Date: Tue, April 01, 2025 | 12:12 PM GMT

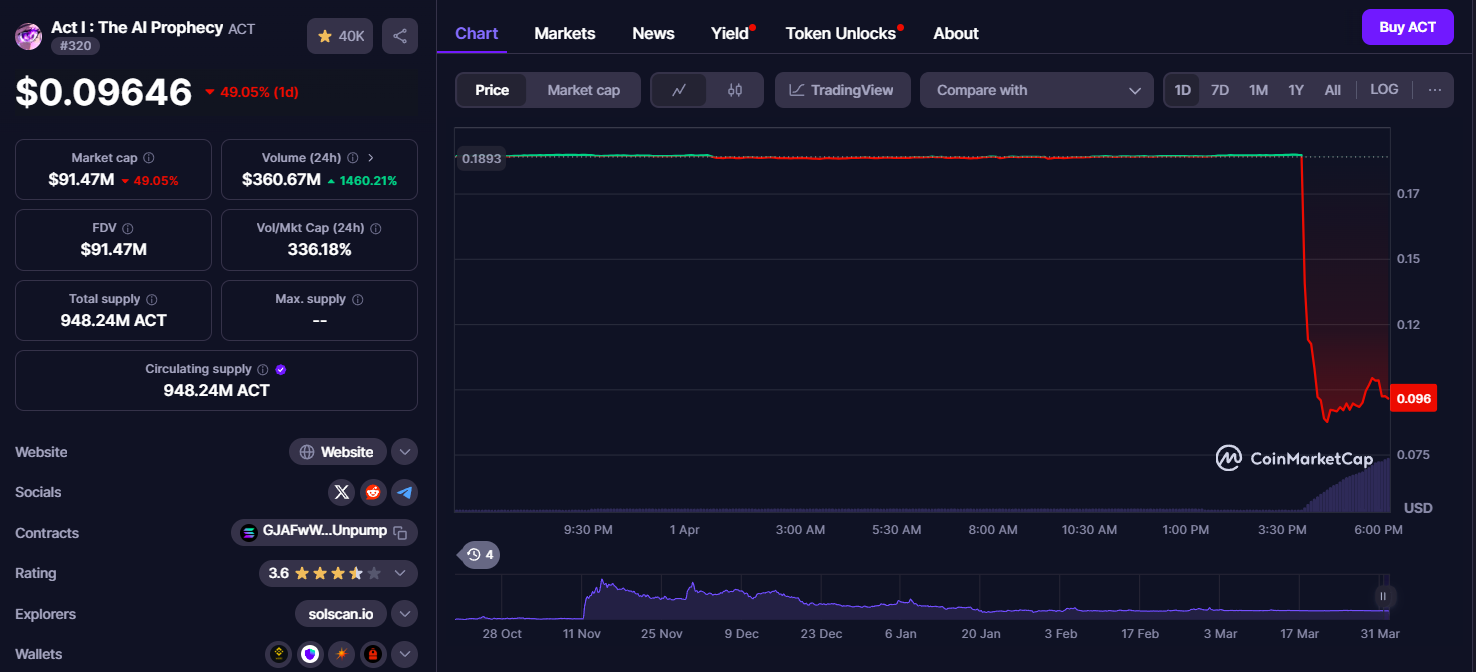

The cryptocurrency market has seen yet another dramatic event as Act I: The AI Prophecy (ACT) token plunged nearly 50% within hours. The massive drop came after Binance announced leverage & margin tier updates for multiple tokens, including ACT, as reported by Lookonchain . The update triggered forced liquidations, panic selling, and a major sell-off by market makers, further deepening the decline.

Source: Coinmarketcap

Source: Coinmarketcap

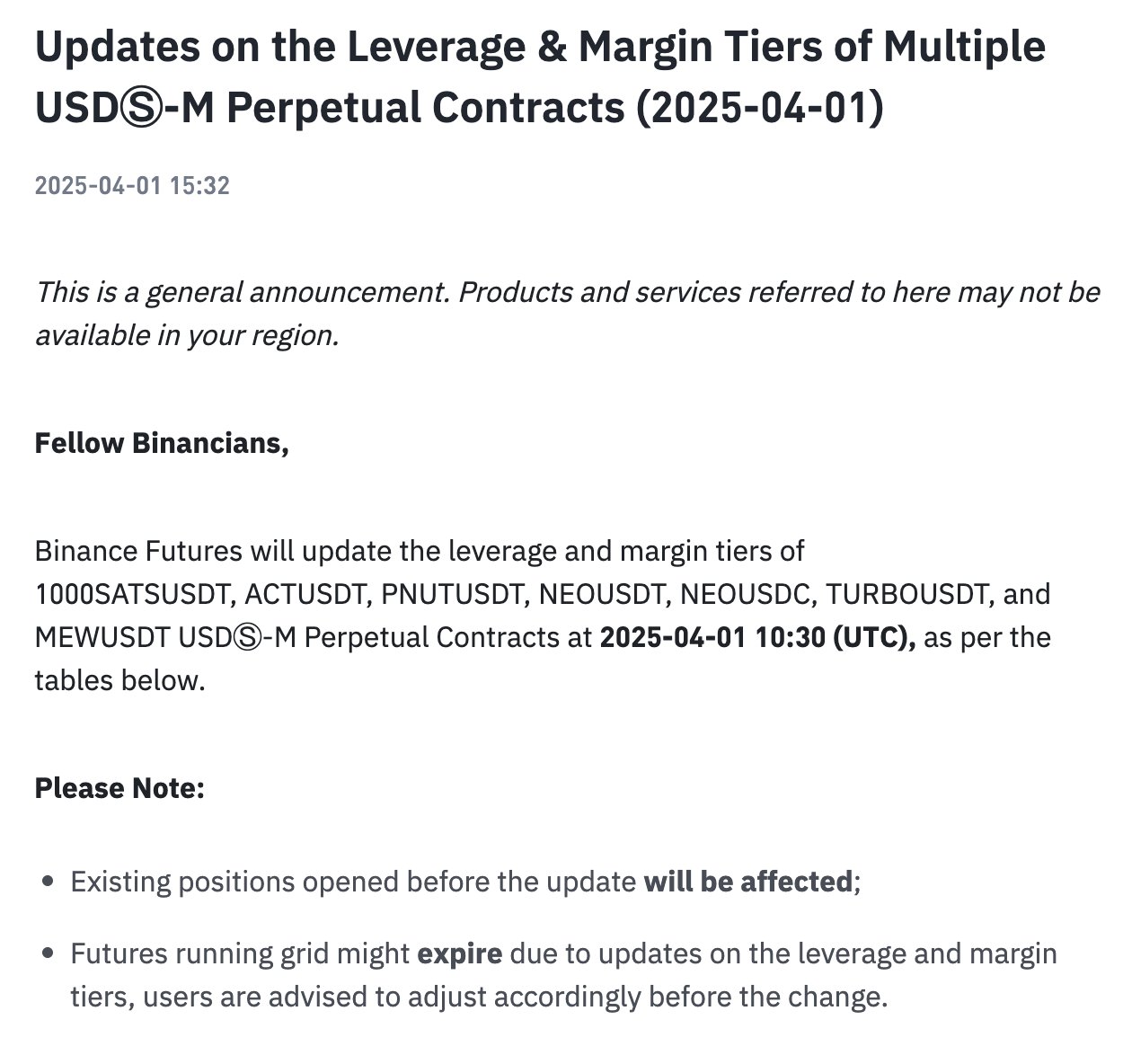

Understanding Binance Futures’ Leverage and Margin Tier Update

Binance Futures announced a reduction in leverage and margin tiers for several perpetual contracts, including ACTUSDT. The update, set to take effect on April 1, 2025, at 10:30 UTC, directly impacted existing positions on the platform.

Source: @lookonchain (X)

Source: @lookonchain (X)

Why Did ACT Drop After This News?

The key factor behind ACT’s sudden crash was Binance’s decision to reduce position sizing across multiple leverage tiers. Before the change, traders could hold larger leveraged positions, but after the update, position limits were slashed, forcing traders to reduce their exposure or risk liquidation.

How This Led to a Price Drop

1. Forced Position Reductions Across All Leverage Levels

With Binance cutting leverage limits, many traders were forced to downsize their positions, triggering a wave of sell-offs. Since both high-leverage and low-leverage traders were affected, selling pressure intensified rapidly.

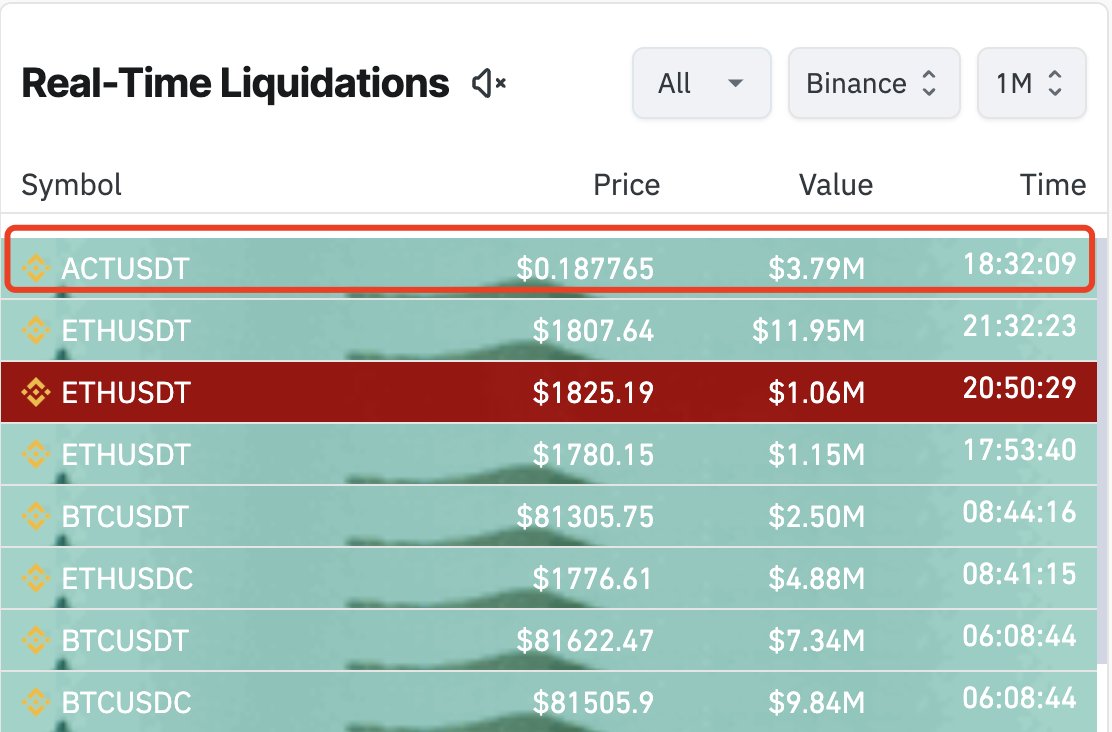

2. Whale Liquidation Adds to the Sell-Off

According to Lookonchain , a major whale holding ACT was liquidated for $3.79 million at a price of $0.1877. Whale liquidations often trigger a cascading effect, leading to further declines as large positions get automatically closed.

Source: @lookonchain (X)

Source: @lookonchain (X)

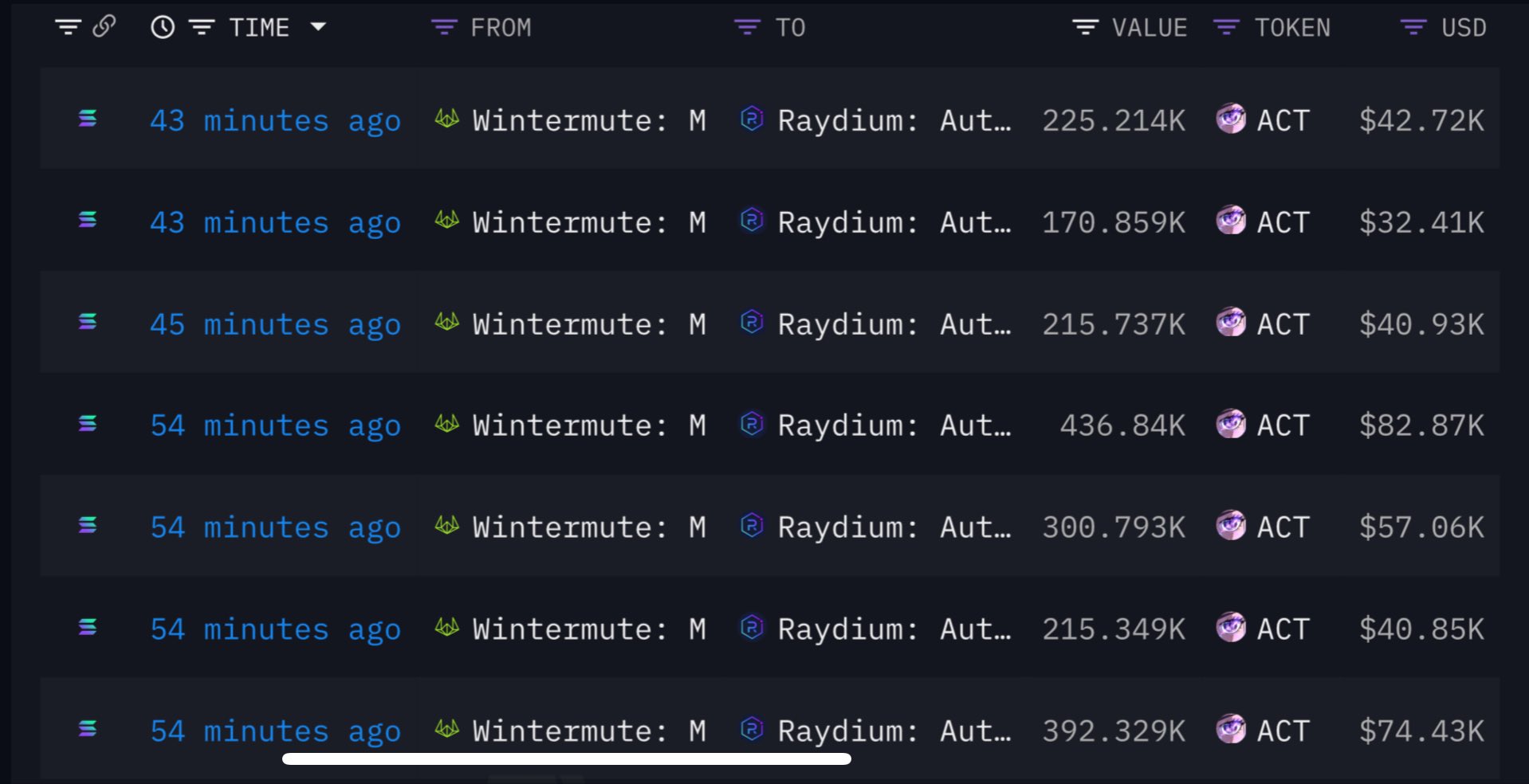

3. Market Maker Wintermute Off-loaded ACT Tokens

Adding to the turmoil, on-chain data from @OnchainDataNerd revealed that market maker Wintermute responded to the price crash by offloading a large number of ACT tokens. In just two hours, Wintermute sold a significant amount of meme coins, including ACT, contributing to the token’s steep decline.

Source: @OnchainDataNerd (X)

Source: @OnchainDataNerd (X)

What’s Next for ACT?

- The immediate liquidation wave might slow down, allowing ACT to stabilize.

Final Thoughts

The combination of Binance’s leverage restrictions, forced liquidations, and market maker sell-offs led to ACT’s 50% price drop. Whether the token can bounce back depends on market sentiment, demand from new buyers, and whether more major players continue selling.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.