Bitcoin (BTC) price showed strong signs of momentum after a week of consistent gains. The leading cryptocurrency was trading near $94,846, marking a steady recovery after previous consolidations.

Market data suggests Bitcoin is set for one of its strongest weekly performances in 2025.

Analysts believe that if current conditions hold, a potential 15% breakout move could soon push Bitcoin above $109,000.

Large Transaction Volumes and Whale Accumulation Drive Confidence

Over the past 24 hours, Bitcoin price has recorded 23,550 large transactions. This number is very close to the 7-day high of 23,740, achieved earlier this week.

High transaction activity, especially from whales and institutions, often signals growing market confidence and accumulation phases.

Market participants are closely watching this surge in transaction volumes. Many analysts suggest that large players moving Bitcoin are preparing for a continuation of the uptrend.

This steady rise in activity has typically led to stronger price moves in the past, as seen in earlier Bitcoin cycles.

Source: IntoTheBlock

Source: IntoTheBlock

In addition, the current large transaction activity suggests that major investors are still engaging with Bitcoin at higher price levels.

This behavior reflects a belief that the asset has further room to grow, despite the challenges seen around the $95,000 resistance zone.

Open Interest in Bitcoin Futures Signals Rising Leverage

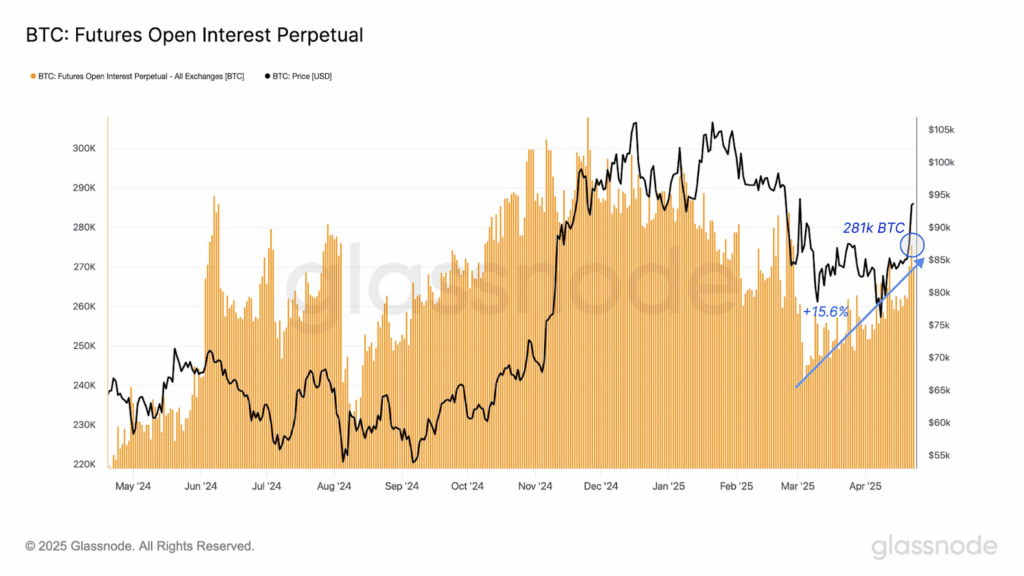

According to data from Glassnode, Open Interest in Bitcoin perpetual swaps has climbed to 281,000 BTC.

This figure represents a 15.6% increase since early March 2025. Rising Open Interest suggests that traders are increasing their leverage exposure as Bitcoin prices rebound.

Higher leverage can amplify price movements in either direction. This build-up has raised concerns about potential volatility from liquidations and stop-outs.

However, in a bullish environment, leverage could also accelerate upward moves when price breaks key resistance levels.

Source: X

Source: X

Analysts have warned that weekends generally see lower liquidity, which sometimes leads to price gaps when markets reopen.

Bitcoin ended the week at its 2-month high, setting the stage for possible market gaps in the coming days if the trend continues.

Macro Environment Supports Bullish Momentum

The broader market environment remains favorable for Bitcoin’s bullish momentum. Factors such as the upcoming Bitcoin halving event and strong inflows into spot Bitcoin ETFs have supported buying pressure. Many believe these events could continue to drive prices higher in the coming months.

Michael Saylor, founder of MicroStrategy, recently pointed out that Bitcoin had once again outperformed major stock indexes like the Nasdaq and S&P 500.

Saylor posted, “Bitcoin is Faster,” on his social media account, accompanied by a graphic showing Bitcoin’s price strength.

Furthermore, Bitcoin reserves on centralized exchanges continue to decline. A reduction in exchange-held Bitcoin supply generally indicates that holders are moving coins into long-term storage, reducing available supply for trading.

This trend often precedes stronger price moves as demand rises against shrinking supply.

Meanwhile, top executives like John D’Agostino from Coinbase have acknowledged that Bitcoin’s correlation with stock markets can be both positive and negative.

Current positive correlation with rising equities adds another supportive factor for Bitcoin’s bullish price behavior.

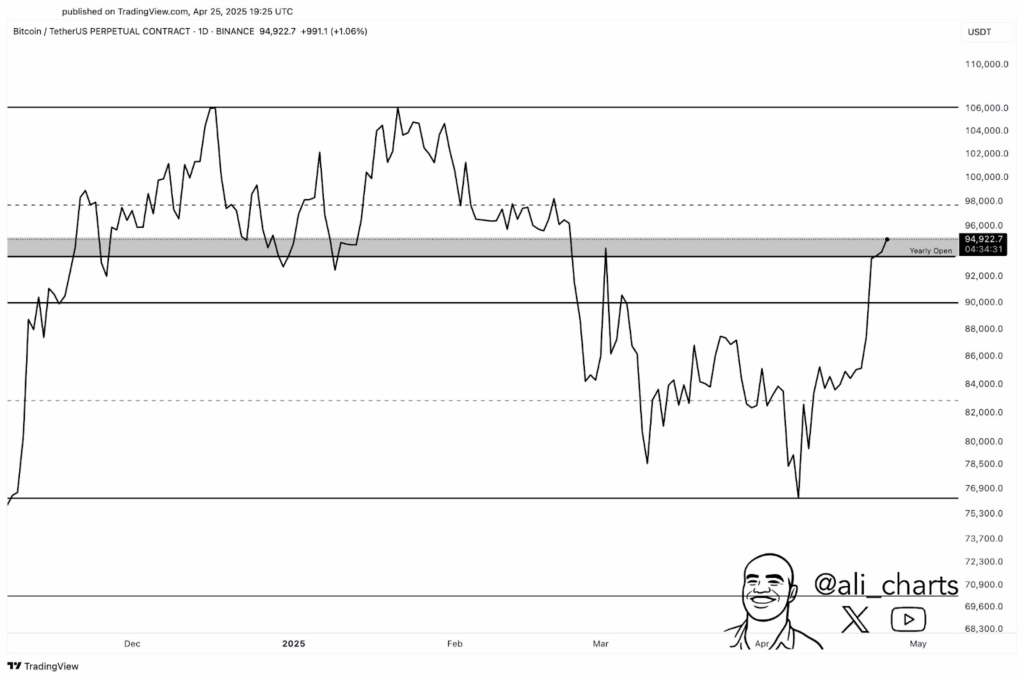

Price Consolidation Sets Stage for Breakout Above $95,000

Bitcoin has been trading back and forth between $84,000 to $88,000 before this spike to $95,000. This clean breakout from consolidation indicates that there is renewed buying interest evident in the market.

The area of $95,000 has acted as a major obstacle in the past; however, the price action still depicts a bullish outlook for Bitcoin.

It is for this reason that higher lows and sustainable trend provide confirmation that buyers are firmly in charge.

Accordingly, if Bitcoin price reclaims $95K, technical indications mean the near-term target is $98K price level.

Source: X

Source: X

Above $98,000, several analysts have provided specific below $106,000 in short term and between $109,300 in the longer term thus a 15% appreciation from the current rate.

These factors have been backed up by trends of whale accumulation, higher transactions volumes, as well as positive macros.

At press time, Bitcoin traded at $94,089.9, reflecting a 0.02% surge from the intraday low. It attained a $1.86 Trillion market capitalization, highlighting increasing investment.

It has been up by a 0.18% increase while 24-hour volume decreased by 22% and is currently at $25.13 billion.