POPCAT Price Struggles to Recover from 48% Drop; Could Robinhood Listing Trigger a Rally?

POPCAT has been unable to recover from a 48% drop, with weak investor sentiment and a lack of buying interest holding back any significant rebound. The altcoin is currently consolidating between $0.140 and $0.203, and it needs stronger market support to break this range.

POPCAT has faced significant challenges since the beginning of February, as attempts at recovery have failed to materialize. Despite some price rallies, the meme coin has struggled to regain its losses, with a 48% drop weighing heavily on its performance.

While the altcoin is still attempting a recovery, a lack of strong support and market optimism is causing delays in any significant rebound. But the meme coin did have a key bullish moment this week.

POPCAT Needs Investors’ Backing

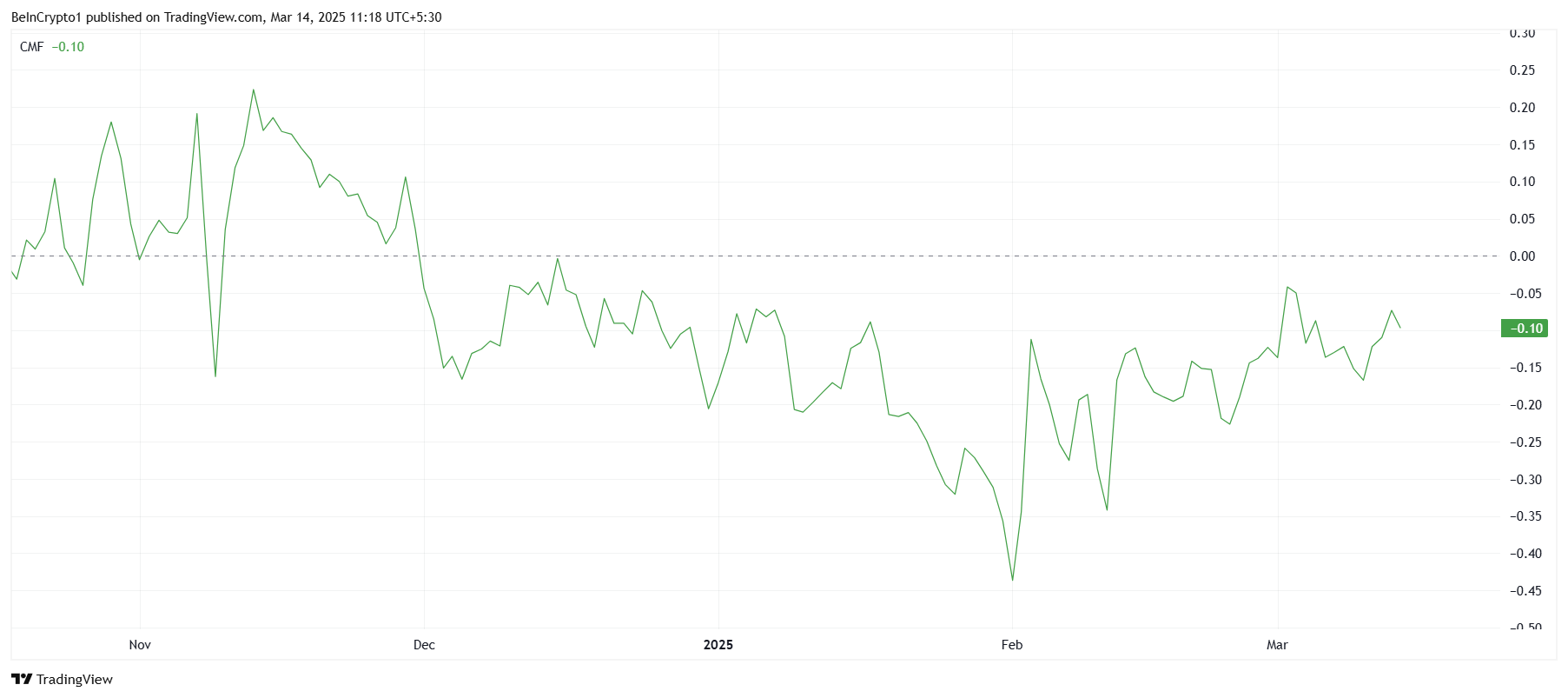

The Chaikin Money Flow (CMF) indicator has remained stuck below the zero line for the past three and a half months. This suggests that inflows into POPCAT have been weak since early December 2024, with little buying interest. The lack of conviction due to fear of losses from investors has contributed to a lack of momentum, keeping the meme coin from experiencing a recovery.

The weak CMF reading signals that investors are not pouring money into POPCAT, which is preventing a meaningful price increase. This has led to the coin’s struggle to maintain any positive price action, further delaying the recovery.

POPCAT CMF. Source:

TradingView

POPCAT CMF. Source:

TradingView

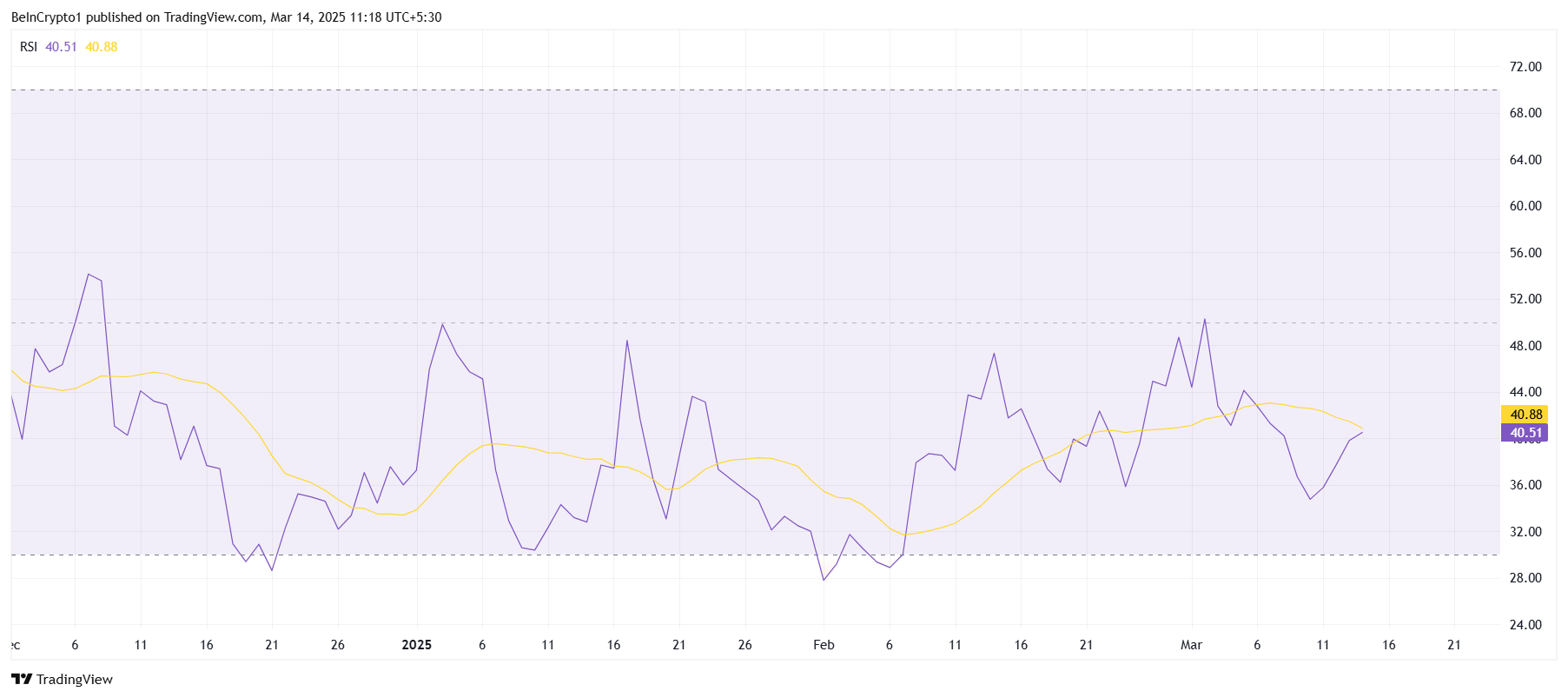

Technical indicators such as the Relative Strength Index (RSI) also reflect POPCAT’s struggle to find sustained momentum. The RSI has remained below the neutral line of 50.0 for the past three months, indicating weak bullish signals. This reinforces the notion that broader market cues are not supporting a strong recovery for the meme coin.

Without support from the broader market, POPCAT has found it difficult to break out of its current downtrend. Until the market improves, POPCAT is unlikely to break its bearish cycle.

POPCAT RSI. Source:

TradingView

POPCAT RSI. Source:

TradingView

POPCAT Price Is Likely Consolidating

Over the last four days, POPCAT has rallied nearly 20%, currently trading at $0.180. A key catalyst was Robinhood’s POPCAT listing on Thursday, which is expected to drive more investment into the asset and expose it to more investors.

The altcoin has bounced off the support level of $0.140 and is now under the resistance of $0.203. While this recent recovery is encouraging, it will face significant challenges in breaching the $0.203 barrier.

Given the weak market conditions and investor sentiment, POPCAT could struggle to break through the $0.203 resistance. It is more likely that the altcoin will consolidate within the range of $0.140 to $0.203, at least until stronger market cues emerge. This could delay any potential recovery further.

POPCAT Price Analysis. Source:

TradingView

POPCAT Price Analysis. Source:

TradingView

However, if market conditions and investor behavior improve, POPCAT may push past the $0.203 resistance. A successful breach of this level could see the altcoin test $0.238, invalidating the current bearish outlook. This would signal a shift in market sentiment and possibly set the stage for a more sustained recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket Opens Waitlist Access as US Relaunch Gains Momentum

BitMine invests $150M in Ether and aims to control 5% of all Ethereum

Crypto M&A Activity Soars in 2025, Surpassing $8.6 Billion

Crypto: The SEC Slows Down 3x–5x Leveraged ETFs