Cardano (ADA) Traders Face $20 Million Liquidations if Price Rises 9%

Cardano struggles with a potential 9% rise to $0.77, which could trigger $20 million in short liquidations. However, low investor participation and weak momentum suggest the price may fail to sustain the uptrend.

Cardano (ADA) has been experiencing a period of fluctuating price action. Despite efforts to recover, ADA has faced challenges in maintaining its upward momentum.

While the altcoin has held onto an uptrend since the beginning of the month, it now faces a challenge. Traders may be pulled back from participating, potentially stalling any further price recovery.

Cardano Traders Are In Trouble

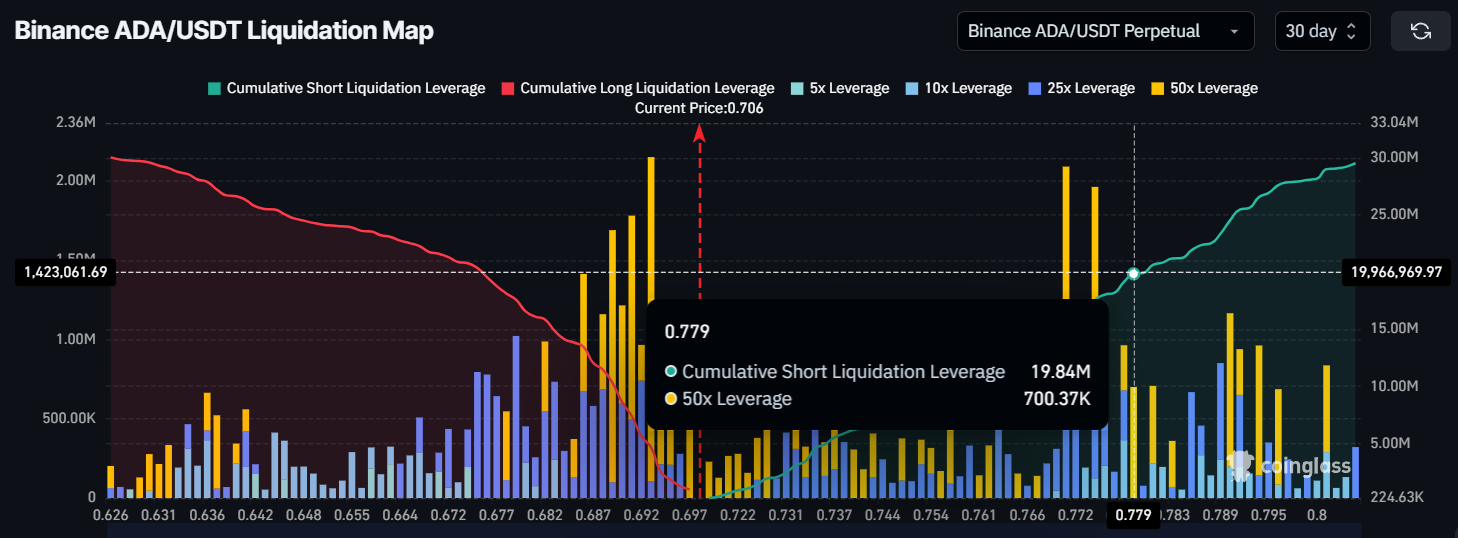

The sentiment around Cardano (ADA) is mixed. According to the Liquidation Map, short traders are at a disadvantage if ADA continues its uptrend. A breach of $0.77 would lead to the liquidation of approximately $20 million worth of short contracts.

This could result in upward pressure on the price as shorts are forced to close their positions.

However, without strong bullish momentum, this upside potential may not materialize, keeping traders cautious. While short traders could face substantial losses if ADA rises, this risk does not necessarily mean that the uptrend is sustainable.

Cardano Liquidation Map. Source:

Coinglass

Cardano Liquidation Map. Source:

Coinglass

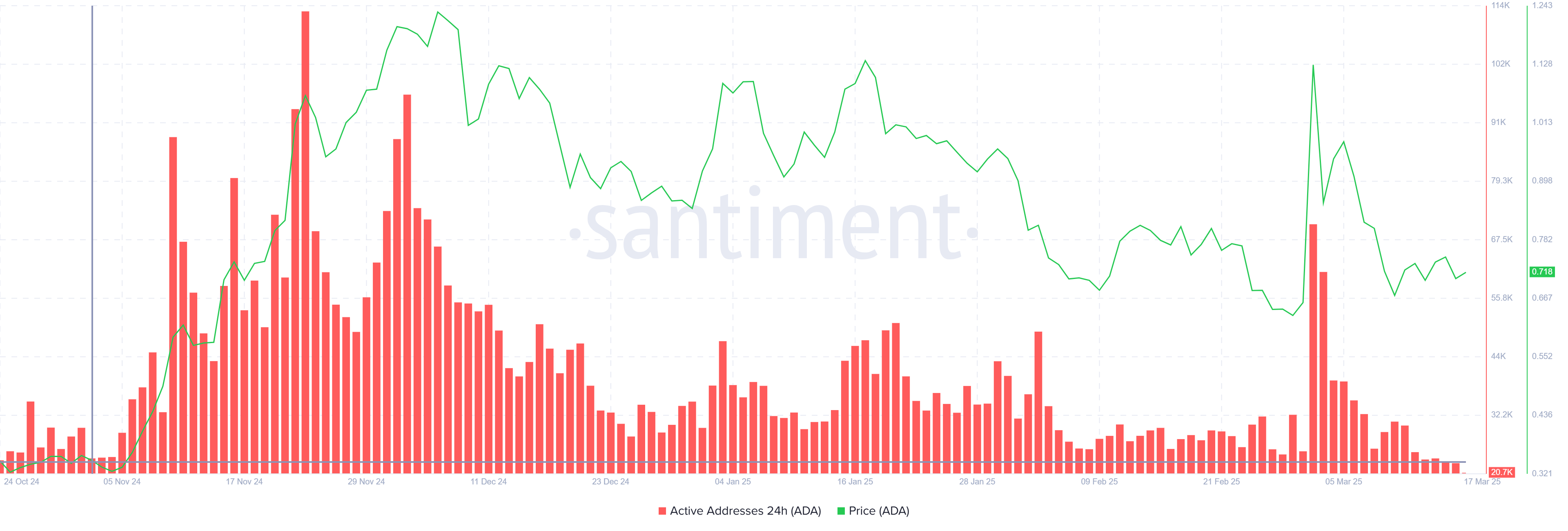

Overall, Cardano’s market momentum reflects a sense of uncertainty. The number of active addresses on the network has recently dropped to a four-month low of 20,700. This decline in investor participation indicates a lack of enthusiasm among ADA holders. Many investors are seemingly pulling back, waiting for clearer signals of recovery before re-engaging with the token.

This lack of participation has had a negative impact on Cardano’s liquidity and transaction volume, further influencing its price dynamics. The decreasing number of active addresses also suggests that traders are hesitant to invest in ADA, which could slow down any potential price recovery.

Cardano Active Addresses. Source:

Santiment

Cardano Active Addresses. Source:

Santiment

ADA Price Faces Barrier

Cardano is currently trading at $0.70, holding above the support level of $0.70, and the uptrend line has supported the price since early March. The immediate target for ADA is to breach the $0.77 resistance level, but this remains a challenge. Achieving this would require a rise of approximately 9%, which may be difficult under the current market conditions.

In the absence of a broader market rally, ADA is likely to remain consolidated under the $0.77 resistance. Should the altcoin fail to hold the $0.70 support, it could experience a decline, potentially falling to $0.62. This would invalidate the recent bullish outlook, further dampening investor confidence.

Cardano Price Analysis. Source:

TradingView

Cardano Price Analysis. Source:

TradingView

If ADA successfully breaches the $0.77 resistance, it could rise to $0.85, thereby invalidating the bearish thesis. Such a move would likely signal a more sustained recovery, as it would clear a significant hurdle for Cardano.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Faces Key Resistance at $3,987, Analyst Reports

Key Market Intelligence for July 21st, how much did you miss?

1. On-chain Funds: $31M Flows into Arbitrum; $14.6M Flows out of Unichain 2. Biggest Price Swings: $DIA, $ELX 3. Top News: Total NFT Trading Volume Surpasses $31M in the Past 24 Hours, Marking a Nearly 200% Increase

POL eyes 95% surge as Polygon’s stablecoin supply hits 3-year highs

Bitcoin’s Realized Cap Reaches $1 Trillion Milestone