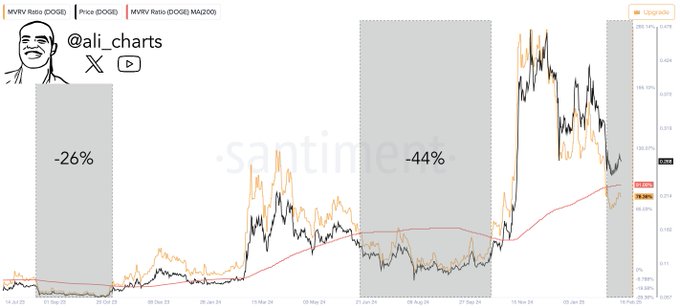

Dogecoin (DOGE) , the meme-inspired cryptocurrency, has flashed a potentially bearish signal, according to renowned Chartist, Ali. In a recent post on X , Ali pointed out that Dogecoin’s Market Value to Realized Value (MVRV) ratio has just crossed below its 200-day moving average (MA)—a pattern known as a “death cross.” Historically, this has been a precursor to significant price declines.

What Is the MVRV Ratio?

The MVRV ratio measures an asset’s market capitalization relative to its realized capitalization (the price at which coins last moved on-chain). This indicates if an asset is overvalued or undervalued. When the MVRV ratio is above the 200-day MA, it often signals strength, as the market is willing to price the asset above its long-term realized value. However, when it falls below the 200-day MA, it suggests declining investor confidence and a possible downtrend.

Dogecoin (DOGE) Price Chart/ Ali

Dogecoin (DOGE) Price Chart/ Ali

Historical Precedent

Ali highlighted that the last two instances of this death cross resulted in sharp corrections for DOGE . The first occurrence led to a 26% decline, while the second saw prices drop by 44%. Given this pattern, traders and investors are now bracing for another potential downturn. The market has often reacted strongly to such signals, with investors taking precautionary measures or preparing for potential accumulation at lower levels.

Current Market Context

Dogecoin has been trading amidst market turbulence, mirroring broader market sentiment. While Bitcoin and major altcoins have seen renewed volatility, DOGE has struggled to break key resistance levels.

The appearance of this death cross could add downward pressure, especially if macroeconomic factors and market-wide sentiment remain weak. The cryptocurrency market has been highly reactive to such technical signals, and with Dogecoin already facing resistance, this could be another catalyst for a pullback.

What’s Next for DOGE?

If history repeats, DOGE could be in for a double-digit percentage drop. Traders should watch key support zones around psychological levels like $0.07 and $0.06. A breach of these levels could accelerate selling pressure, leading to further declines.

However, if Dogecoin finds strong support after a pullback, it could present a buying opportunity for long-term holders. Historically, sharp corrections in DOGE have often been followed by strong rebounds, driven by retail enthusiasm and market sentiment.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Another crucial factor to watch is Bitcoin’s price movement. As with most altcoins, Dogecoin’s trajectory is closely tied to Bitcoin’s overall trend. A strong BTC rally could mitigate some of the bearish effects on DOGE, while further downside in Bitcoin could exacerbate Dogecoin’s weakness. Market participants should also monitor trading volume and whale activity, as these could indicate whether the selling pressure is intensifying or if accumulation is taking place.

The MVRV death cross is a concerning signal for Dogecoin holders, especially given its historical impact. While past performance does not guarantee future results, traders should approach DOGE with caution in the short term. Monitoring price action and key support levels will assess whether this bearish setup plays out as expected.

Ali’s analysis serves as a valuable heads-up for market participants, emphasizing the importance of historical patterns in crypto trading. As always, traders should combine technical signals with a broader market context before making investment decisions.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter , Facebook , Telegram , and Google News