Michael Saylor hinted that Strategy, formerly MicroStrategy, may be preparing to buy more Bitcoin. On May 11, he shared a post on X showing a screenshot of Strategy’s Bitcoin wallet.

The post said only “connect the dots,” with no other details.

This post followed a familiar pattern. In the past, Saylor used similar short phrases on social media before large Bitcoin purchases.

The current post raised speculation about another upcoming Bitcoin purchase by the company.

SaylorTracker data shows Strategy now holds 555,450 BTC. At the current price, the Bitcoin is worth over $58 billion. This makes Strategy the largest corporate Bitcoin holder in the world.

Strategy’s Bitcoin Holdings Now Worth Over $58 Billion

Strategy’s Bitcoin holdings began in August 2020. Since then, the firm has continued adding Bitcoin through debt offerings and equity sales. The firm has never sold any BTC from its holdings.

As of May 11, Strategy’s total Bitcoin purchase stood at 555,450 BTC. The company bought the coins at an average price of around $33,000. With BTC trading near $104,000, the total value of Strategy’s Bitcoin now exceeds $58 billion.

Saylor did not confirm any new Bitcoin purchase in the post. However, the post followed a pattern he used before earlier acquisitions.

These typically appeared days or weeks before Strategy revealed new BTC buys in filings.

Bitcoin Price Rises to $104,621 After 10% Weekly Gain

Bitcoin’s price rose 10% in the past seven days. The BTC price moved above $100,000 on May 10, marking its highest level since February. As of May 11, Bitcoin trades at $104,621.

The price is now only 4% below its all-time high of $109,021 set in January 2025. Market activity shows increasing interest from corporate investors. Exchange trading volumes also saw a sharp rise during the week.

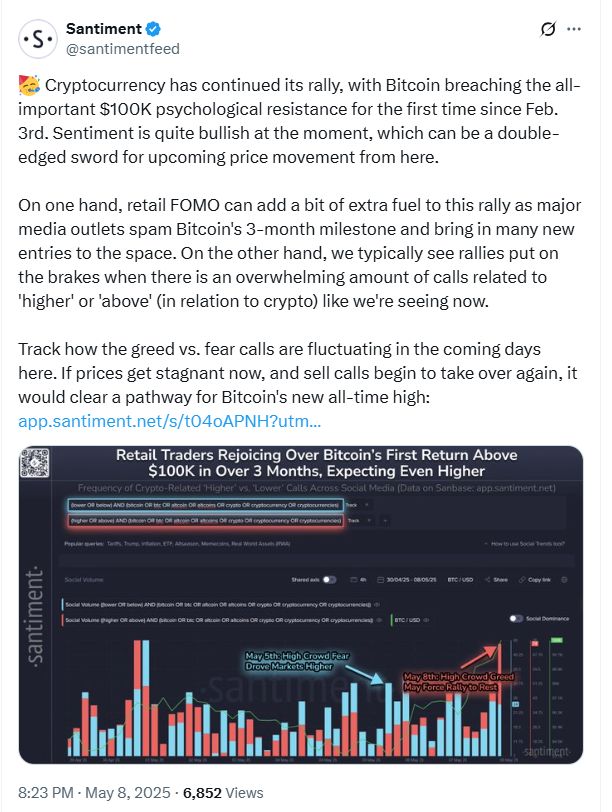

Analysts from Santiment commented on the trend.

“Sentiment is quite bullish at the moment,”

the firm noted. They added that heavy enthusiasm from traders often coincides with local tops in Bitcoin price.

Retail Traders Expect More Gains as Bitcoin Breaks $100K. Source: Santiment/@santimentfeed

Retail Traders Expect More Gains as Bitcoin Breaks $100K. Source: Santiment/@santimentfeed

Metaplanet and Tether Compete in Corporate Bitcoin Space

Other companies are expanding their Bitcoin strategies. Japan-based Metaplanet now holds over 5,000 BTC. The firm also opened a U.S. division to grow its Bitcoin operations outside Asia.

In the United States, Cantor Fitzgerald and Tether announced a new Bitcoin fund. The joint initiative is worth $3 billion. It will focus on building a corporate Bitcoin treasury platform for U.S. clients.

Meanwhile, Strive merged with Asset to form another corporate Bitcoin treasury firm. Vivek Ramaswamy, who founded Strive, aims to compete with larger players like Strategy in the BTC space.

Saylor Says Bitcoin Should Be at $150K Without Profit Taking

Saylor made another statement earlier this month. He said Bitcoin’s price would already be at $150,000 if not for short-term selling. According to him, many holders took profits during recent rallies.

He added that long-term Bitcoin holders are still active. These participants continue to buy and hold despite price changes. Saylor did not give a specific date for any upcoming Bitcoin purchase.

For now, Strategy remains the biggest corporate Bitcoin holder. Its public balance sheet shows no sales, and the company continues to support BTC as its primary treasury asset.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.