Polkadot Just Hit a Danger Zone!

Polkadot (DOT) has seen better days. Once hailed as a core layer-0 infrastructure token, its recent price action has left many traders on edge. As May 2025 unfolds, DOT is sitting at a critical support level after a multi-week consolidation and a sharp recent dip. With trading volume fluctuating and moving averages pointing downward, investors are asking : is DOT price preparing for a rebound , or will the support finally give way?

Polkadot Price Prediction: Current Price Action and Market Structure

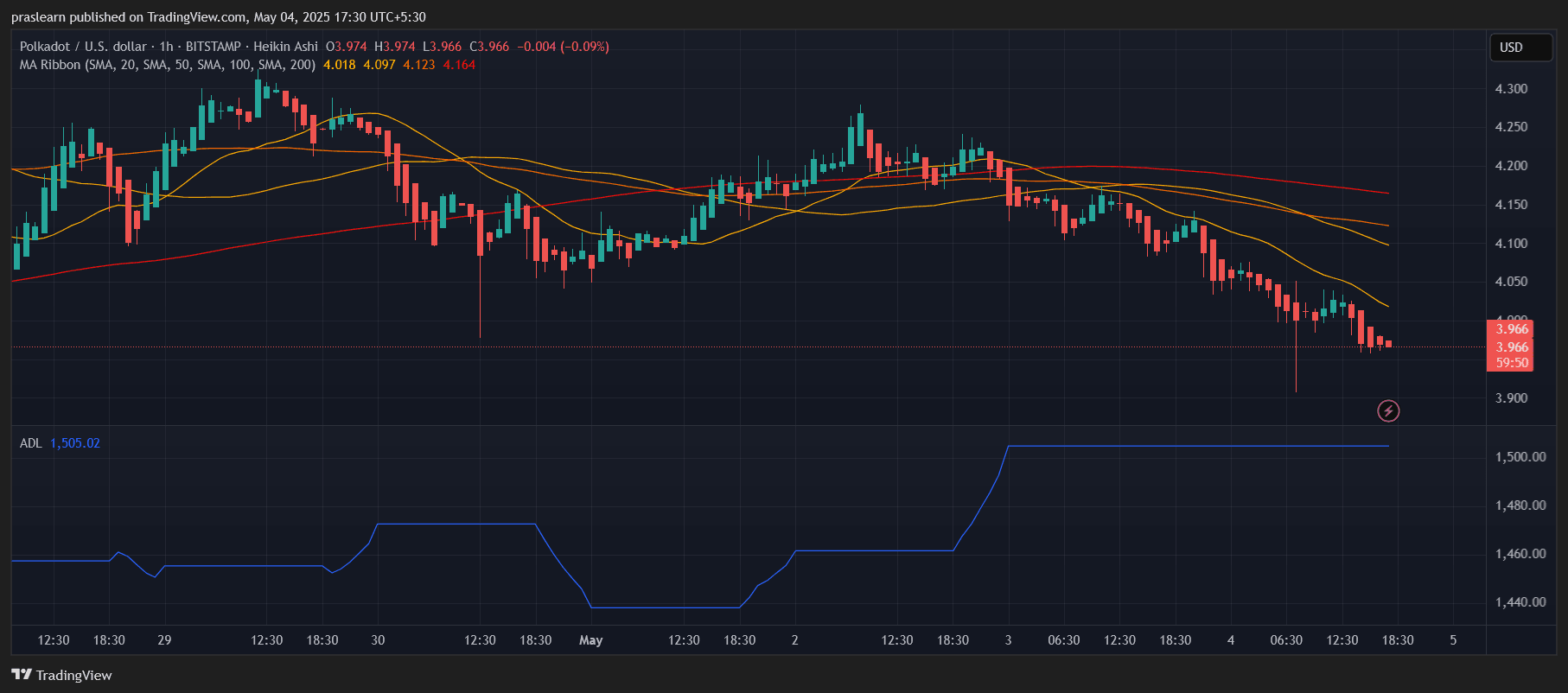

DOT/USD 1 Hr Chart- TradingView

DOT/USD 1 Hr Chart- TradingView

As of the latest candle close, DOT is trading around $3.98 , with hourly charts revealing sustained selling pressure. The price has decisively broken below the short-term support range around $4.10, and has lost grip of all key short-term moving averages (20, 50, and 100 SMA). The hourly 200 SMA, which often acts as the final defense for bullish momentum, is well above the price at $4.16 — now serving as stiff resistance.

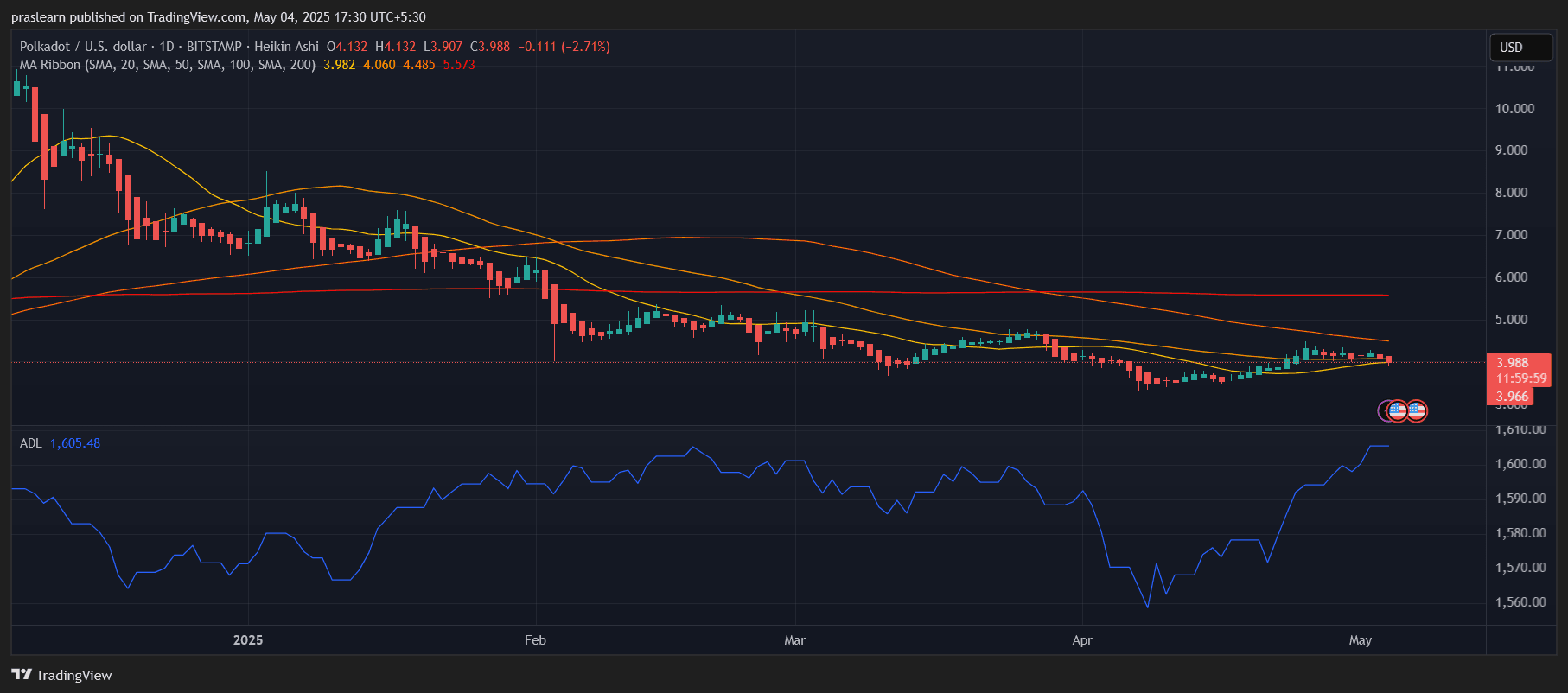

DOT/USD 1 Day Chart- TradingView

DOT/USD 1 Day Chart- TradingView

On the daily chart, DOT price rejection from the 100 SMA (currently at $4.48) capped the recent rally. The 50 SMA is currently positioned at $4.06, and the price is now sitting just below it. This confluence suggests a weakening bullish structure with an increasing risk of further decline if DOT closes a few more candles below $4.00.

Volume and ADL Analysis: Bearish Divergence

Looking at the Accumulation/Distribution Line (ADL), DOT shows a concerning pattern. Despite slight upticks in price during late April, the ADL failed to make a corresponding higher high. This divergence signals that smart money may be exiting positions during price relief rallies. On the hourly chart, the ADL continues its slow descent, confirming that bearish sentiment is currently stronger than what surface-level price action suggests.

Volume has also dried up, meaning there's little conviction from buyers to defend the $4 mark. Unless a catalyst emerges to spike demand, this stagnation may lead to a stronger downside move in the coming sessions.

Key Support and Resistance Levels

- Immediate Support: $3.90 — A psychological and technical level where price previously bounced.

- Next Major Support: $3.60 — The low from mid-April and a potential reversal zone if sellers accelerate.

- Immediate Resistance: $4.10 and $4.16 (20 and 200 SMA on hourly).

- Breakout Barrier: $4.50 — The level DOT must reclaim on the daily chart to resume a bullish trend.

Polkadot Price Prediction: Bounce or Breakdown?

The broader chart structure indicates that Polkadot price is at a decision point . If DOT price loses the $3.90 support with volume, it could swiftly drop to $3.60 or even test $3.30 — a level not seen since Q1 2023. However, if bulls manage to reclaim $4.10 and sustain above the 50 and 100 daily SMA, a short-term rally to $4.50 or even $5.00 becomes plausible, especially if the crypto market as a whole regains momentum.

Momentum indicators on lower timeframes hint at a possible oversold bounce, but without volume confirmation, any relief may be short-lived.

Polkadot Price May Outlook

May could be make-or-break for DOT price . The current technical landscape suggests caution, as Polkadot price is at risk of losing its footing. However, these conditions also often precede strong reversal rallies — if bulls show up. A decisive reclaim of $4.10 would flip the script in favor of buyers, while sustained weakness below $3.90 could open the floodgates for deeper losses.

Polkadot (DOT) has seen better days. Once hailed as a core layer-0 infrastructure token, its recent price action has left many traders on edge. As May 2025 unfolds, DOT is sitting at a critical support level after a multi-week consolidation and a sharp recent dip. With trading volume fluctuating and moving averages pointing downward, investors are asking : is DOT price preparing for a rebound , or will the support finally give way?

Polkadot Price Prediction: Current Price Action and Market Structure

DOT/USD 1 Hr Chart- TradingView

DOT/USD 1 Hr Chart- TradingView

As of the latest candle close, DOT is trading around $3.98 , with hourly charts revealing sustained selling pressure. The price has decisively broken below the short-term support range around $4.10, and has lost grip of all key short-term moving averages (20, 50, and 100 SMA). The hourly 200 SMA, which often acts as the final defense for bullish momentum, is well above the price at $4.16 — now serving as stiff resistance.

DOT/USD 1 Day Chart- TradingView

DOT/USD 1 Day Chart- TradingView

On the daily chart, DOT price rejection from the 100 SMA (currently at $4.48) capped the recent rally. The 50 SMA is currently positioned at $4.06, and the price is now sitting just below it. This confluence suggests a weakening bullish structure with an increasing risk of further decline if DOT closes a few more candles below $4.00.

Volume and ADL Analysis: Bearish Divergence

Looking at the Accumulation/Distribution Line (ADL), DOT shows a concerning pattern. Despite slight upticks in price during late April, the ADL failed to make a corresponding higher high. This divergence signals that smart money may be exiting positions during price relief rallies. On the hourly chart, the ADL continues its slow descent, confirming that bearish sentiment is currently stronger than what surface-level price action suggests.

Volume has also dried up, meaning there's little conviction from buyers to defend the $4 mark. Unless a catalyst emerges to spike demand, this stagnation may lead to a stronger downside move in the coming sessions.

Key Support and Resistance Levels

- Immediate Support: $3.90 — A psychological and technical level where price previously bounced.

- Next Major Support: $3.60 — The low from mid-April and a potential reversal zone if sellers accelerate.

- Immediate Resistance: $4.10 and $4.16 (20 and 200 SMA on hourly).

- Breakout Barrier: $4.50 — The level DOT must reclaim on the daily chart to resume a bullish trend.

Polkadot Price Prediction: Bounce or Breakdown?

The broader chart structure indicates that Polkadot price is at a decision point . If DOT price loses the $3.90 support with volume, it could swiftly drop to $3.60 or even test $3.30 — a level not seen since Q1 2023. However, if bulls manage to reclaim $4.10 and sustain above the 50 and 100 daily SMA, a short-term rally to $4.50 or even $5.00 becomes plausible, especially if the crypto market as a whole regains momentum.

Momentum indicators on lower timeframes hint at a possible oversold bounce, but without volume confirmation, any relief may be short-lived.

Polkadot Price May Outlook

May could be make-or-break for DOT price . The current technical landscape suggests caution, as Polkadot price is at risk of losing its footing. However, these conditions also often precede strong reversal rallies — if bulls show up. A decisive reclaim of $4.10 would flip the script in favor of buyers, while sustained weakness below $3.90 could open the floodgates for deeper losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SBF appeal hearing set to start November 3, two years after 25-year conviction

Share link:In this post: The Second Circuit has scheduled the appeal hearing for Sam Bankman-Fried for the week of November 3, 2025. Sam Bankman-Fried was convicted on November 3, 2023, and sentenced to 25 years in prison on March 28, 2024. The founder of the defunct FTX exchange filed an appeal on September 13, 2024.

Elon Musk says xAI is attracting Meta’s engineers even without “insane” pay offers

Share link:In this post: Elon Musk revealed that senior Meta engineers have moved to xAI without needing “insane” initial compensation, trusting in the company’s long-term potential. While Meta has tried to lure AI talent, offering up to $100M packages, some candidates, including OpenAI and Anthropic researchers, have declined, citing mission-driven motives and organizational agility. xAI’s fast rollout of 10 tools in under two years has impressed observers, as major players like Meta, OpenAI, Google, and

Charles Hoskinson says Cardano treasury won’t cover listing fees for SNEK or Midnight

Share link:In this post: Charles Hoskinson clarified that the Cardano Treasury will not be used to pay exchange listing fees for projects like SNEK or Midnight. The statement was made in response to SNEK’s proposal to withdraw 5 million ADA for a Tier 1 exchange listing. Hoskinson emphasized that all projects must self-fund their listings, regardless of community support or strategic value.

LuBian’s 2020 Bitcoin Heist Surfaces, Largest Crypto Theft Revealed