Bitcoin Surges Past $100,000 as Institutional Demand Opens Paths for Altcoin Growth and Future Price Movements

-

Bitcoin’s recent surge past $100,000 highlights the increasing role of institutional interest and ETF inflows in shaping its market trajectory.

-

The rise has reinvigorated optimism in the crypto space, with predictions of near-term all-time highs amidst growing scrutiny from traditional finance.

-

According to Ki Young Ju, CEO of CryptoQuant, the evolving sentiment and liquidity dynamics fundamentally alter the established Bitcoin cycle theory.

As Bitcoin breaks the $100,000 barrier, institutional dynamics point to a new bullish phase, with significant implications for the crypto market landscape.

Large Players Shift Dynamics in Bitcoin Market

In a transformative moment for the crypto landscape, Bitcoin’s price surge above $100,000 points to a sea change in market dynamics.

Institutional players, evidenced by substantial holdings from firms like Strategy, which has amassed over $53.9 billion in BTC, and the ongoing inflow of capital into Bitcoin ETFs from giants like BlackRock, are reshaping traditional perceptions of Bitcoin’s price movements.

This growing institutional engagement underscores a potential shift away from previous cycle theories as liquidity dynamics become increasingly dominated by traditional finance.

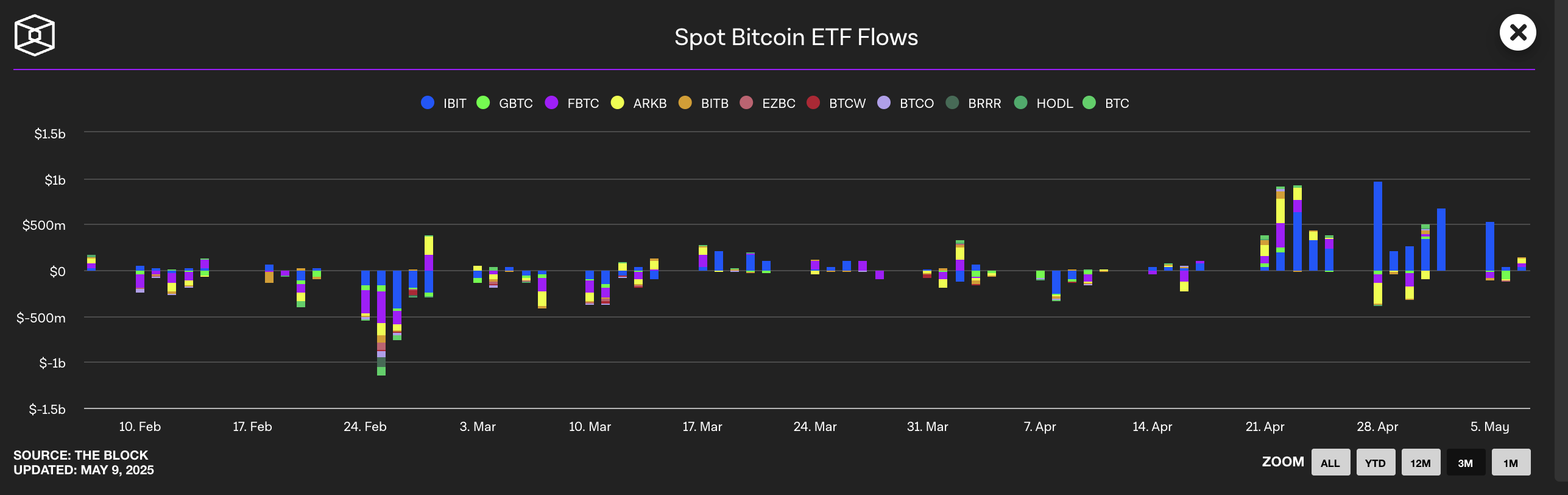

Source: The Block

With sentiment varied in the options market, increasing futures interest points to Bitcoin maturing as an asset class driven more by macroeconomic conditions than by retail participation.

Moreover, as Bitcoin’s dominance appears to have peaked, altcoins are gaining traction, with experts like Raoul Pal suggesting the onset of the “Banana Zone,” a phase where altcoins typically experience significant growth.

Institutional Support Fuels Bitcoin’s Upward Momentum

The involvement of major players like BlackRock suggests that the crypto market is becoming more integrated with traditional financial models. Recent analyses show an escalation in capital inflows, further reinforcing the upward price trajectory.

Standard Chartered has recently revised its bullish stance, projecting that Bitcoin could hit a new all-time high in the second quarter of the year. This optimistic forecast aligns with the broader trend of increased ETF participation and interest from sovereign funds.

Exchange Supply Dynamics Indicate Strong Accumulation

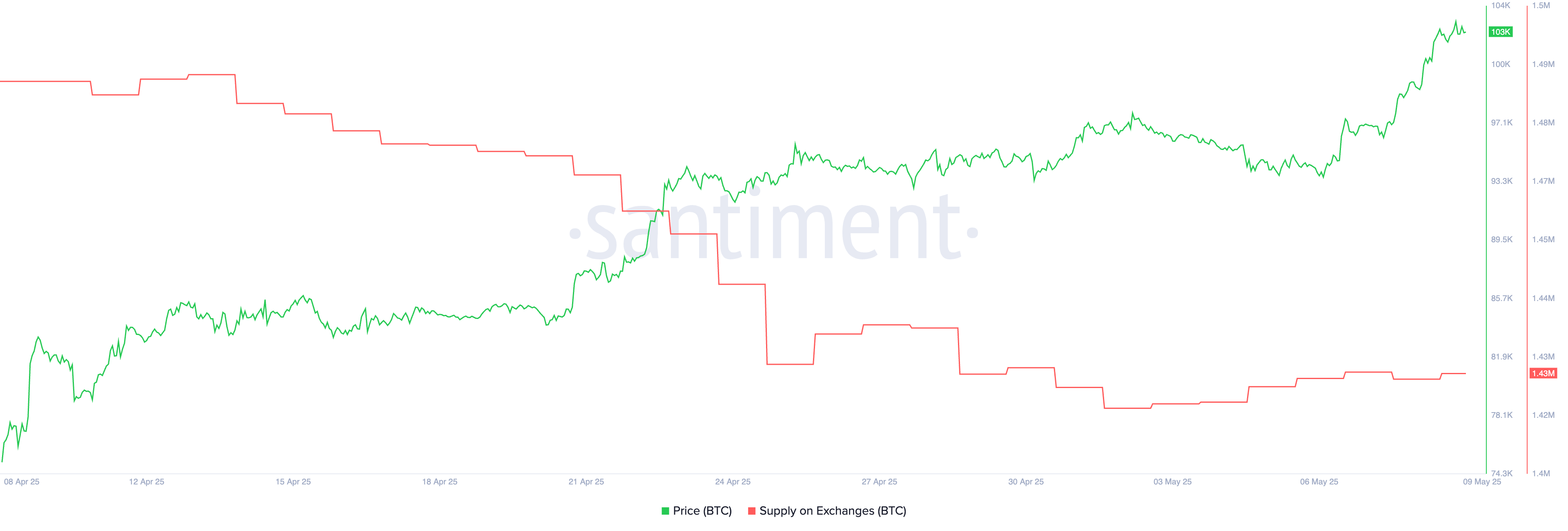

In a telling indicator of market sentiment, Bitcoin’s supply on exchanges has decreased significantly in recent weeks, highlighting strong accumulation. From April 13 to April 25, the supply fell from 1.49 million to 1.43 million BTC, a reduction suggesting robust long-term holding behavior among investors.

Historically, declining exchange supply is viewed positively, indicating that Bitcoin is moving into wallets for long-term investment rather than circulating on the market for immediate sale.

Source: Santiment

This stabilization at 1.43 million BTC could suggest heightened confidence in maintaining current price levels, bolstered further by exhibited bullish patterns in technical indicators like the Ichimoku Cloud.

Positive Technical Signals Reinforce Bullish Outlook

The Ichimoku Cloud framework for Bitcoin currently illustrates a strong bullish momentum. The price is hovering above the cloud, signaling an established uptrend.

With the Tenkan-sen and Kijun-sen indicators both displaying an upward trajectory, the market sentiment remains firmly in bullish territory.

Source: TradingView

As the Leading Span A maintains its position over Leading Span B, market support levels appear robust. Unless there is a dramatic shift indicating reversal, the outlook for Bitcoin retains its bullish characterization.

Maintaining Support: Key Levels to Watch

Bitcoin’s EMA lines currently suggest strong upward momentum, positioning short-term averages above long-term metrics. Should this positive trajectory continue, Bitcoin is poised to test the resistance level at $106,296.

A successful breakthrough of this level could pave the way toward potential highs nearing the $110,000 mark.

Source: TradingView

Conversely, a breakdown below the critical support level at $99,472 could signal a shift in market sentiment, possibly resulting in price retracements to lower support levels around $94,118.

Conclusion

The intersection of institutional involvement and emerging altcoin interest presents an intriguing landscape for Bitcoin and the broader crypto market. As Bitcoin navigates crucial resistance and support levels, the outlook remains optimistic, tempered by the need for sustained technical and market support. Ultimately, the coming weeks will likely provide critical insights into the future trajectory of Bitcoin amidst these evolving dynamics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MicroStrategy, Metaplanet Invest $1.5B in Bitcoin

Metaplanet, MicroStrategy Expand Bitcoin Holdings With $1.5B Investment

MicroStrategy and Metaplanet Invest $1.5B in Bitcoin

Conor McGregor Advocates for Irish Bitcoin Reserve