Bitcoin Long-Term Holders Take Profits as Price Surges, But Cycle Peak Still Ahead

Bitcoin’s surge past $105K has led long-term holders to take profits, with market data showing a spike in realized profits. Despite this, a positive funding rate signals that the cycle peak may still be ahead, maintaining a bullish outlook.

Bitcoin’s brief rally above the psychological $105,000 price mark has triggered increased activity among its long-term holders (LTHs).

According to on-chain data, there is a notable spike in realized profits within this group over the past few days.This trend suggests that many LTH investors are beginning to take advantage of the sharp price gains by selling coins at a profit.

BTC Long-Term Investors Increase Profit-Taking

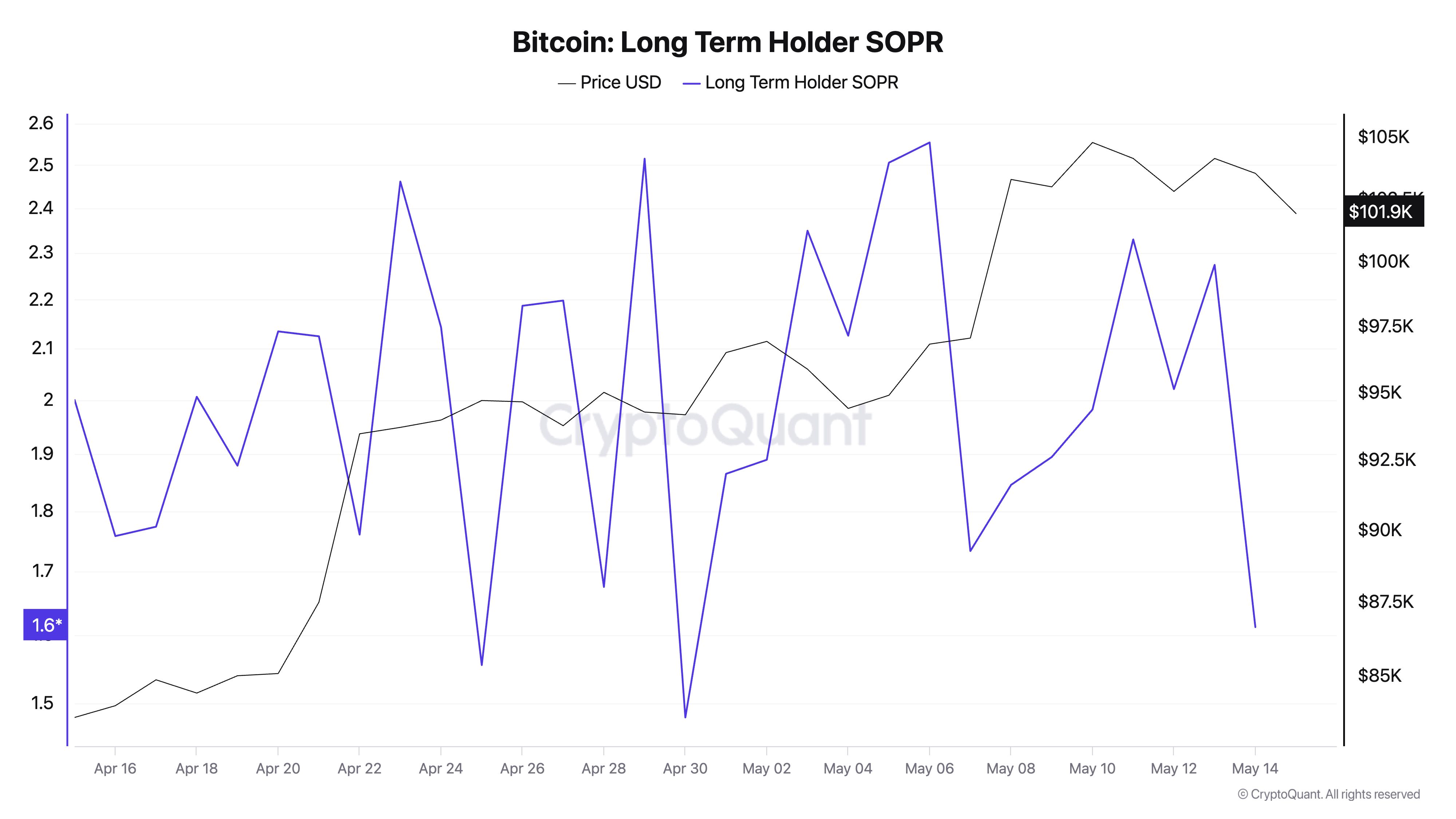

In a new report, CryptoQuant analyst Carmelo Alemán noted that BTC LTHs—investors who have held their coins for over 150 days—have significantly increased their profit-taking in recent weeks, according to on-chain data.

Alemán found that BTC’s Long-Term Holder Spent Output Profit Ratio (LTH-SOPR), which measures whether investors who have held a particular asset for over twelve months are in profit or not, reached a yearly low of 1.32 on March 12.

However, as market sentiment improved, it steadily climbed to reach 2.274 by May 13. According to Alemán, this marks a 71.33% increase in realized profits over two months, suggesting that coins spent by LTHs are being sold at much higher profit margins than earlier in the year.

As of this writing, the metric stands at 1.612.

Bitcoin Long Term Holder SOPR. Source:

CryptoQuant

Bitcoin Long Term Holder SOPR. Source:

CryptoQuant

“This suggests that LTHs are beginning to capitalize on their accumulated gains, possibly in anticipation of future corrections or in response to an overall improvement in market sentiment. This profit-taking could be key to understanding upcoming price movements, as historically, these periods have preceded significant price fluctuations in Bitcoin,” the analyst noted.

Historically, spikes in BTC’s LTH-SOPR have coincided with distribution phases, where seasoned investors begin selling their holdings ahead of potential downturns. However, “the market is still far from its cycle peak,” Alemán wrote.

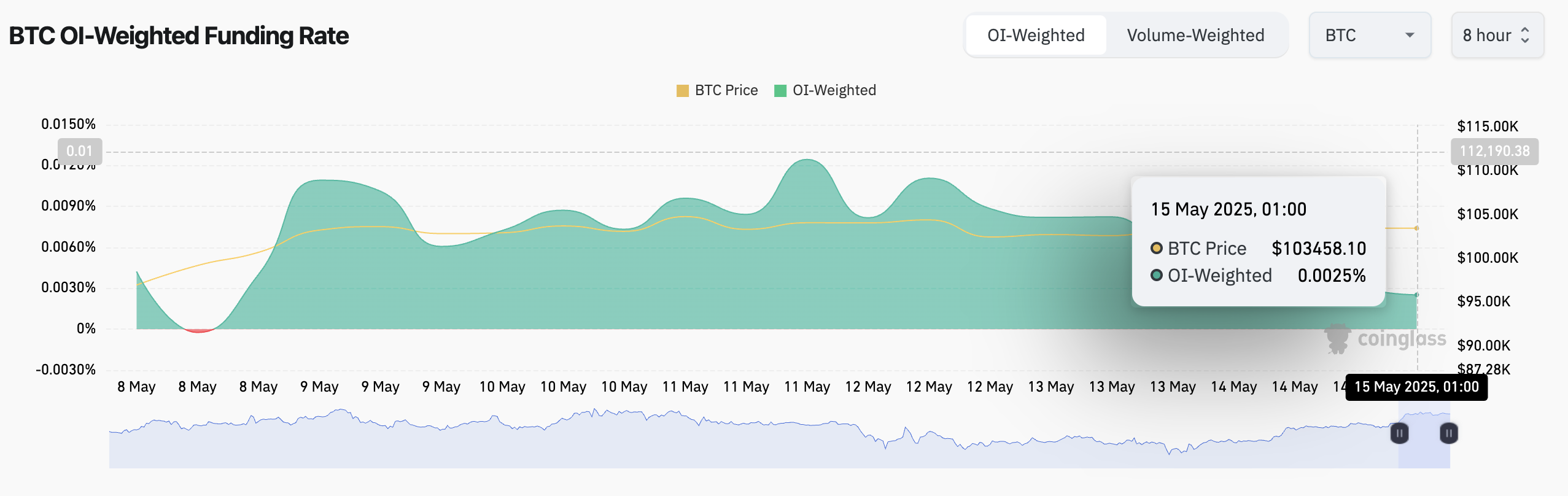

One may attribute this to BTC’s persistent positive funding rate. This stands at 0.0025% at press time, signaling a high demand for long positions among futures market participants.

Bitcoin Funding Rate. Source:

Coinglass

Bitcoin Funding Rate. Source:

Coinglass

A positive funding rate like this means that traders holding long positions (betting the price will rise) are paying a fee to those holding short positions, indicating bullish sentiment in the BTC market.

BTC Faces Pressure After $105,000 Rally

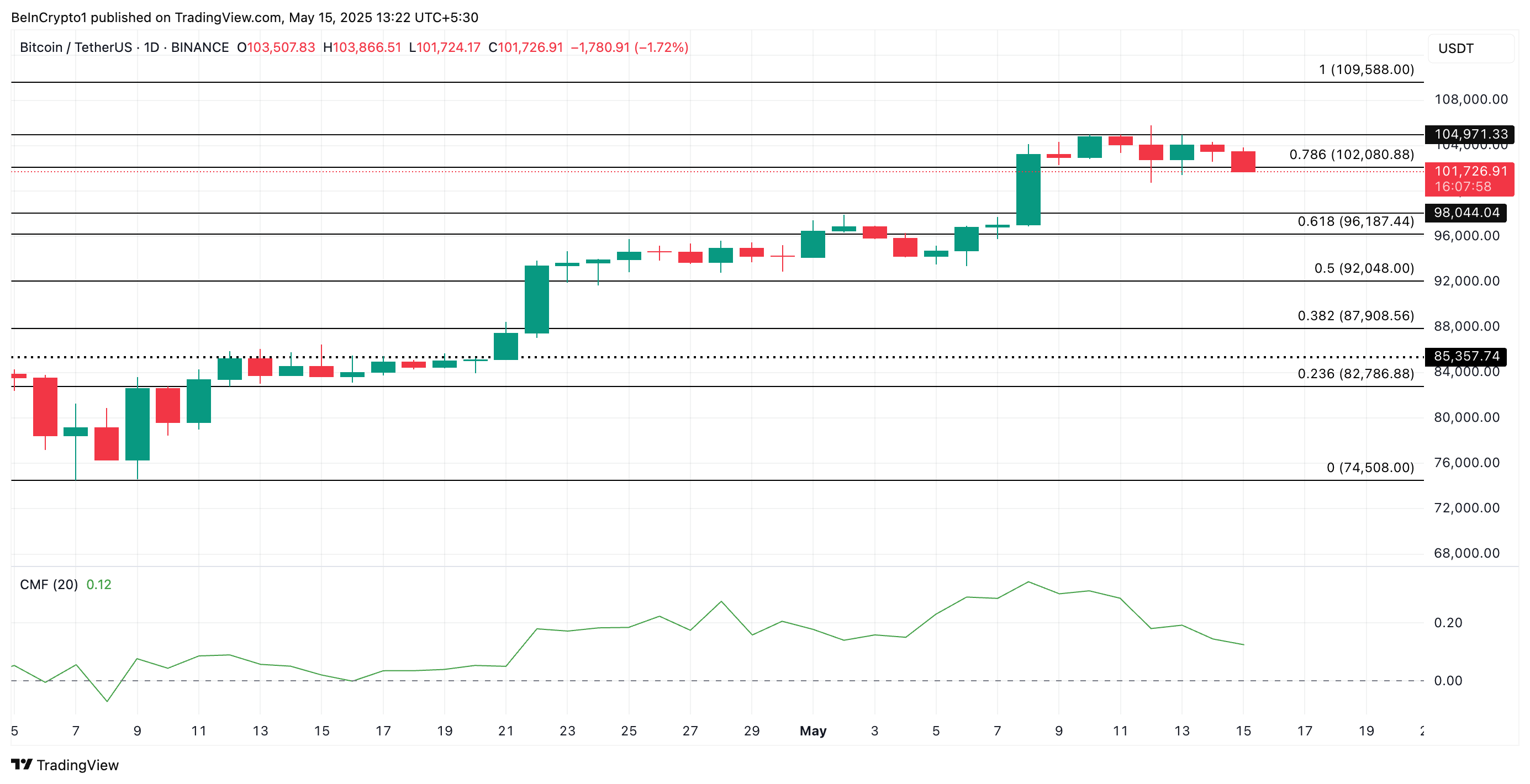

At press time, BTC trades at $101,726. The king coin’s price is down 2% over the past day, mirroring the broader market pullback.

On the daily chart, the coin’s Chaikin Money Flow (CMF) trends downward, highlighting the drop in demand as profit-taking activity rockets among BTC traders and investors.

The CMF indicator measures how money flows into and out of an asset. When it declines, it indicates weakening buying pressure or increasing selling pressure. This means less capital flows into BTC as market participants capitalize on the coin’s recent surge past the $105,000 price mark.

If selloffs strengthen, the downward pressure on BTC climbs and could force its price down to $98,044.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

On the other hand, if accumulation resumes, the coin could break resistance at $102,080 and rally to $104,971.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Today 15/05/2025: BTC Approaches $101K Support, PI Coin Loses 27%

SWIFT to test digital assets and tokenized cryptos in November, $XRP and $HBAR in focus

Peter Schiff criticizes Bitcoin treasury stocks: “worse than BTC itself”

Bitcoin looks ‘ridiculous’ as bulls attempt $2T market cap flip — Analyst