Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Real Vision’s chief crypto analyst says that Bitcoin ( BTC ) may soon print a series of rallies as macroeconomic conditions could ease later this year.

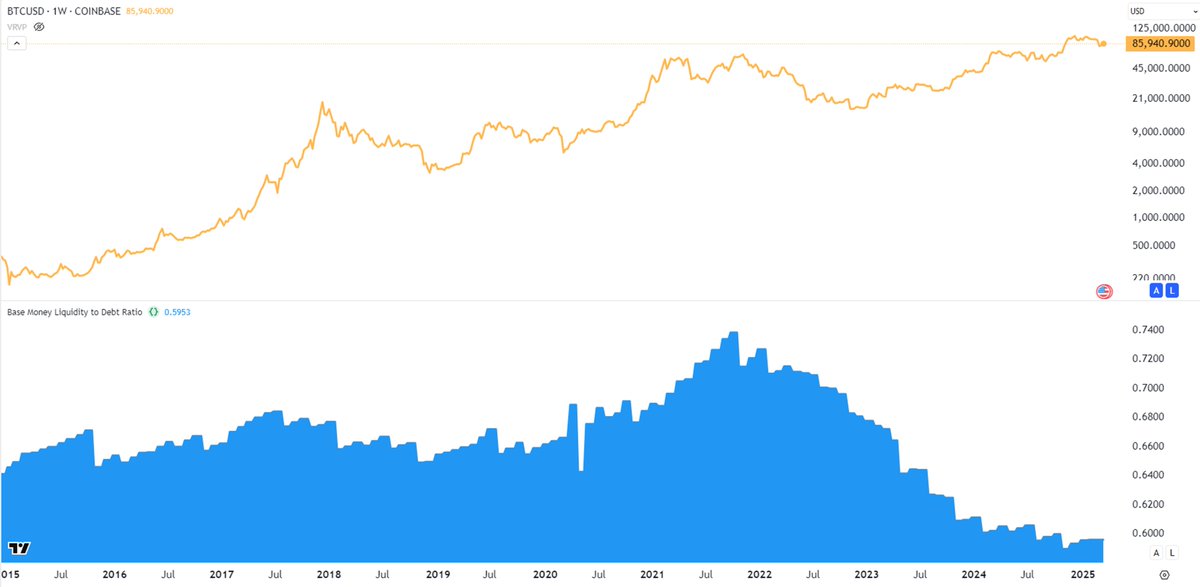

In a new thread, crypto strategist Jamie Coutts tells his 37,300 followers on the social media platform X that market liquidity is expected to increase in the second half of 2025, which may pump Bitcoin.

“The bottom line, though, is that if Bitcoin can rally through the worst liquidity withdrawal in decades, it’s primed for more significant moves as conditions ease through the rest of the year. Watch the blue line [Base Money Liquidity to Debt Ratio] begin to tick higher in 2H (second half) of the year.”

Source: Jamie Coutts/X

Source: Jamie Coutts/X

In addition to predicting money supply will increase faster than US debt, he also predicts that Bitcoin adoption will increase among US banks and sovereign wealth funds, helping to increase the value of the flagship crypto asset.

“More likely, base money outpaces government debt growth. What happens if base money expands faster than U.S. debt growth? In some reality, that might steady the ship and dampen the fear fueling Bitcoin adoption. But, in my view, that only hits the margins.

Meanwhile, deeper Bitcoin integration at both sovereign and banking levels is inevitable. Ultimately, US structural deficits are not changing. The US government will need to find new and inventive ways to ensure there is a bid for their debt.”

Bitcoin is trading for $84,090 at time of writing, flat on the day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.