-

Bitcoin’s recent momentum has come to a halt near the $110,000 mark as new whales take profits, exerting selling pressure on the market.

-

Despite a remarkable surge of over 30% since mid-April, the price of Bitcoin seems stymied by the activities of new market entrants, particularly large investors.

-

According to CryptoQuant, 82.5% of profit realizations since April 20 have come from these new participants, underlining a shift in market dynamics.

Bitcoin remains near $110,000 amid a significant profit-taking phase by new whales, which may hinder its ability to surpass previous highs, according to CryptoQuant data.

Whale Activity and Its Effect on Bitcoin Prices

Analysis by CryptoQuant indicates a notable trend where recent market dynamics have been heavily influenced by new Bitcoin whales, who are actively capitalizing on the recent price rallies. This group has primarily been facilitated by an entry point averaging around $91,922.

“Monitoring profit realization among newer and older whales has become crucial,” says J.A. Maartunn, a leading analyst at CryptoQuant. “Currently, it’s revealing that a staggering 82.5% of profit-taking since April has directly stemmed from newer whales,” he elaborated, adding context to the market’s current state.

The newly established whales netted approximately $3.21 billion in profits, overshadowing the $679 million earned by older whale accounts. This shift has significant implications for price resistance, especially as Bitcoin battles to stay above the key resistance level near $112,000.

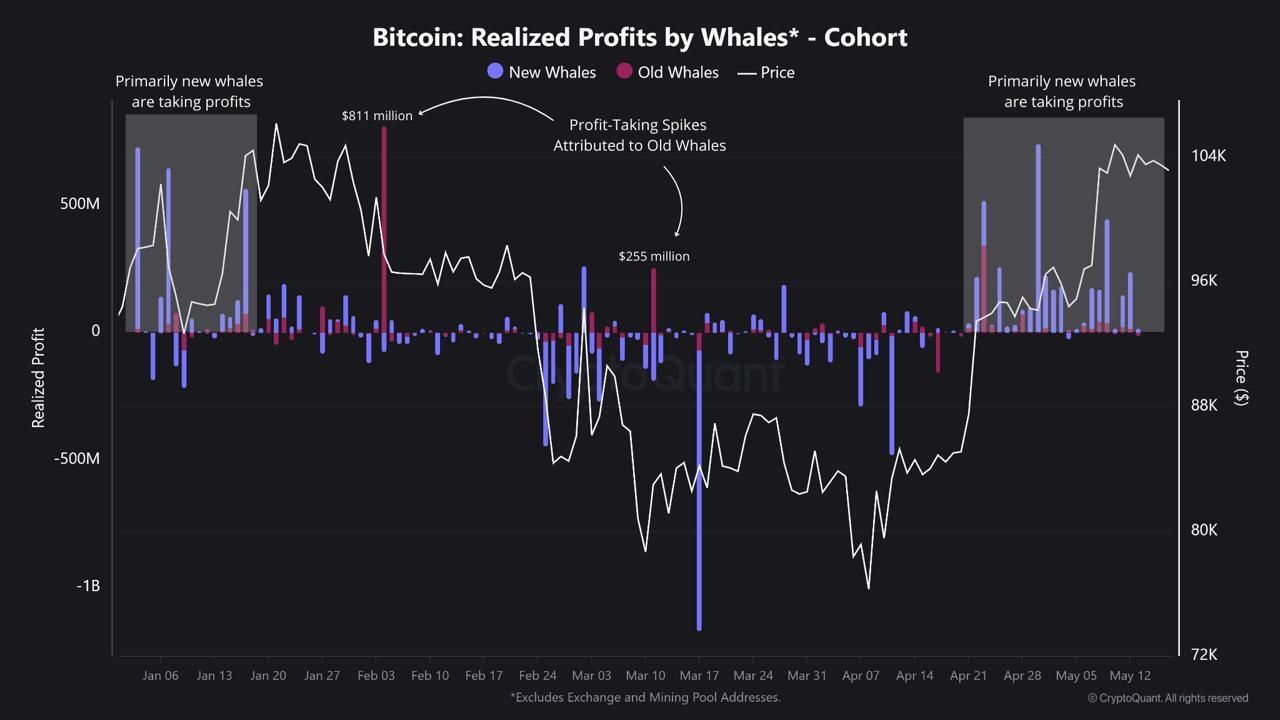

Supporting this, the chart from CryptoQuant illustrates how newer whale addresses have predominantly dominated profit realizations since the late-April surge. The blue bars, which signify the activities of these newcomers, depict a stark contrast to prior profit-taking events associated with older whales.

Previous high-profile profit events, like those totaling $811 million and $255 million in February and March, were predominantly attributed to seasoned investors. However, the ongoing trend indicates that newer players are consistently locking in profits, maintaining pressure on Bitcoin’s upward potential.

Market Implications of New Whale Behavior

The recent behavioral shift among new whales indicates a calculated approach to profit realization. Many of these investors appear eager to exit positions that were established during the downturn observed in the first quarter of the year. Their actions are contributing to ongoing overhead selling pressure that has inhibited price acceleration.

Conversely, the apparent inactivity among older whales suggests a long-term confidence in Bitcoin’s future trajectory, potentially acting as a buffer against immediate price declines. Until the current wave of profit-taking from new whales abates, Bitcoin may continue to face challenges in establishing a robust breakout beyond its current ceiling.

Market observers are advised to keep a close watch on the ongoing activities of these whale segments, as their selling trends could dictate Bitcoin’s market movements in the coming weeks.

Conclusion

The ongoing balance between profit-taking by new whales and the relative inactivity of older whales is shaping Bitcoin’s price landscape. With selling pressure persistent near the $110,000 mark, analysts recommend a careful observation of market trends. As holders adjust their strategies, the potential for future price movements remains closely tied to the behavior of whale investors.