Senate votes to repeal controversial IRS rule, Trump expected to sign

Quick Take Sen. Ted Cruz, R-Texas, and Rep. Mike Carey, R-Ohio, introduced a joint resolution to repeal an Internal Revenue Service rule. White House Crypto A.I. and Crypto Czar David Sacks said that President Donald Trump’s senior advisors plan to recommend the president sign it.

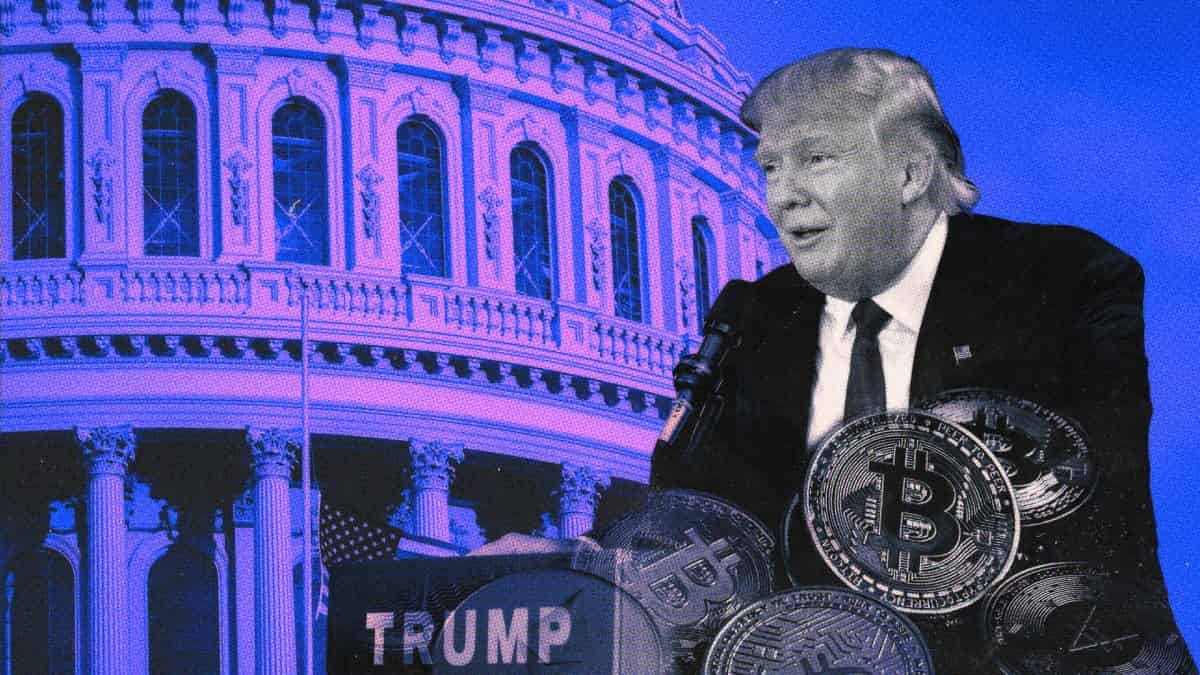

The U.S. Senate voted to repeal a controversial crypto tax rule finalized weeks before the Trump administration took office.

"After this bill passes today, it will be sent to President Trump's desk to be the first crypto bill signed," Ron Hammond, senior director of government relations at the Blockchain Association, said in a post on X ahead of the vote.

When it was finalized, the rule sparked strong opposition from crypto industry leaders. The DeFi Education Fund, along with other groups, sued the IRS shortly after its finalization, warning that the requirements would "push this entire, burgeoning technology offshore."

Calling the repeal a "crucial step towards protecting U.S. innovation and ensuring that developers can continue to build cutting-edge technologies without the burden of unclear, overreaching regulations," Amanda Tuminelli, the fund's executive director, hailed the Senate's vote in a statement on Wednesday. "The DeFi Education Fund commends the bipartisan supermajority of Congressional leaders who voted in favor of the 'DeFi Broker' CRA resolution, recognizing the severe and far-reaching consequences of the IRS’ misguided rulemaking."

Some Democrats have opposed passing the resolution and say Republicans are trying to weaken the IRS.

"They are the party that has consistently underfunded the IRS," said Rep. Richard Neal, D-Mass., in a hearing in February.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MARA Holdings to raise $850M to buy more Bitcoin and repurchase debt

SEC Meets Citadel to Discuss Tokenization Plans

The SEC held talks with Citadel Securities to explore the future of tokenization in traditional finance.Wall Street & Web3: A Quiet RevolutionTokenization Gains Ground on Wall StreetA Glimpse Into the Future of Finance

Tether Unveils Investment Portfolio with 120+ Companies

Tether reveals its venture portfolio, including 120+ firms like Bitdeer and CityPay, showing its broader push beyond stablecoins.Who’s in the Portfolio?A Broader Vision for Tether

Solana Surges Past $200, Signals Major Price Rally