Bitcoin’s Declining Retail Interest May Signal Potential Future Opportunities

While retail interest in Bitcoin dims, market analysis indicates potential opportunities for growth, primarily driven by institutional investors.

-

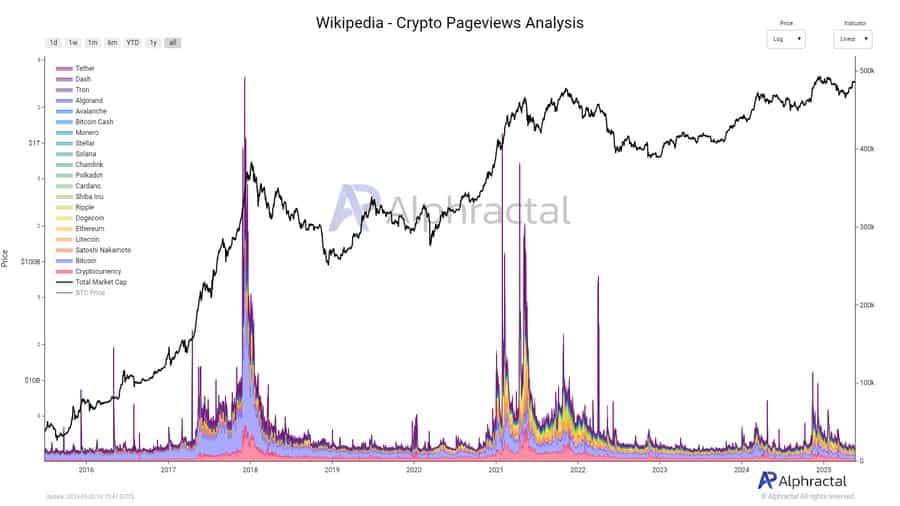

According to Wikipedia search trends, retail curiosity about Bitcoin has dropped significantly.

-

Analysis reveals Bitcoin’s recent upward movement has been driven largely by whales in the market.

Bitcoin’s [BTC] surged 4.07% in the past 24 hours to $107,944.92, just $1,169.96 shy of its previous record.

This rally has been fueled almost entirely by large holders and institutional investors rather than retail participants.

Despite the lack of retail engagement, COINOTAG analysis suggests this could present a unique opportunity for the asset.

Retail Interest Falls—What Does It Mean for Bitcoin?

Data from Alphractal shows Wikipedia search activity for Bitcoin—a common indicator of retail interest—has reached a new low.

This contradicts historical trends, where retail curiosity typically rises alongside prices as the asset nears an all-time high.

Source: Alphractal

The market’s lack of retail attention suggests Bitcoin has not yet reached a euphoric state, indicating that its peak may still be distant, allowing for further price increases.

If retail investors return in significant numbers, their demand could drive prices even higher—potentially impacting Bitcoin’s price trajectory.

Can Bitcoin Break Its All-Time High?

Analysis indicates the asset’s rally is supported by strong momentum, chiefly fueled by institutional investors who view the asset as a premium investment. Spot Bitcoin ETFs have further reinforced this trend.

Currently, spot Bitcoin ETFs have experienced five consecutive days of net inflows, totaling $1.69 billion, with minimal seller activity.

Source: Coinglass

Further data reveals why investors persist in accumulating the asset.

A benchmark index comparing major asset classes shows Bitcoin has outperformed the S&P 500 and gold significantly. With a 53.2% growth rate, Bitcoin has far outpaced gold’s 35.3% and the S&P 500’s 12.9%.

Source: Artemis

This robust performance is attracting more traditional investors toward Bitcoin, which now appears poised for better potential returns.

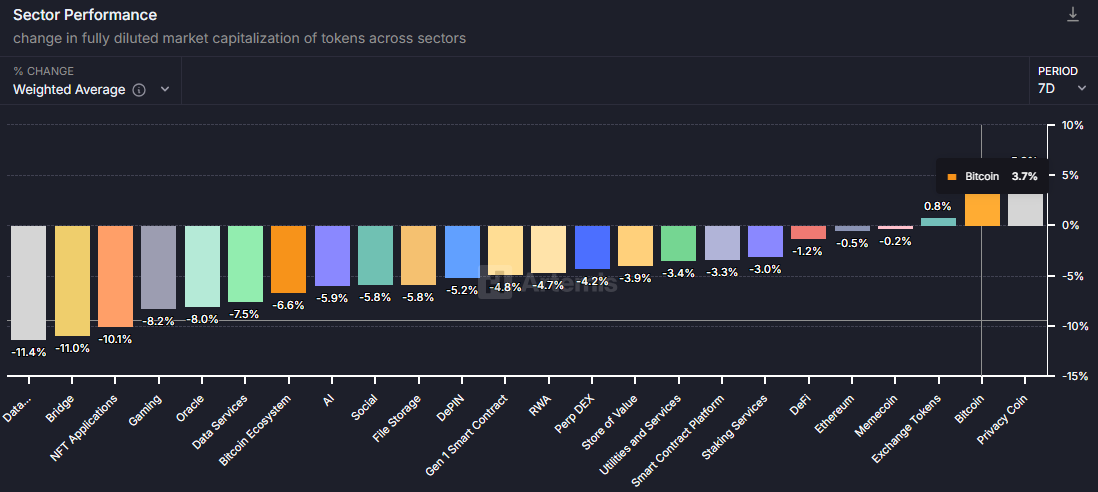

Within the crypto sector, Bitcoin is regaining dominance. Over the past week, it rose 3.7%, trailing only privacy coins, which currently lead the market.

Source: Artemis

This trend is striking, especially as other sectors, including Ethereum, real-world assets, and decentralized finance, are underperforming and attracting less capital.

If this momentum continues, Bitcoin could not only break its all-time high but also establish a new benchmark.

Why Retail Investors May Return Soon

Previously, COINOTAG reported that retail interest in Bitcoin was dwindling on Google Trends, as many traders shifted their focus to memecoins.

However, BTC is currently regaining dominance, even outpacing the memecoin sector, which now holds only 1.0% of the market.

If BTC maintains its upward trajectory, traders in the memecoin space may soon rediscover their capital’s potential in Bitcoin.

Conclusion

As Bitcoin hovers near its all-time high, the finite retail engagement suggests a notable opportunity for growth. With institutional support driving momentum and potential retail participation looming, the market landscape may shift quickly. Investors should stay informed and vigilant as these dynamics evolve.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Briefly Surpasses $107,500!

SEC Delays Decision on XRP and Dogecoin Spot ETFs

Bitcoin hits $109K as ETFs and institutional buying boost Bitcoin hits $XNUMXK

Standard Chartered Predicts $500,000 Bitcoin by 2028