Bitcoin Price Approaches 8% Breakout as Holders Signal Reversal

Bitcoin’s Short-Term MVRV suggests a reversal, with BTC aiming for $91,500. But with LTH selling pressure, can it hold above $85,000?

Bitcoin is positioning itself for a potential breakout that could push its price above $91,000. The leading cryptocurrency is currently trading within a symmetrical triangle, signaling a possible bullish move.

However, this rally faces challenges as short-term holders (STHs) adjust their stance while long-term holders (LTHs) contribute to selling pressure.

Bitcoin Holders Are Settling Down

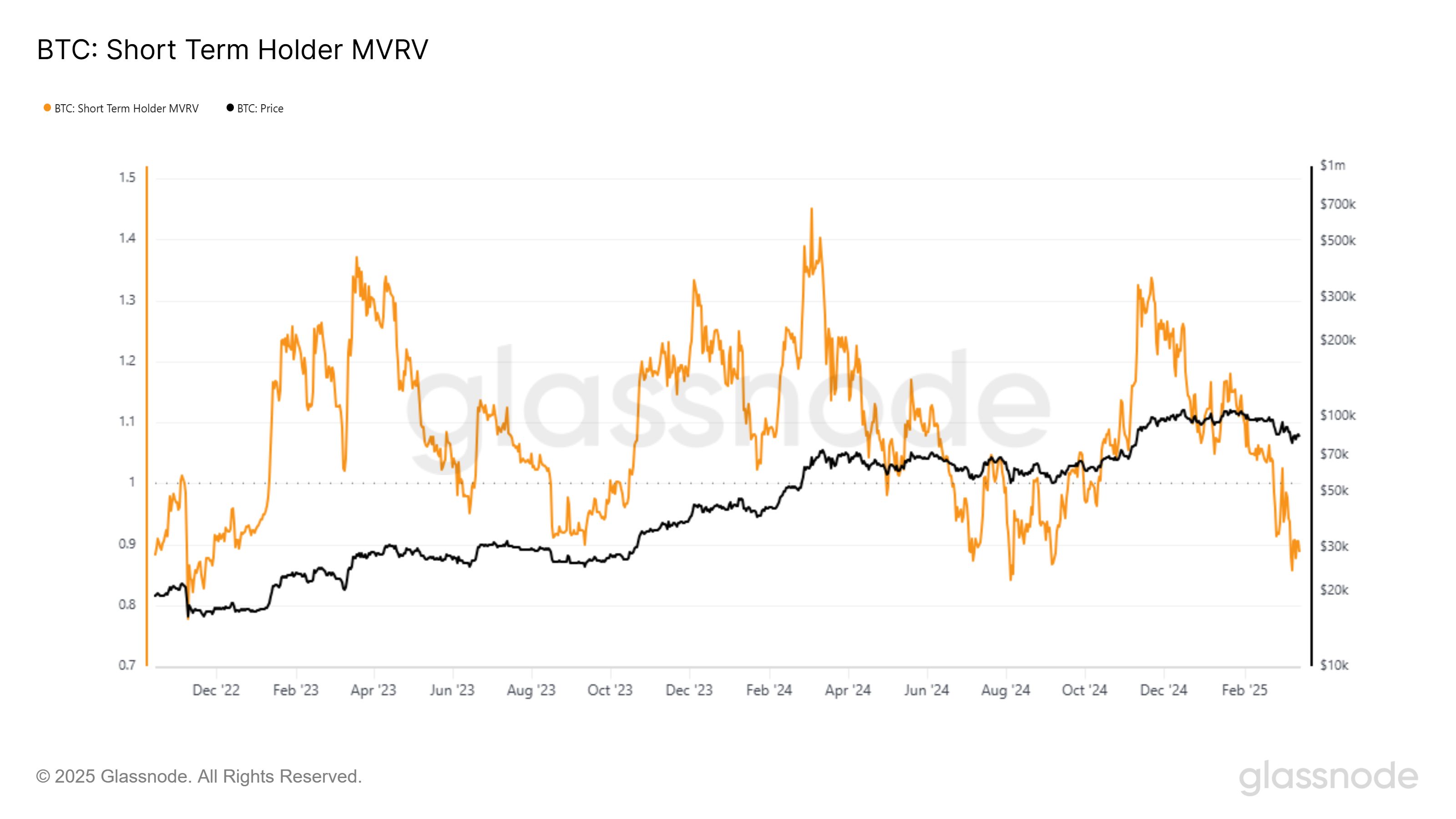

The Short-Term MVRV has fallen below the 0.9 mark, a level historically associated with saturation points for STH selling. This indicator often signals the end of a selling phase and a potential price reversal. If history repeats itself, Bitcoin may soon witness renewed buying pressure, setting the stage for recovery.

Bitcoin has previously shown a pattern of price rebounds when the Short-Term MVRV dips to these levels. If the same trend follows, BTC could gain upward momentum in the short term.

Bitcoin STH MVRV. Source:

Glassnode

Bitcoin STH MVRV. Source:

Glassnode

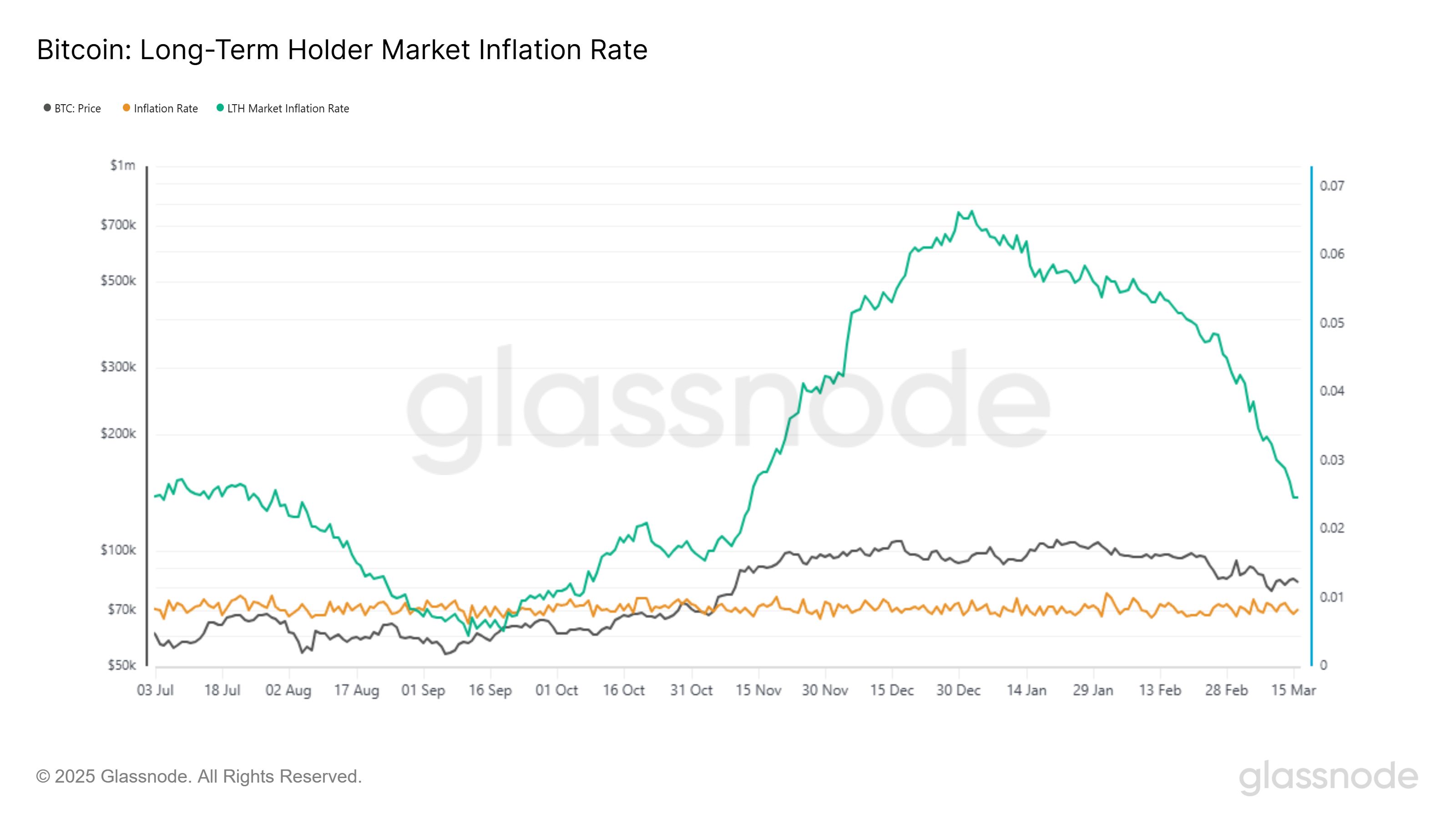

The Long-Term Holder Market Inflation Rate measures the annualized rate of net accumulation or distribution by LTHs relative to miner issuance. Currently, values of 0.025 suggest that LTHs are still adding to sell-side pressure. Although this indicator is noting a downtick, it continues to impact Bitcoin’s price movement.

Once the LTH Market Inflation Rate drops below miner issuance levels (inflation rate at 0.008), the pressure on Bitcoin’s price will likely ease. This shift would allow BTC to gain traction, increasing its chances of breaking through resistance. Until then, the market remains vulnerable to fluctuations driven by LTH selling activity.

Bitcoin LTH Market Inflation Rate. Source:

Glassnode

Bitcoin LTH Market Inflation Rate. Source:

Glassnode

BTC Price Breakout Ahead

Bitcoin is currently trading at $83,336, holding above the crucial $82,761 support level. The symmetrical triangle pattern suggests a potential 8.8% breakout, indicating a price move that could send BTC higher in the coming days.

The breakout target of $91,521 will only become viable once Bitcoin breaches $85,000 and establishes $87,041 as a support level. Achieving this milestone would bring Bitcoin closer to recovering its recent losses, reinforcing a bullish outlook for the cryptocurrency.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, failure to break past $85,000 could result in Bitcoin sliding back to $82,761 or even dropping further to $80,000. This scenario would invalidate the bullish pattern and introduce additional downside risk, delaying any potential recovery in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.