Key Notes

- Ethereum market cap topped the $308 billion threshold days after the Pectra upgrade.

- The coin now ranks above Coca-Cola and Alibaba in global assets.

- The Pectra upgrade serves as a boost, validator limits, and long-term valuation catalyst.

The second-largest digital asset, Ethereum ETH $1 845 24h volatility: 2.6% Market cap: $222.72 B Vol. 24h: $14.22 B , has moved past Alibaba, Coca-Cola, and Hermes in global asset rankings after a major price and market value increase. This happened shortly after Ethereum introduced the long-awaited Pectra upgrade to its network.

Ethereum Value Climbs After Network Upgrade

According to the current market data, Ethereum’s value jumped by 42% within five days, reaching over $308 billion. The price climbed from around $1,786 on May 7 to $2,549.83 by May 12.

It is worth noting that Ethereum’s recent growth comes at a time when digital assets are gaining significant attention. For example, Bitcoin BTC $96 611 24h volatility: 2.1% Market cap: $1.92 T Vol. 24h: $29.09 B recently flipped both silver and Amazon, becoming the fifth most valuable asset in the world.

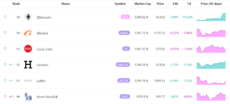

According to data from 8MarketCap , this latest rally moved the largest alternative cryptocurrency to the 39th spot among the world’s most valuable assets. The new position puts it above companies like Coca-Cola and Alibaba.

Coca-Cola’s market capitalization is approximately $303.5 billion, and its shares trade near $70.52 Alibaba trades around $125, giving it a market value of about $303.7 billion. Hermès, priced at $2,828 per share, has a market cap of roughly $296.54 billion.

List of world’s most valuable assets. Source: 8marketcap.com

This notable increase came shortly after Ethereum completed its latest network upgrade, Pectra. The Pectra upgrade introduced several improvements to the chain. It made it easier for the blockchain to handle more data, especially in areas like layer-2 scaling and validator performance.

According to the update, Pectra also simplifies the experience for both users and developers on the network. An important feature of the upgrade is that regular user accounts can now work more like smart contracts. That means users can pay fees with tokens other than Ethereum. Another change raised the validator staking limit from 32 ETH to 2,048 ETH.

This makes things more straightforward for larger stakers. The upgrade also allows more data blobs per block, which helps improve speed and performance on layer-2 networks.

Pectra Ships Despite Early Testnet Issues

Pectra was originally scheduled for March 2025 but was released later than expected. Testing began in February when developers rolled it out on the Holesky testnet. However, that version failed to finalize. The team later tested it on Sepolia, but attackers exploited bugs and caused empty blocks to be mined.

To fix these problems, developers built a new testnet named Hoodi. It helped them prepare for a proper mainnet launch. On May 7, the upgrade finally went live on Ethereum’s main network.

In the days after the launch, Ethereum’s price rose steadily, gaining over $760 million. This growth reflects the market’s response to the upgrade and signals increased interest in Ethereum’s future.

The Pectra upgrade is one of the most important changes to Ethereum in recent times, and for now, it is having a positive effect.

Ethereum has been making headlines for several reasons. Brazil’s B3 Exchange, for example, is set to launch Solana and Ethereum futures on June 16, which will help expand access to the underlying coins for institutional investors.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.