-

Redstone (RED) showcases a volatile market performance, with a 25% surge this week juxtaposed against a significant 20% pullback, indicative of investor uncertainty.

-

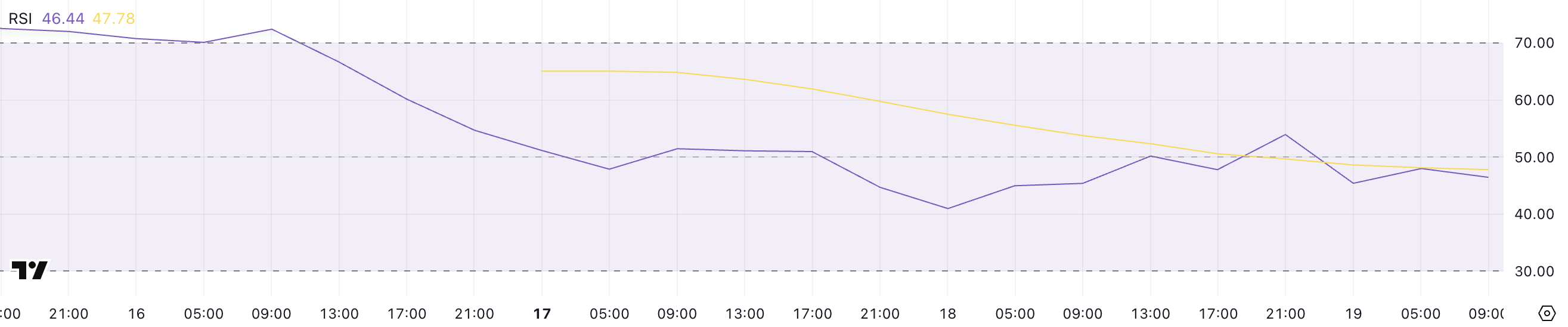

The current RSI reading, now at 46.44, signals escalating bearish momentum amidst a backdrop of market consolidation, suggesting a potential shift in price dynamics.

-

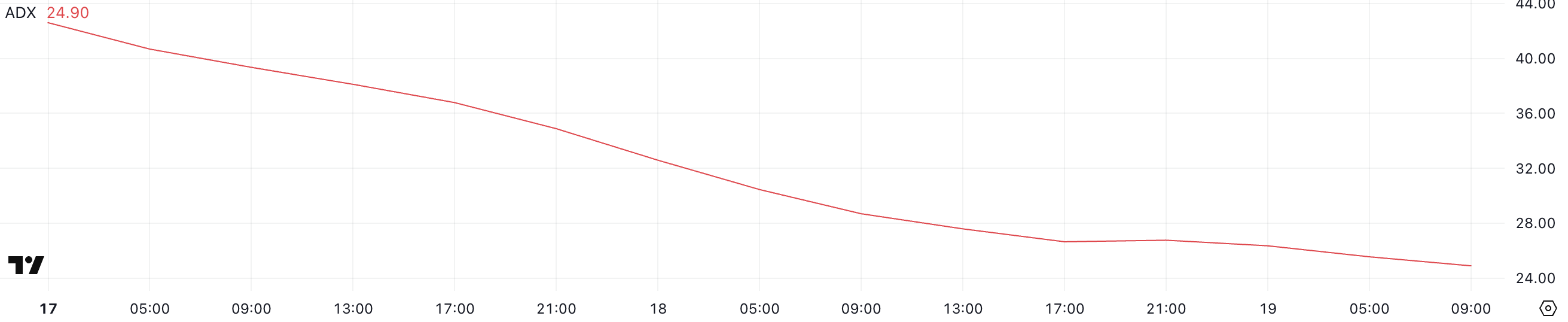

As reported by COINOTAG, “ADX has dropped from 42.6 to 24.9, indicating a weakening trend that could lead to a stabilization phase for RED.”

Redstone faces turbulent market conditions as it experiences a 25% rise amidst bearish signals; key indicators hint at potential for further price instability.

RED RSI Shows Shift to Bearish Sentiment

Redstone’s RSI (Relative Strength Index) has shown a significant drop to 46.44, down from 53.93 just a day earlier. This descent reflects an uptick in bearish pressure, suggesting that bullish momentum is waning.

For the past two days, the RSI has hovered around the neutral 50 mark, signifying a stalemate between buyers and sellers. The recent move below this critical threshold indicates a growing bearish sentiment taking root in the market.

RED RSI. Source: TradingView.

The RSI, a pivotal momentum oscillator, fluctuates between 0 and 100. A reading above 70 typically signals overbought conditions, while below 30 indicates oversold conditions. The 50 mark serves as a significant pivot for traders; a fall below it often suggests declining bullish momentum.

Currently situated at 46.44, Redstone’s RSI indicates a notable shift towards seller dominance, posing risks to its attempts to secure a foothold among leading assets in the Oracle sector. Without a resurgence from buyers to reclaim levels above 50, the asset may face further downside pressure.

Redstone ADX Indicates Fading Downtrend

The Average Directional Index (ADX) for Redstone has seen a remarkable decline to 24.9 from a previous high of 42.6, reflecting a significant erosion in the strength of the prevailing downtrend.

This steep drop suggests that while a bearish trend remains intact, the momentum fueling it is subsiding. Previously, with ADX readings soaring above 25, the market experienced clear directional movement; however, the current level indicates a transition toward potential stabilization.

RED ADX. Source: TradingView.

The ADX serves as a crucial indicator that measures the strength of an existing trend, with values exceeding 25 signaling robust trends, while readings below this mark suggest weakness. The current reading of 24.9 places Redstone in a precarious position, as it demonstrates a lack of conviction in the downtrend despite its persistence.

As the trend’s strength wanes, traders should remain vigilant, as this could signal a potential price stabilization or a short-term reversal if bullish movements gain traction.

Future Price Action: Can Redstone Surpass $1?

Analysis of Redstone’s EMA (Exponential Moving Average) indicates ongoing consolidation rather than a definitive trend, with price action visibly moving sideways. With a crucial support level established at $0.65, this level will be pivotal in determining short-term price movements.

RED Price Analysis. Source: TradingView.

If the $0.65 support holds, it may allow bulls to mount a challenge against the $0.77 resistance. A successful breakout above this threshold could pave the way for a rally towards $0.90 and even $0.95, increasing the likelihood of Redstone finally breaking the $1 mark for the first time in several weeks.

Given the current EMA readings, traders should exercise caution, as the sideways movement suggests a market grappling with indecision. Holding the $0.65 support will be crucial for a bullish revival, while any breach could invite stronger bearish pressures, necessitating a closer watch on market developments.

Conclusion

In summary, Redstone’s market dynamics are intertwined with key technical indicators reflecting investor sentiment. With bearish momentum evident through the RSI and a weakening ADX suggesting potential stabilization, the next few days will be critical in determining whether Redstone can reclaim lost ground or face further declines. As always, traders should approach with caution and remain informed on market developments.