Why Gold Outshines Bitcoin as the Safe Haven in Trump’s 2025 Tariff Chaos

In the face of Trump's 2025 trade war turmoil, institutional investors are fleeing to gold, not Bitcoin, citing its stability and crisis-time reliability.

Bitcoin (BTC) has long been touted as “digital gold.” However, as the global economy reels from escalating trade war tensions under Trump’s second term, institutional investors are fleeing to the real thing.

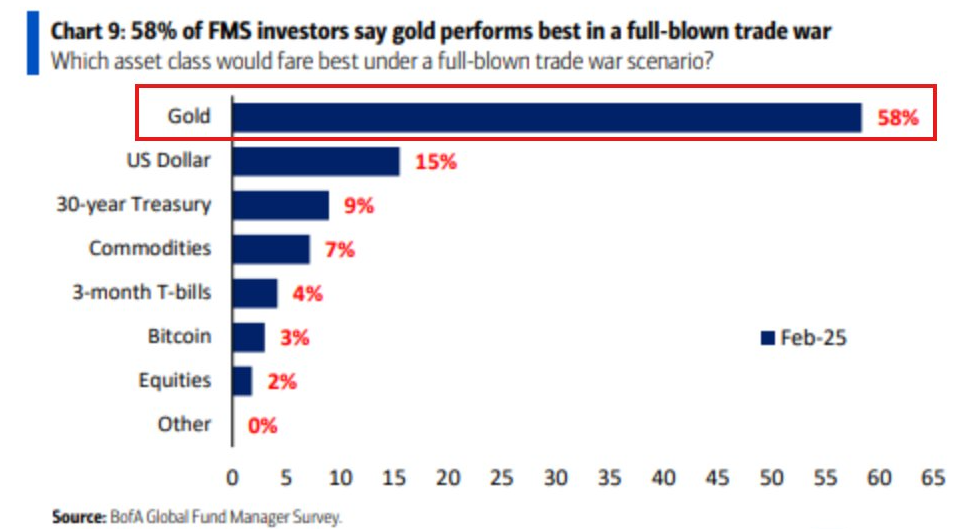

A recent Bank of America (BofA) survey found that 58% of fund managers view gold as the best-performing haven in a trade war—leaving Bitcoin with only a 3% preference.

Bitcoin’s Haven Status Faces a Reality Check

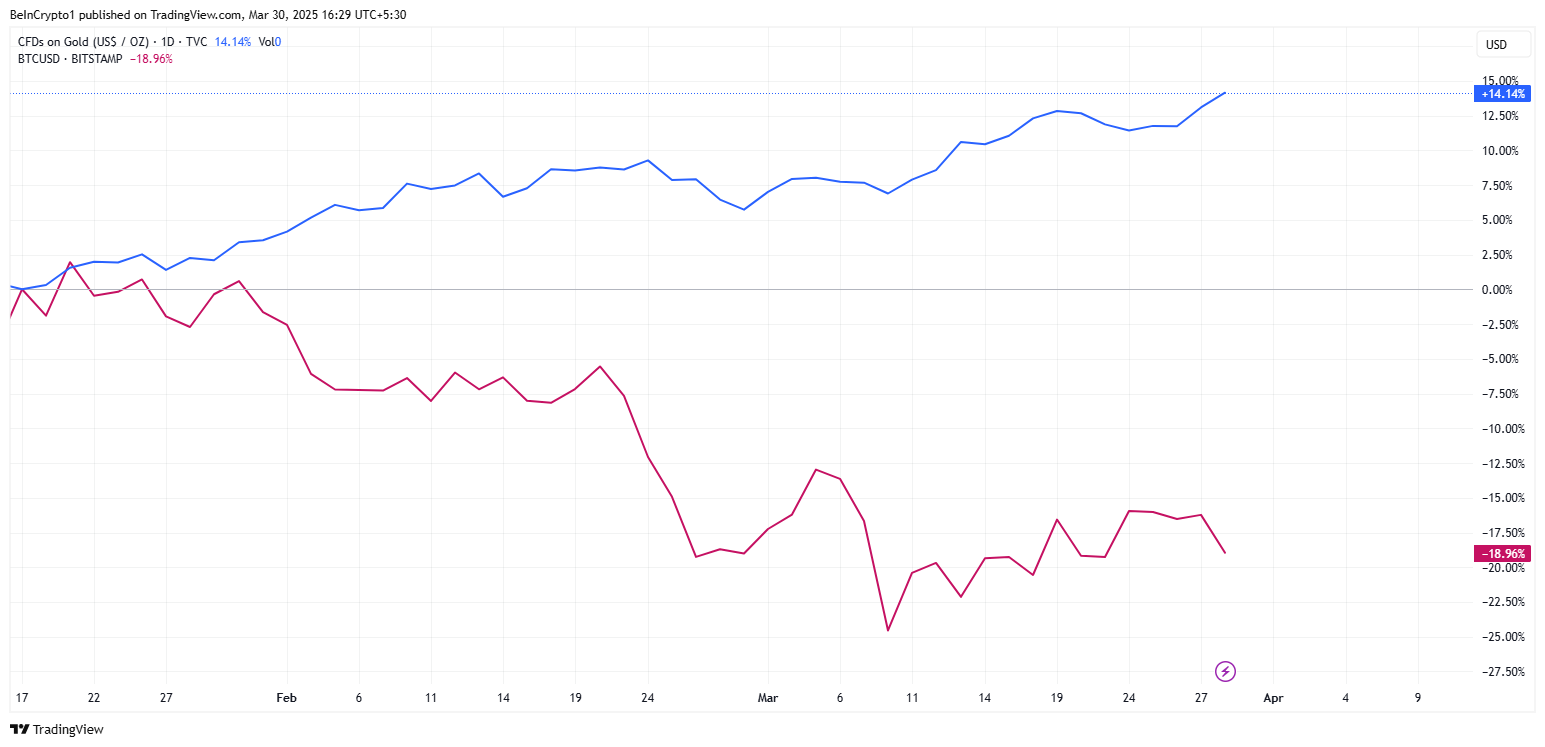

Gold is proving its dominance as the crisis asset of choice while Bitcoin struggles to hold its ground. This comes amid rising geopolitical risks, the ballooning US deficit, and uncertainty driving capital flight.

“In a recent Bank of America survey, 58% of fund managers said gold performs best in a trade war. This compares to just 9% for 30-year Treasury Bonds and 3% for Bitcoin,” The Kobeissi Letter noted.

Survey of Gold vs. Bitcoin during trade wars. Source:

Bank of America

Survey of Gold vs. Bitcoin during trade wars. Source:

Bank of America

For years, Bitcoin advocates have championed it as a hedge against economic instability. Yet, in 2025’s volatile macro environment, Bitcoin struggles to earn institutional investors’ full trust.

The Bank of America survey reflects this status, with long-term US Treasury bonds and even the US dollar losing appeal as trade wars and fiscal dysfunction shake market confidence.

The US deficit crisis—now projected to exceed $1.8 trillion—has further eroded confidence in traditional safe havens like US Treasuries.

“This is what happens when the global reserve currency no longer behaves as the global reserve currency,” a trader quipped in a post.

However, instead of looking to Bitcoin as an alternative, institutions are overwhelmingly choosing gold, doubling physical gold purchases to record levels.

Gold vs. Bitcoin. Source:

TradingView

Gold vs. Bitcoin. Source:

TradingView

Barriers To Bitcoin Institutional Adoption

Despite its fixed supply and decentralization, Bitcoin’s short-term volatility remains a key barrier to institutional adoption as a true safe-haven asset.

While some traders still view Bitcoin as a long-term store of value, it lacks the immediate liquidity and risk-averse appeal that gold provides during crises.

Further, President Trump is expected to announce sweeping new tariffs on “Liberation Day.” Experts flag the event as a potential trigger for extreme market volatility.

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen, “Alex Krüger predicted.

Trade tensions have historically driven capital into safe-haven assets. With this announcement looming, investors preemptively position themselves again, favoring gold over Bitcoin.

“Gold’s no longer just a hedge against inflation; it’s being treated as the hedge against everything: geopolitical risk, de-globalization, fiscal dysfunction, and now, weaponized trade. When 58% of fund managers say gold is the top performer in a trade war, that’s not just sentiment that’s allocation flow. When even long bonds and the dollar take a back seat, it’s a signal: the old playbook is being rewritten. In a world of rising tariffs, FX tension, and twin deficits, gold might be the only politically neutral store of value left,” trader Billy AU observed.

Despite Bitcoin’s struggle to capture institutional safe-haven flows in 2025, its long-term narrative remains intact.

Specifically, the global reserve currency system is changing, US debt concerns are mounting, and monetary policies continue to shift. Despite all these, Bitcoin’s value proposition as a censorship-resistant, borderless asset is still relevant.

However, in the short term, its volatility and lack of widespread institutional adoption as a crisis hedge mean gold is taking the lead.

For Bitcoin believers, the key question is not whether Bitcoin will one day challenge gold but how long institutions will adopt it as a flight-to-safety asset.

Until then, gold remains the undisputed king in times of economic turmoil. Meanwhile, Bitcoin (BTC exchange-traded funds notwithstanding) fights to prove its place in the next financial paradigm shift.

“The ETF demand was real, but some of it was purely for arbitrage…There was a genuine demand for owning BTC, just not as much as we were led to believe,” analyst Kyle Chassé said recently.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A new skin for the US dollar, a new wallet for corruption: Trump turns the White House into a crypto exchange

The article discusses how Trump combines his personal brand with cryptocurrency, accumulates wealth by issuing tokens, and may trigger new forms of political corruption. It reveals how blockchain technology can be used for gray-area transactions involving power and finance. Summary generated by Mars AI This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Weekly News Preview | US Bureau of Labor Statistics to Release September CPI Report; Meteora to Conduct TGE

Weekly highlights for October 20th to October 26th.

Betting on the real world: What kind of business are these 8 prediction markets doing?

The real turning point for this sector lies not in the form of the product, but in the boundaries of regulation.

From tariffs to tweets, how a meticulously orchestrated "financial script" helped him earn 1 billion USD