Date: Tue, February 18, 2025 | 10:58 AM GMT

The cryptocurrency market is experiencing a sharp downturn, with BTC dominance surging by 0.84% in the last 24 hours, currently sitting at 61.14%. This increased dominance has put significant pressure on altcoins, causing widespread corrections.

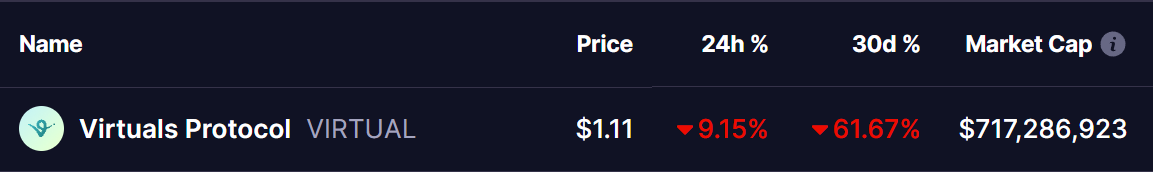

One such altcoin, Virtuals Protocol (VIRTUAL)—the platform specializing in AI agent creation—has been facing a major downtrend, with today’s decline adding another 9% drop, pushing its 30-day correction beyond 60%.

Source: Coinmarketcap

Source: Coinmarketcap

This retracement has led VIRTUAL to retest a key breakout level, raising questions about a potential rebound.

Retesting Falling Wedge Breakout

From late November to early January, VIRTUAL saw an explosive 846% rally, surging from $0.54 to a peak of $5.17 on January 2. However, following this massive uptrend, the price entered a correction phase, forming a falling wedge pattern—a structure often associated with bullish reversals.

Virtuals Protocol (VIRTUAL) Daily Chart/Coinsprobe (Source: Tradingview)

Virtuals Protocol (VIRTUAL) Daily Chart/Coinsprobe (Source: Tradingview)

On February 14, VIRTUAL successfully broke out of the wedge’s descending trendline, reaching a short-term high of $1.49 before pulling back. Now, amid broader market weakness, VIRTUAL is retesting its breakout trendline, currently trading around $1.10, where it has found support at the 200-day moving average (MA).

If buyers step in at this level and the price crosses above the 15-day MA, it could signal a strong recovery, potentially targeting resistance levels at $2.08 and $2.61—which represents an upside of over 140% from current levels.

The MACD indicator shows early signs of a potential bullish crossover, which could indicate a momentum shift.

What’s Next for VIRTUAL?

With VIRTUAL currently retesting breakout trendline with the support of 200MA, a successful bounce and a move above the 15MA could confirm a recovery phase. However, if the breakout trendline fails to hold and the 200MA support is breached, further declines could follow.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.