could easily become a billion-dollar-level airdrop.

My speculation on the airdrop formula is:

Airdrop = (Unit Asset Holdings × Holding Time) + (Cross-chain Transaction Volume × Coefficient)

So I cross-chain early, cross-chain at scale,

Then let the assets sit quietly in spot HL, liquidity pools, or the lending market.

Let's talk about Project X. Currently, it's still a black box, but...

This team has been driving its development since the early days of InfoFi, even airdropping a significant amount of $$$ to participants.

Yes, they had some buzz during the prelaunch, but I still think it's early days.

That's exactly why I want to get involved.

That's my setup.

Delta neutral, capital efficient. Earning returns while stacking under-the-radar points. Most people are waiting for the next big airdrop. I'm already prepared for it.

If I'm wrong? I still have a fallback.

If I'm right? You'll see the results on-chain.

P.S. I have no affiliation with these protocols, nor have I received any compensation. Please DYOR.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WinnerMining Promises Daily Crypto Profits Without Equipment

Former PayPal Head Drives Bitcoin Payment Adoption

Bitcoin Scarcity Prompts Global Corporate Acquisition Race

Bitcoin Faces Resistance as $3.2B Inflow Influences Price