Date: Fri, February 14, 2025 | 10:53 AM GMT

The cryptocurrency market has been in a correction phase following the November rally, but signs of an altcoins recovery are emerging. Bitcoin dominance has dropped by 2.12% over the past 7 days, now sitting at 60.58%, suggesting that altcoins might be gearing up for a rebound.

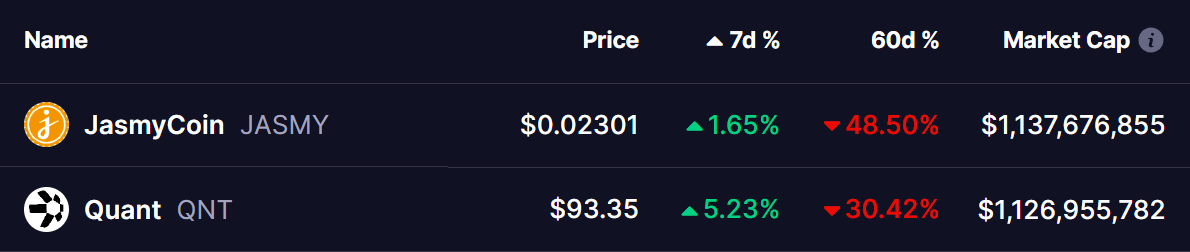

Following this, JasmyCoin (JASMY) and Quant (QNT) are turning green in weekly performance after experiencing deep corrections of 48% and 30% over the past two months.

Source: Coinmarketcap

Source: Coinmarketcap

Both tokens are approaching key resistance levels within their falling wedge patterns—a classic bullish formation that often leads to breakouts.

JasmyCoin (JASMY)

JASMY has been stuck in a falling wedge since December 6, when it got rejected at $0.059. The price plunged to $0.018, testing the lower trendline of the wedge, but it has since started to recover.

JasmyCoin (JASMY) Daily Chart/Coinsprobe (Source: Tradingview)

JasmyCoin (JASMY) Daily Chart/Coinsprobe (Source: Tradingview)

Now, JASMY is trading at $0.023 and inching closer to the upper trendline of the wedge. If the price manages to break above this resistance and confirm support on a retest, a strong rally could follow. The next major obstacle will be the 200-day simple moving average (SMA). A successful breakout could push JASMY toward $0.03467, marking a potential 50% gain from its current price.

The MACD indicator is flashing early signs of a bullish crossover, suggesting that buying pressure is starting to build.

Quant (QNT)

Similar to JASMY, Quant (QNT) has also been forming a falling wedge pattern after facing strong rejection from its December 7 high of $171. The correction brought QNT all the way down to $73, where it found support at the lower trendline of the wedge.

Quant (QNT) Daily Chart/Coinsprobe (Source: Tradingview)

Quant (QNT) Daily Chart/Coinsprobe (Source: Tradingview)

Currently, QNT is recovering and trading around $93.50. With the MACD indicator shifting toward a bullish crossover, momentum appears to be favoring buyers.

If QNT breaks above resistance and confirms it as support, the next major hurdle will be the 25-day SMA. A successful breakout could push the price up to $115, offering a potential 22% upside.

What’s Next?

With JASMY and QNT nearing crucial breakout levels, traders should keep a close eye on their price action in the coming days. A breakout from the falling wedge pattern could trigger a strong rally, but overall market conditions, including Bitcoin dominance and Ethereum’s price movement, will play a key role in determining whether altcoins can sustain their recovery.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing in cryptocurrencies.