Bitcoin ETFs Experience Major Outflows as Trump Tariffs Begin

Spot bitcoin exchange-traded funds (ETFs) experienced $326.27 million in outflows on Tuesday, their largest single-day exodus since March 11. This withdrawal coincided with the full implementation of President Trump's new tariffs, which took effect at midnight Wednesday.

BlackRock's IBIT led the retreat with $252.9 million leaving the fund. Bitwise's BITB saw $21.7 million exit, while Ark and 21Shares' ARKB lost $19.9 million. Other funds reporting outflows included Grayscale's GBTC, the Grayscale Bitcoin Mini Trust, Franklin's EZBC, and Invesco's BTCO.

Strategy, the largest publicly listed corporate holder of Bitcoin, also showed caution by pausing Bitcoin purchases for the week ending April 6. The company reported an unrealized loss of $5.91 billion for Q1 2025, while holding 528,185 Bitcoin at an average price of $67,458 per coin.

Tuesday's negative flows extended the ETFs' losing streak to four consecutive days, following Monday's $109.2 million in outflows. Trading volume for these bitcoin ETFs totaled $3 billion on Tuesday, down from $6.6 billion on Monday and $4.4 billion last Friday.

"The largest outflow since March 11 points to renewed macro-driven risk aversion, with tariff headlines potentially adding pressure on risk assets," said Rick Maeda, research analyst at Presto Research. He added that ETF flows will likely remain volatile as investors often sell across the board during risk-off periods.

Global markets are responding to President Trump's recently announced reciprocal tariffs, including a 104% levy on Chinese imports. Asian markets showed mixed results Wednesday:

- Japan's Nikkei 225 dropped 3.9%

- Shanghai Composite rose 1.3%

- South Korea's Kospi fell 1.4%

U.S. stock indexes closed lower Tuesday, with the Dow Jones Industrial Average falling 0.84%, the S&P 500 dropping 1.57%, and the Nasdaq Composite declining 2.15%. Maeda noted that shocks to global trade typically hurt risk assets in the short term as investors reassess conditions.

Bitcoin's price fell 2.6% over 24 hours to $77,465 at the time of reporting, giving up gains from its brief climb above $80,000 on Tuesday. Spot ether ETFs also recorded $3.29 million in outflows Tuesday after showing no movement on Monday.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Crypto bull" Tom Lee: The crypto market correction may be nearing its end, and bitcoin is becoming a leading indicator for the US stock market.

"Crypto bull" Tom Lee stated that on October 10, an abnormality in the cryptocurrency market triggered automatic liquidations, resulting in 2 million accounts being liquidated. After market makers suffered heavy losses, they reduced their balance sheets, leading to a vicious cycle of liquidity drying up.

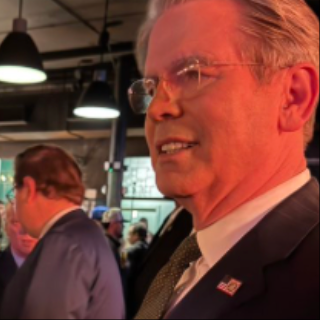

Besant unexpectedly appears at a "Bitcoin-themed bar," crypto community "pleasantly surprised": This is the signal

U.S. Treasury Secretary Janet Yellen made a surprise appearance at a bitcoin-themed bar in Washington, an act regarded by the cryptocurrency community as a clear signal of support from the federal government.

Solana founder shares eight years of behind-the-scenes stories: How he recovered from a 97% crash

What doesn’t kill it makes it legendary: How Solana was reborn from the ashes of FTX and is now attempting to take over global finance.

What’s next for the strongest altcoin of this round, ZEC?

There is a fierce debate between bullish and bearish views on ZEC.