Date: Tue, April 01, 2025 | 06:46 PM GMT

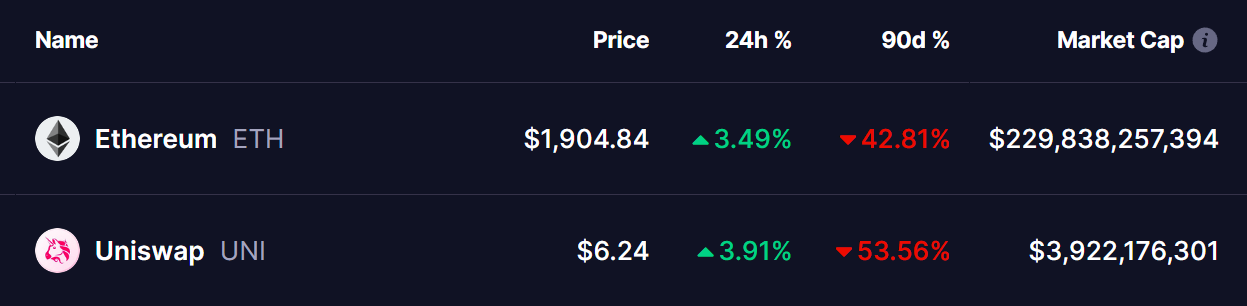

The cryptocurrency market has kicked off Q2 on a bullish note, with Ethereum (ETH) surging by over 3% today, marking a potential shift in momentum after a huge bearish Q1. ETH itself had declined by more than 42%, dragging most altcoins down by over 50%, and Uniswap (UNI) was no exception.

However, today UNI has surged by nearly 4%, and its recent price action suggests a potential bullish reversal could be underway.

Source:

Coinmarketcap

Source:

Coinmarketcap

Retesting Its Symmetrical Triangle Breakout

On the weekly chart, Uniswap (UNI) made a major breakout back in November 2024 from a long-standing symmetrical triangle pattern—a formation that had been developing since the last bull run in 2021. The breakout occurred when UNI surged past the upper boundary of the triangle around $11, pushing its price to a local high of $19.44 before pulling back for a major correction amid the broader market downturn. Currently, UNI is retesting its breakout trendline.

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

Uniswap (UNI) Weekly Chart/Coinsprobe (Source: Tradingview)

The price is hovering near $6.24, a crucial support level, and a successful rebound from this zone could confirm the breakout retest.

Additionally, UNI is trading close to its 100-week moving average (MA), which is another key level to watch. A breakout above the 100 MA at $7.77 could be a strong bullish signal, potentially triggering a rally back toward the $19.44 breakout high. This move would represent an impressive 215% gain from current levels.

MACD Indicating Potential Momentum Shift

The Moving Average Convergence Divergence (MACD) indicator on the weekly chart is showing signs of bottoming out. The MACD line has been trending below the signal line for an extended period, but the histogram is beginning to show diminishing bearish momentum. If the MACD crosses bullishly in the coming weeks, it could further confirm the possibility of an uptrend.

Final Thoughts

Uniswap’s price action suggests that it is at a critical juncture. A successful retest of the breakout trendline followed by a move above the 100 MA could set the stage for a significant rally. However, failure to hold support might lead to further downside pressure.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.