Bitcoin Soars Past $107K, Inches From ATH – What’s Fueling the Surge?

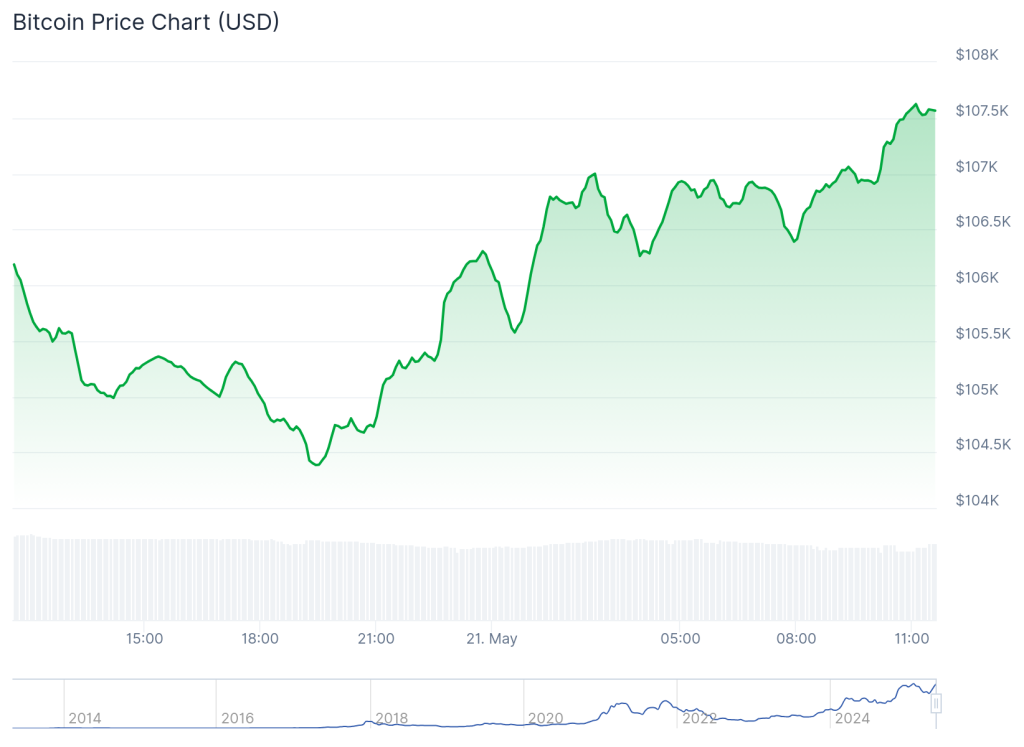

Bitcoin rallied 40% in six weeks, held above $100K for 11 days, notched just its fourth-ever close at this level, and hit a weekly high of $106,500.

Bitcoin climbed above $107,500 on Wednesday, just 1.1% shy of its all-time high of $108,786 as investors seek refuge from global uncertainty.

The flagship crypto has broken out of a two-week consolidation between $102,000 and $105,000 to reach fresh highs.

Over the past six weeks, Bitcoin has rallied roughly 40%, and held above $100,000 for more than 11 days. Moreover, only four trading sessions in history have recorded a daily close above the current level, and last week’s close at $106,500 marked a new record.

Source: Coingecko

Source: Coingecko

Moody’s Debt Downgrade Sparks Flight to Crypto

Bitcoin’s surge has been propelled by a confluence of macroeconomic and geopolitical factors.

Moody’s downgrade of US debt rattled confidence in traditional financial systems, while cooling trade war tensions between the US and China fostered risk-on sentiment.

Meanwhile, persistent inflation has eroded fiat purchasing power, and the Federal Reserve’s cautious pace of rate cuts kept real yields elevated, dynamics that have boosted demand for Bitcoin as a hedge.

Analysts Eye ETF Flows as Momentum Driver

Spot Bitcoin ETFs have drawn substantial capital amid this backdrop. On May 20, they recorded a net inflow of $329m , marking a fifth straight day of positive flows. Spot Ethereum ETFs also saw $64.9m in net inflows for a third consecutive day.

Himanshu Maradiya, founder and chairman at CIFDAQ, said the market remains in a consolidation phase with repeated tests of $106,000.

He added “this fresh regulatory openness, combined with rising institutional participation, continues to position crypto for long-term growth despite short-term range-bound price action.”

Ruslan Lienkha, head of markets at YouHodler, noted a clear accumulation trend. He said:

“While the risk of a downside correction cannot be ruled out, particularly if negative sentiment returns to the equity markets, the likelihood of such a scenario remains relatively low in the short to medium term.”

CryptoQuant analyst Axel Adler said that if the 30-day moving average of the ratio between holders’ profits and losses on coins that have moved climbs above 200, it signals an overheated market. He noted the current reading is 99, so there’s no sign of excessive euphoria yet.

With Bitcoin now flirting with its previous peak, market watchers say the next few trading days will be critical. If bulls sustain above $107,000 and clear $108,786, a test of fresh highs appears increasingly likely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solar-Powered Bitcoin Mining Facility Launched by Sangha Renewables

Bitcoin Surpasses Amazon, Hits Fifth Largest Asset Spot

Sovereign Wealth Funds Increase Bitcoin Holdings Significantly

Bitcoin Overtakes Amazon in Market Cap Race