Bitcoin ETFs recorded a decline in weekly inflows despite Bitcoin’s recent price recovery.

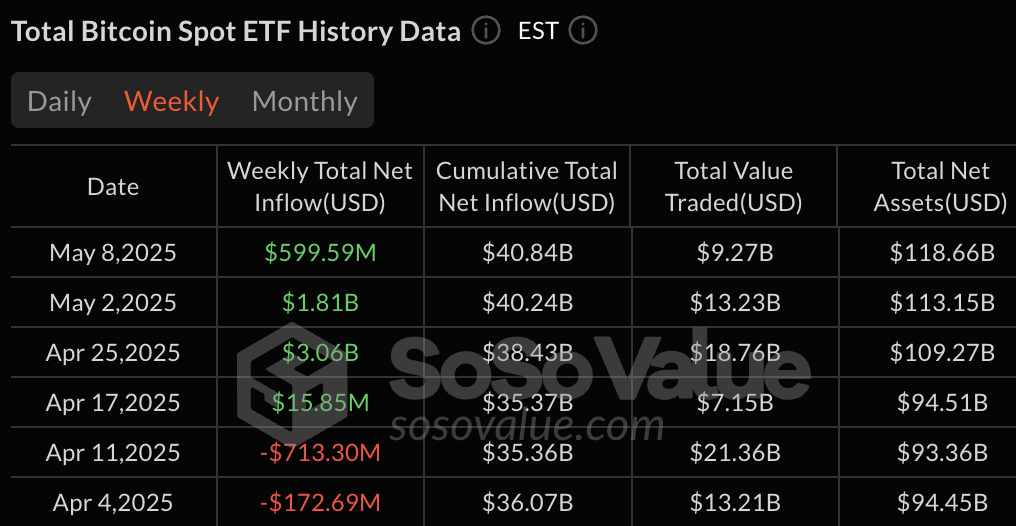

According to data updated on May 8, 2025, weekly inflows to Bitcoin ETFs dropped to $599.59 million. This is a 67% decrease from the previous week’s $1.81 billion. This marks the second consecutive week of declining inflows after the April 25 peak of $3.06 billion.

Bitcoin ETF weekly inflows drop

Bitcoin spot ETFs recorded their lowest weekly inflow figure since mid-April, with just $599.59 million in new capital for the week ending May 8, 2025. This is a 67% decrease from the previous week’s $1.81 billion and an 80% drop from the $3.06 billion recorded for the week ending April 25.

Looking at the weekly history, Bitcoin ETFs experienced two consecutive weeks of outflows in early April (-$713.30 million and -$172.69 million). This was before returning to positive territory with $15.85 million for the week ending April 17. This was followed by the strong $3.06 billion inflow for the week ending April 25, $1.81 billion for May 2, and now the reduced $599.59 million for May 8.

Despite such weekly decline, daily inflow figures still show a positive trend, as $321.46 million was noted in terms of net inflows on May 9. The turnover of trading has also declined, while the volume traded overall dropped to $9.27 billion during the week ending May 8 from a peak of $13.23 billion during the week ending May 2.

Weekly Bitcoin ETF inflow data. Source: SosoValue

Weekly Bitcoin ETF inflow data. Source: SosoValue

ETF assets continue to increase with diminishing inflows

While weekly inflows have slowed, the overall trend for Bitcoin ETFs is still positive, with overall total net assets still increasing. Total net assets of all Bitcoin ETFs as of May 9, 2025, are at $121.19 billion, based on the data.

This is a big surge from $118.66 billion on May 8 and $113.15 billion on May 2. Total assets are on the rise, showing both new capital inflows and appreciation of Bitcoin’s value during that period.

BlackRock’s IBIT tops with $64.45 billion in net assets. It is home to over half of all Bitcoin ETF assets. IBIT had $356.20 million in daily inflows on May 9. Its inflows since inception now stand at $44.71 billion.

Fidelity’s FBTC ranks second with $20.54 billion of assets and saw $45 million of daily inflows on May 9. Grayscale’s GBTC ranks third with $19.47 billion of assets in the face of ongoing outflows.

Other funds that are up include Ark’s ARKB ($4.99 billion), Grayscale’s BTC ($4.41 billion), and Bitwise’s BITB ($3.96 billion). Most ETFs saw positive price action on May 9.

Individual ETF performance

A closer look at single ETF performance reveals varied investor sentiment between various products. BlackRock’s IBIT tops daily inflows again with $356.20 million on May 9. Fidelity’s FBTC had the second-largest daily inflow with $45 million, while most of the other ETFs saw no new inflows on the reporting date.

Grayscale’s GBTC continued its pattern of outflows with -$65.16 million. Bitwise’s BITB also saw outflows of -$14.59 million.

Volume on these products remains strong with $2.67 billion in aggregate value traded on May 9. All ETFs except Hashdex’s DEFI experienced positive price movement on May 9, with Franklin’s EZBC leading the way at +0.16%, followed by ARKB and BRRR at +0.14% each.

The cumulative inflow figure has now reached $41.16 billion and is a substantial portion of the $121.19 billion in total net assets. This ratio suggests approximately 34% of current Bitcoin ETF assets came from net new money.

KEY Difference Wire helps crypto brands break through and dominate headlines fast