-

XRP is currently consolidating between $2.35 and $2.47, with bullish momentum fading as key indicators signal neutral market conditions.

-

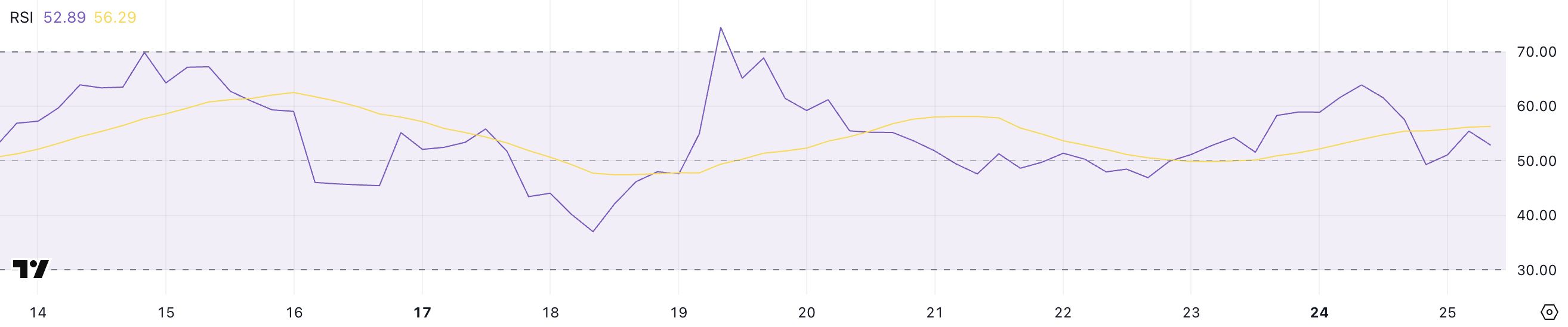

Recent data indicates that the Relative Strength Index (RSI) has dropped to 52.89 from 63.90, reflecting decreasing buyer strength amid growing market uncertainty.

-

The Ichimoku Cloud analysis reveals indecision in the market, displaying a flat trend with weak support levels, which may lead to possible breakouts or breakdowns.

Discover the current state of XRP as it consolidates between key price levels, with indicators signaling neutral momentum amid market uncertainty.

XRP’s RSI Indicates Market Neutrality

XRP’s Relative Strength Index (RSI) currently stands at 52.89, a notable drop from 63.90 just a day prior. This decline highlights a weakening of the recent bullish momentum, suggesting that buying interest is subsiding among traders.

As the RSI nears neutral territory, uncertainty regarding XRP’s next price movement contributes to fluctuating market sentiments.

Additionally, XRP has not surpassed RSI levels of 70—often associated with overbought conditions—since mid-March, further indicating a lack of robust buying pressure in recent days.

XRP RSI. Source: TradingView.

The Relative Strength Index (RSI) is a popular momentum oscillator that evaluates the pace and shifts in price movements, ranging from 0 to 100. A reading above 70 generally indicates overbought conditions, while below 30 suggests oversold situations. Readings from 50 to 70 typically signify bullish momentum, indicating that XRP could be potentially stabilizing unless renewed buying activity emerges.

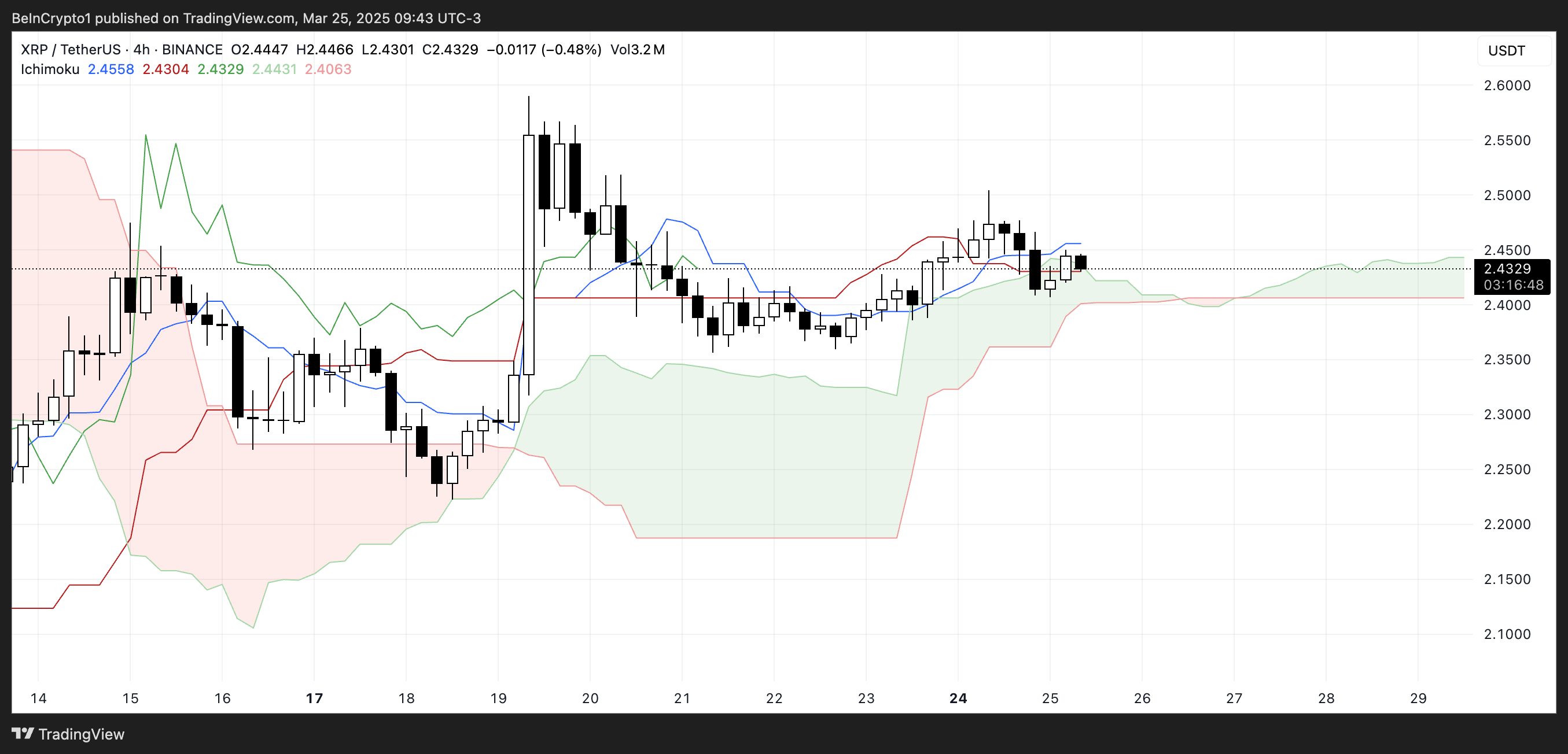

Ichimoku Cloud Analysis Shows Market Indecision

The Ichimoku Cloud framework for XRP illustrates a consolidation phase, with price hovering just above the cloud but lacking sufficient directional momentum.

The Tenkan-sen and Kijun-sen lines remain flat and closely aligned, which signifies a balance between buying and selling pressure in the current market atmosphere.

The absence of a definitive crossover between the Tenkan and Kijun lines further emphasizes a neutral phase with no overwhelming trend in either direction.

XRP Ichimoku Cloud. Source: TradingView.

The thin cloud ahead conveys a fragile support system; hence, XRP could be vulnerable to heightened selling activity. Additionally, the Chikou Span closely interacting with past price actions signals weakening momentum.

Overall, the Ichimoku setup reflects prevailing uncertainty within the XRP market, indicating a critical need for a decisive breakout to escape this range-bound structure.

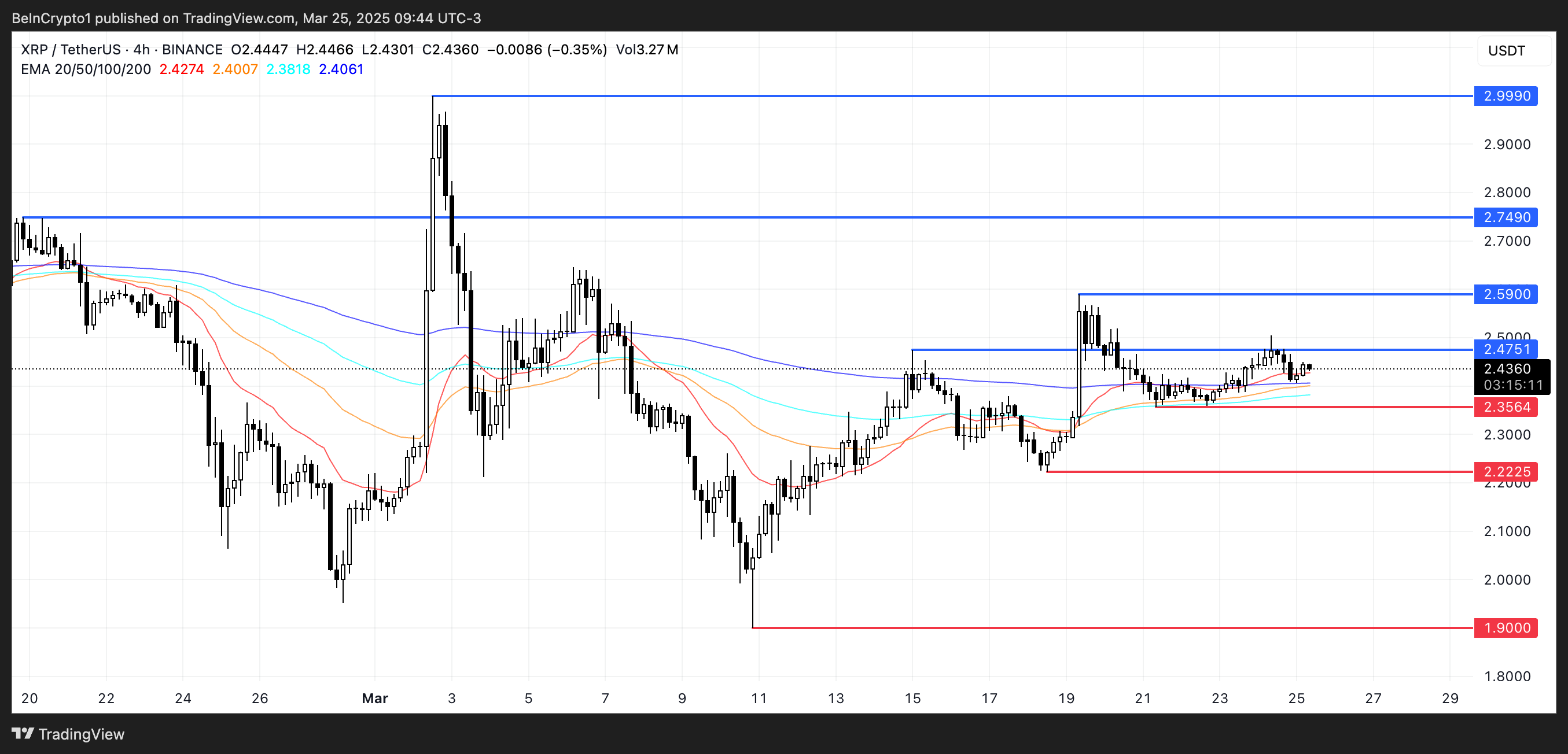

Can XRP Break Through $2.50 Resistance?

XRP’s surge following the SEC’s withdrawal of its lawsuit was significant; however, this momentum has since subsided.

Currently, XRP trades between a resistance level at $2.47 and support at $2.35, exemplifying an ongoing phase of consolidation and market indecision.

If the support level is retested and fails to hold, XRP may experience increased selling pressure, potentially leading to a drop towards $2.22. Should bearish momentum gains traction, further decline to approximately $1.90 could occur.

XRP Price Analysis. Source: TradingView.

Conclusion

In summary, XRP is currently trapped between two key price levels, reflecting neutral market conditions with indecisive indicators. Traders and investors should observe XRP’s movements closely, as a breakout in either direction could signal a significant shift in market dynamics.