Ripple and SEC File Joint Motion to Settle Loose Ends From Legal Battle

Ripple and the SEC are nearing a settlement in their lengthy legal battle, with a joint motion to pause appeals. While a resolution is likely, XRP’s price remains unaffected.

The SEC and Ripple filed a joint motion today, asking a US Appeals Court to halt any appeals and cross-appeals between the two parties. This is a prelude to a formal settlement, which both parties are inclined towards.

The filing notes that any further procedural developments may take up to 60 days despite expectations that the outcome is largely predetermined. In the meantime, the XRP market appears to have priced in the likelihood of a resolution.

Ripple and The SEC Move To Settle

The SEC vs Ripple case has been one of crypto’s most important legal battles over the last few years. After months of hints and credible rumors, the Commission finally dropped its lawsuit last month.

Today, both parties are getting close to a final agreement, filing a joint motion regarding one of the case’s remaining loose ends:

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” claimed James Filan, a lawyer and Ripple supporter who is in no way directly affiliated with the firm’s legal efforts.

Specifically, the loose end between Ripple and the SEC regards Ripple’s cross-appeal, which was filed last October. With this new joint motion, the two parties have “reached an agreement-in-principle” to resolve all outstanding business.

This includes the SEC’s initial appeal, the aforementioned cross-appeal, and any other claims involving individual actors.

Technically, both parties publicly announced that they were ready to settle over two weeks ago. It’s unclear why Ripple and the SEC took so long to file this joint motion.

The price of XRP has persistently been less impacted by lawsuit updates since the comission first dropped its case, and this development seems fully priced in.

The joint motion also mentions that further progress may take another 60 days. When they completely finalize a settlement, it could likely have landmark implications for US crypto policy.

However, based on the way that the SEC is improving relations with Ripple, Coinbase, Kraken, etc., a favorable outcome seems extremely likely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meta faces antitrust probe in Italy over AI integration in WhatsApp

Share link:In this post: Italy’s antitrust watchdog (AGCM) is investigating Meta for integrating its AI assistant into WhatsApp without user consent. The regulator suspects the tech firm abused its dominant position by forcing users toward its AI, potentially harming competitors. AGCM warns that this integration may limit consumer choice and distort market competition under EU law.

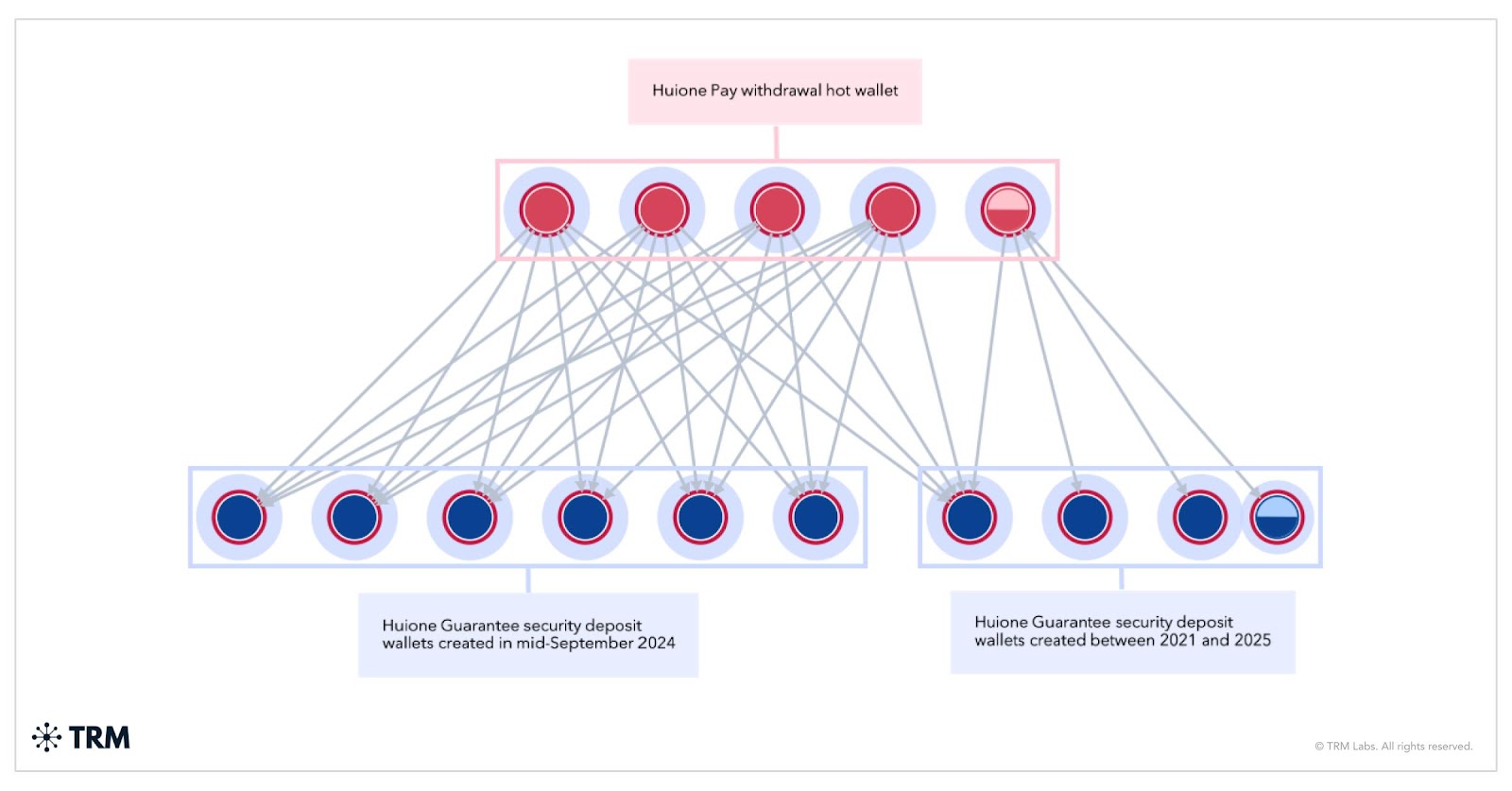

Telegram-banned $35B scam marketplaces find life away from US regulators

Share link:In this post: Telegram banned Huione Guarantee and Xinbi Guarantee after a $35B scam crackdown, but operations quickly shifted to Tudou Guarantee. TRM Labs and Elliptic revealed Huione vendors migrated to alternate platforms, with Tudou seeing a 70x surge in daily transactions. Despite US sanctions and enforcement, Huione Pay, USDH stablecoin, and affiliated services continue operating under new Telegram identities.

Polygon Labs calms fears about reports that its network went down for hours

Share link:In this post: Polygon Labs confirmed its network remained active despite Polygonscan showing no new blocks for over an hour. The issue was caused by a display glitch during a backend update on Polygonscan, not an actual network outage. The incident sparked renewed concerns about overreliance on third-party tools like explorers and RPC providers.

Federal Reserve keeps interest rates unchanged again, as expected

Share link:In this post: The Federal Reserve kept interest rates steady at 4.25% to 4.5%, delaying any cuts until at least September. Trump criticized the Fed’s decision, blaming tariffs for rising costs and demanding lower rates. Borrowers face high rates on credit cards, mortgages, car loans, and student loans, with no relief in sight.