Bitcoin supply on exchanges is falling ‘due to public company purchases’ — Fidelity

Bitcoin reserves on cryptocurrency exchanges have dropped to their lowest level in more than six years, as publicly traded companies ramp up their accumulation of the digital asset following the US presidential election, according to Fidelity Digital Assets.

“We have seen Bitcoin supply on exchanges dropping due to public company purchases — something we anticipate accelerating in the near future,” Fidelity reported on the X social media platform.

Fidelity said the supply of Bitcoin on exchanges had fallen to roughly 2.6 million BTC, the lowest since November 2018. More than 425,000 BTC have moved off exchanges since November, a trend often viewed as a signal of long-term investment rather than short-term trading.

Over the same period, publicly-traded companies acquired nearly 350,000 BTC, Fidelity said.

Fidelity Digital Assets is a subsidiary of Fidelity Investments, the $5.8 trillion asset manager headquartered in Boston, Massachusetts. The Fidelity Digital subsidiary was established in 2018, long before cryptocurrency was considered an institutional asset class.

Fidelity is the issuer of the Fidelity Wise Origin Bitcoin Fund , one of the first 11 spot Bitcoin exchange-traded funds approved in the United States.

Strategy dominates public company purchases

While Fidelity noted significant corporate Bitcoin purchases, most of the accumulation has been driven by Strategy , the business intelligence firm-turned-Bitcoin bank co-founded by Michael Saylor.

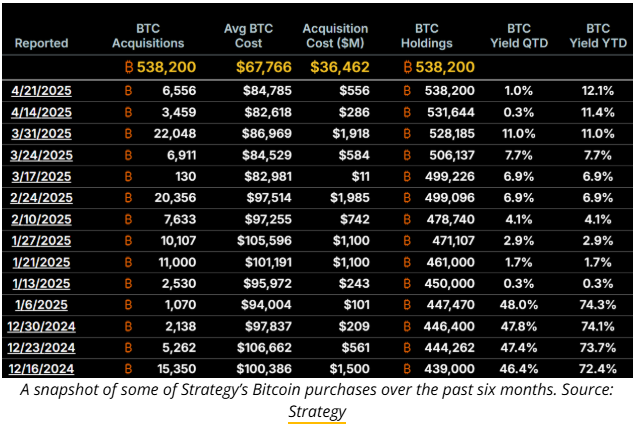

Since November, Strategy has acquired 285,980 BTC, accounting for 81% of the approximately 350,000 BTC purchased by publicly traded companies.

Strategy’s latest purchase of 6,556 BTC was disclosed on April 21.

Outside the United States, publicly traded companies in Asia have adopted a similar Bitcoin treasury strategy, with Japan’s Metaplanet and Hong Kong’s HK Asia Holdings increasing their Bitcoin allocations .

Metaplanet currently holds 5,000 BTC, with CEO Simon Gerovich saying his goal is to double that amount this year.

Meanwhile, HK Asia Holdings announced plans to raise roughly $8.35 million to potentially increase its Bitcoin reserves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL and Meme Coins Are Booming Again

Leading Crypto Presale: Nexchain’s Stage 11 Hits $1.5M with $NEX at $0.042

You can participate in the ongoing Nexchain's presale and gain exposure to one of the leading AI crypto projects before the major exchanges.

Ethereum’s “Trillion Dollar Security” Boosts Onchain Safety

Ethereum Foundation unveils "Trillion Dollar Security" to enhance wallet, UX, and smart contract security.A Step Toward Mass Adoption

Tokenized U.S. Equities: Breakthrough or Just Hype?

Are tokenized U.S. equities the future or just noise? Explore their roots, market trends, and regulatory roadblocks.Where It All Began: From STOs to Tokenized StocksRegulatory Hurdles and the Real-World GapSymbolic Progress, Real Potential