Ethereum price is seeing accumulation as exchange reserves decrease and experts believe it could hit $10,000 in this cycle.

Declining Exchange Reserves and Supply Reduction

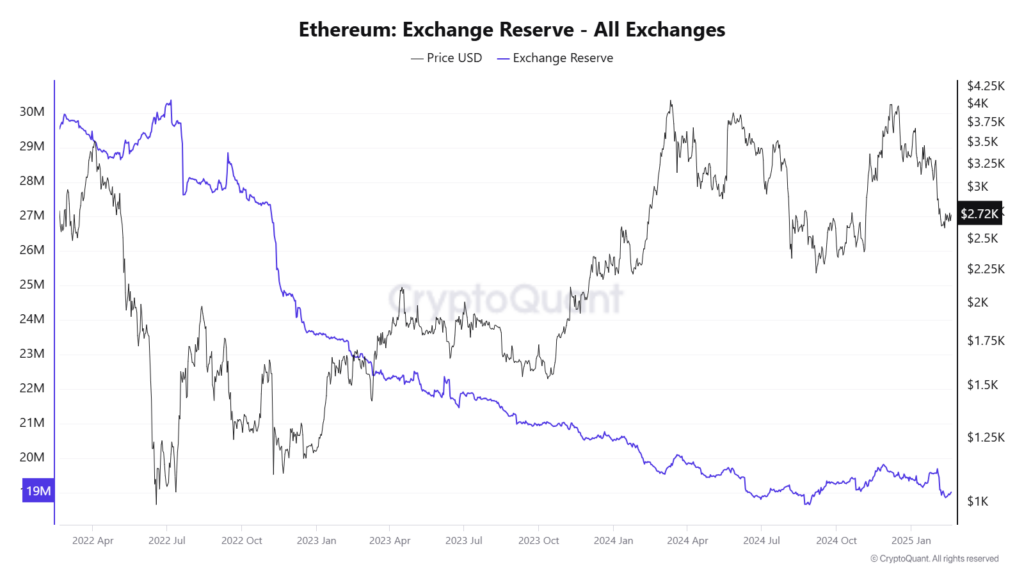

Crypto Quant Exchange reserves data shows that exchange holdings of ETH decreased from 30 million in the beginning of 2022 to 19 million in 2025.

This decline may indicate that fewer ETH tokens are on the trading market, as more traders stake them.

Less availability on the exchanges may, therefore, enhance a relative stability of the price and also an upward trend in case of an increase in demand.

Ethereum Exchange reserve chart

Ethereum Exchange reserve chart

Historically, Ethereum’s price has shown an inverse correlation with exchange reserves.

When reserves decrease, price surges often follow due to a supply squeeze.

In mid-2022, reserves declined significantly, leading to a rebound in Ethereum’s price, which peaked above $4,000 in early 2024 before experiencing volatility.

If this pattern continues, analysts believe Ethereum could move toward the $10,000 price target.

Institutional Adoption and Long-Term Holder Confidence

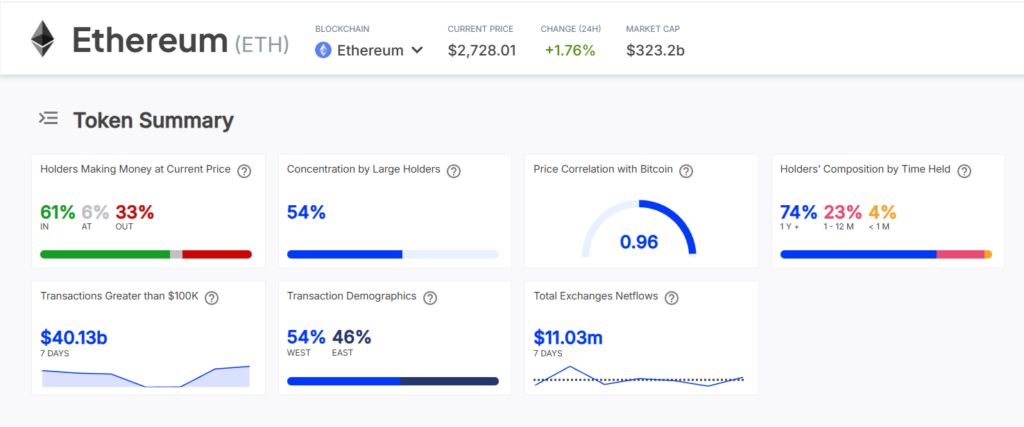

Demand for Ethereum continues to be strong with current data suggesting that top holders that include the whales and institutional investors own 54% of the total Ethereum supply.

These large holders can move the price and their continued accumulation strengthens the long term outlook for Ethereum.

Furthermore, 74% of ETH holders have been found to have been holding their earnings for more than one year while only 4% of the holders have been holding the same for less than a month.

It shows that most of the investors now have long-term perspective and avoid short-term fluctuations with the possibility of large-scale sales.

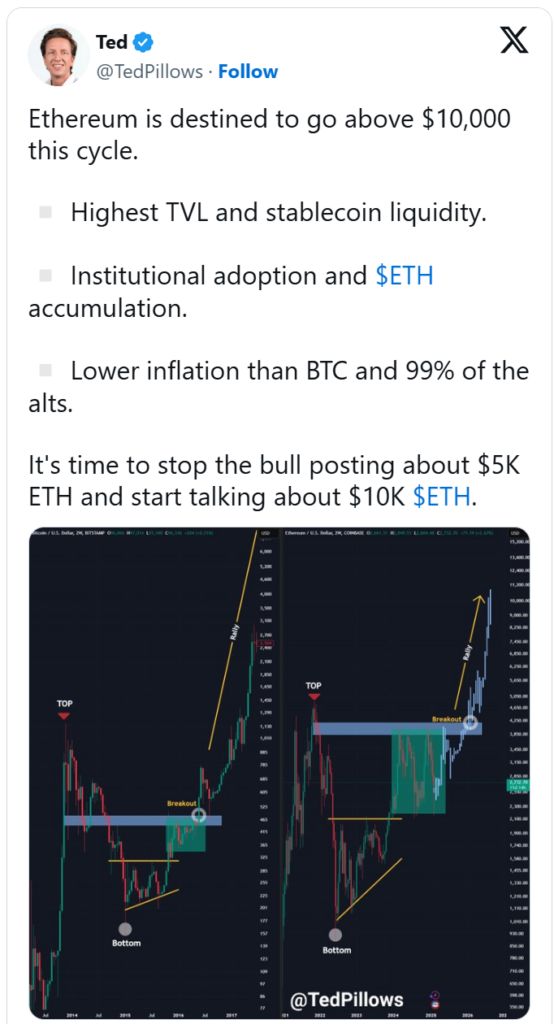

Explaining sentiments on the market, TedPillows predicted that Ethereum will touch $10,000 in this cycle.

With the highest TVL, strong institutional adoption, and lower inflation than most altcoins, the long-term outlook remains positive.

Source: X

Source: X

Ethereum’s Market Performance and Price Correlation with Bitcoin

Ethereum’s current price is around $2,720, following a correction from recent highs.

Ethereum network data shows strong institutional involvement through its large transactions.

During the last seven days there were $40.13 billion worth of transactions which exceeded $100,000.

This level of activity suggests that major market players remain engaged in Ethereum trading and accumulation.

The recent net exchange flows amounting to $11.03 million point toward moderate exchange inflows yet the consolidated data indicates most ETH owners are moving tokens away from exchange platforms into staking and self-custody storage options.

Supply reduction activity can boost future price appreciation because of its market effects.

Ethereum Price Outlook and Market Trends

The Total Value Locked (TVL) on Ethereum is still the highest among all the blockchains, testifying a high demand for Ethereum DeFi ecosystem.

If exchange reserves continue to decline and demand remains strong, Ethereum could see another supply squeeze, leading to higher prices.

Analysts suggest that a break above $5,000 could pave the way for a move toward $10,000.

However, macroeconomic factors and market sentiment will continue to influence Ethereum’s trajectory.

Ethereum’s current market behavior suggests an accumulation phase, with investors positioning for potential future growth.

If demand remains steady, Ethereum may continue its upward trend in the coming months.