Top DeFi Yield Farming Platforms to Watch in 2025 for Maximum Returns

- Still, Compound, Curve and SushiSwap are vital for anyone involved in yield farming.

- DAO Maker provides new startups with a way to be financed through their community.

- It uses an advanced AMM structure to provide flexible liquidity solutions.

Yield farming platforms are growing in importance in the digital asset sector as decentralized finance advances in 2025. With these protocols, users can receive rewards for supplying liquidity to pools, aiding decentralized exchange features or getting involved in funding early on. Compound, Curve, SushiSwap, DAO Maker and Balancer are offering important features that make it easier to use liquidity, take part in governance and make better use of capital. Using these protocols, people are taking part in a more open, fair and user-centered financial system as users and developers.

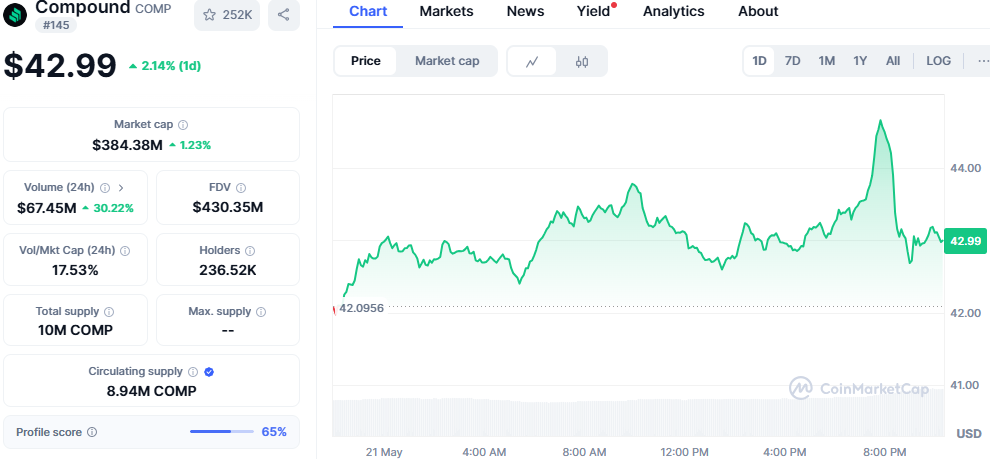

Compound: Get Crypto Interest by Lending in Pools

Source: CoinMarketcap

The protocol, Compound, allows users to deposit crypto into pools and receive interest as they wait for their funds to be borrowed. Once users deposit assets, they receive cTokens that track and increase in value as their invested asset rises. You can earn interest from your investments using this model, without trading any tokens.

Those lending on Compound can get secured loans if they use more assets than the loan is worth. Depending on the asset, a loan-to-value ratio limits your risk and features automatic safeguards for when assets are sold. Since its launch two years ago, Compound’s value has rose and it now contains over $800 million of assets, placing it at the heart of yield farming in the world of lending.

CurveDAOToken(CRV): Designed for Farming Yield with

Source: CoinMarketcap

A curve is an exchange on the blockchain that uses AMM for stablecoins trading. Because its pools minimize slippage and cut back on fees for coins with similar values, it is preferred by those interested in stablecoin yield farming. People who help Curve with liquidity receive a portion of the platform’s fees and CRV tokens. You can use these tokens either to help govern the blockchain or as part of staking.

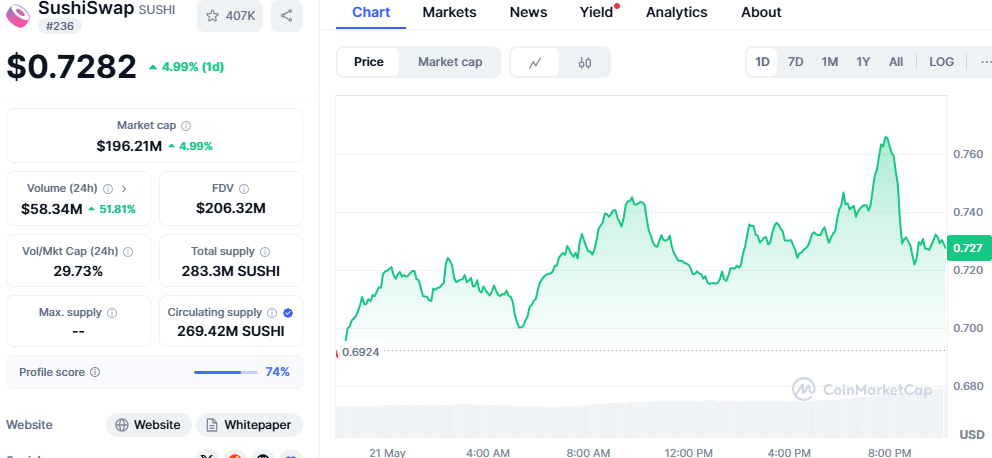

SushiSwap(SUSHI): enables users to source liquidity from different blockchains

Source: CoinMarketcap

SushiSwap is an AMM powered by decentralized technology and built on top of over 40 different blockchain networks. It allows users to instantly swap their tokens and add liquidity on several blockchains. People who help provide liquidity are paid trading fees and given SUSHI tokens for voting in protocol decisions. With the help of Sushi Labs, the Sushi DAO is growing its DeFi suite by introducing Susa, Saru, and Wara.

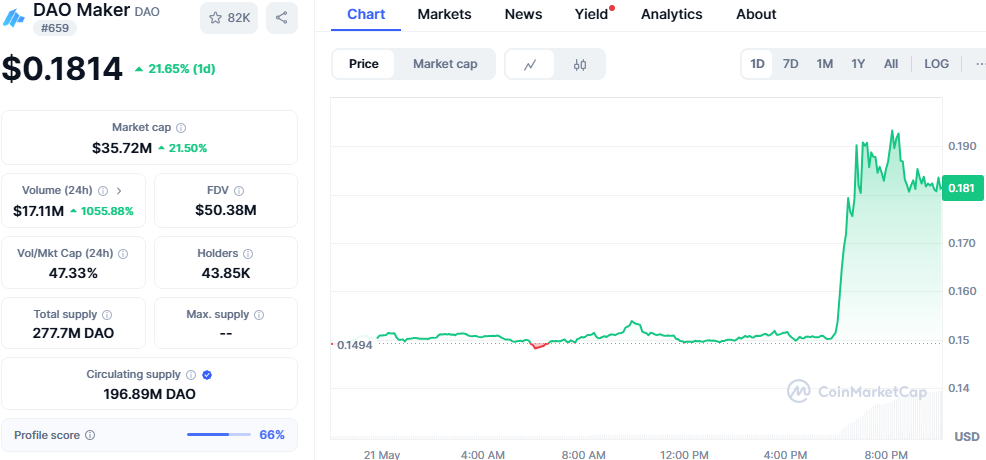

DAO Maker(DAO): relies on the community for project funding and community

Source: CoinMarketcap

DAO Maker is a place where early cryptocurrency projects get support. It supports startups with raising funds from decentralized community investments.] DAO Pad enables retail investors to access screened investment options and join in governance decisions by using DAO tokens.

Besides being a social platform, it rewards people who share information or comment on it. DAO Maker helped launch Orion Protocol and My Neighbor Alice, allowing users to make income through new token releases and engaging with the community. For this reason, DAO Maker is different from other yield farming platforms because it awards users who get in early and stay involved.

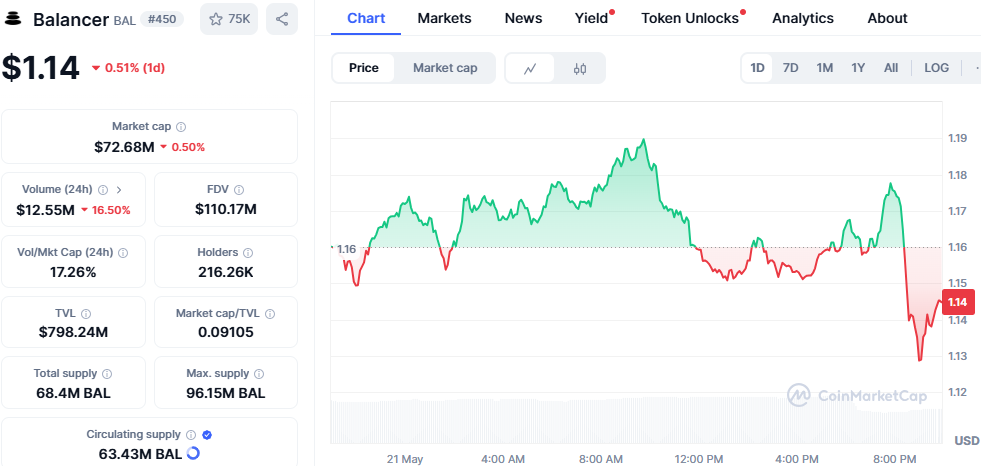

Balancer(BAL): introduces dynamic liquidity and allows users to create

Source: CoinMarketcap

Anyone can use the balancer protocol which has customizable AMM pools for both developers and liquidity providers. The design creates a special type of vault splitting pool logic from core infrastructure, making it possible to build advanced pools such as Boosted Pools, Weighted Pools and LVR-mitigating stable swaps.

Externally produced pool types such as CoW AMMs and FxPools, are also supported on Enertia. Individuals providing liquidity on Balancer can earn fees by how often the pool is used and the platform designs it so that impermanent loss isn’t an issue. Because Balancer is designed to avoid MEV and provide yield, it is a valuable asset for yield farming.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solar-Powered Bitcoin Mining Facility Launched by Sangha Renewables

Bitcoin Surpasses Amazon, Hits Fifth Largest Asset Spot

Sovereign Wealth Funds Increase Bitcoin Holdings Significantly

Bitcoin Overtakes Amazon in Market Cap Race