5 Token Unlocks to Watch Next Week

Major token unlock events are scheduled next week for Optimism and other projects, releasing previously blocked tokens under fundraising terms. These events can lead to price volatility based on market conditions and investor reactions.

Token unlocks release previously restricted tokens tied to fundraising agreements. Projects schedule these events strategically to limit market pressure and stabilize prices.

Here are five large token unlocks scheduled for next week.

Ethena (ENA)

- Unlock date: January 29

- Number of tokens unlocked: 12.86 million ENA

- Current circulating supply: 3.03 billion ENA

Ethena, a synthetic currency protocol on Ethereum, delivers a solution independent of traditional banking. It also offers global users a dollar-denominated savings tool called the “Internet Bond.”

Ethena’s native token, ENA, allows holders to take part in governance decisions for the protocol. On January 29, Ethena will unlock over 12 million ENA tokens, valued at $11 million, with the funds allocated to ecosystem development.

ENA Unlock. Source:

Tokenomist

ENA Unlock. Source:

Tokenomist

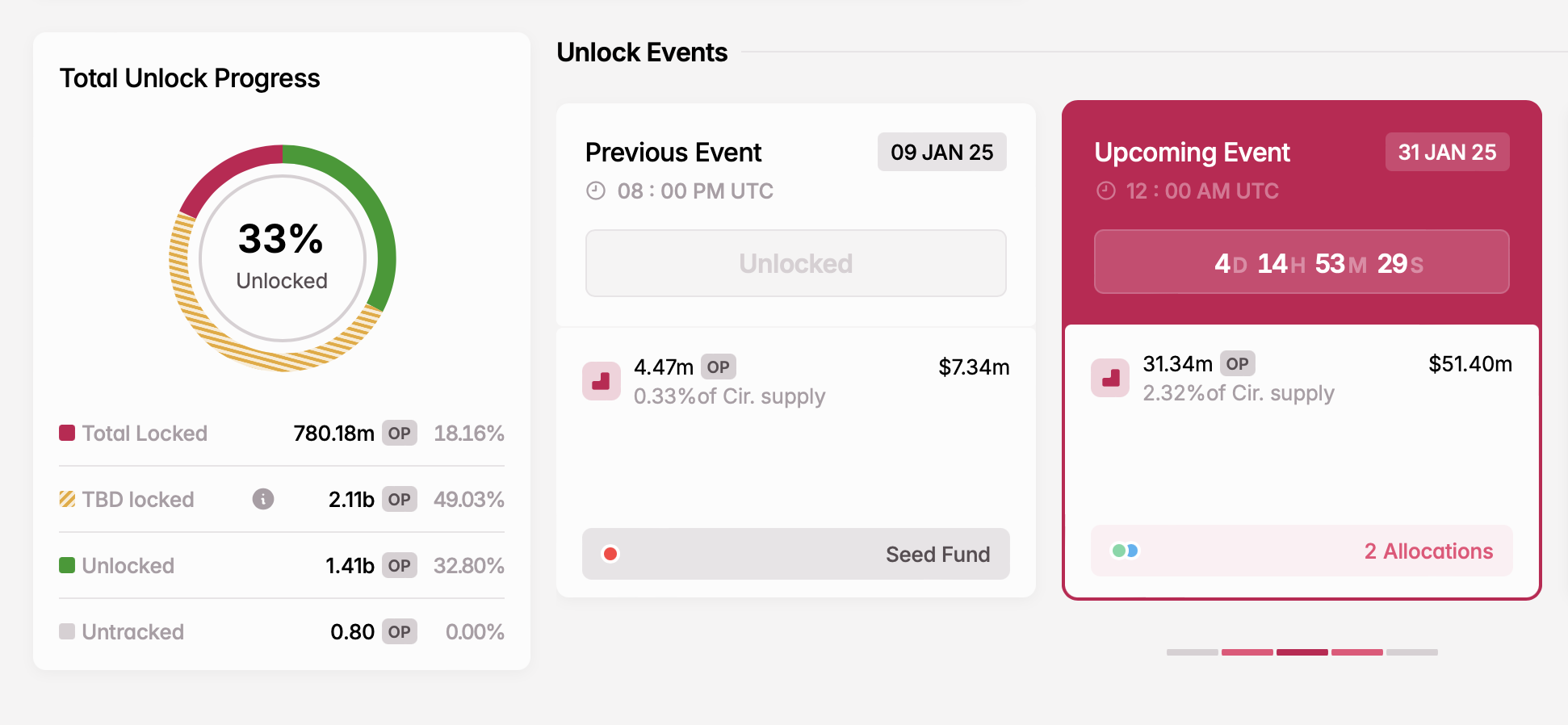

Optimism (OP)

- Unlock date: January 31

- Number of tokens unlocked: 31.34 million OP

- Current circulating supply: 1.35 billion OP

Optimism, a Layer-2 scaling solution, speeds up transactions and reduces costs on Ethereum. Its OP token is essential for governance, letting holders vote on proposals and influence the network’s future.

On January 31, Optimism will unlock 31.34 million OP tokens. According to Tokenomist (formerly TokenUnlocks), these tokens will be distributed to core contributors and investors.

OP Unlock. Source:

Tokenomist

OP Unlock. Source:

Tokenomist

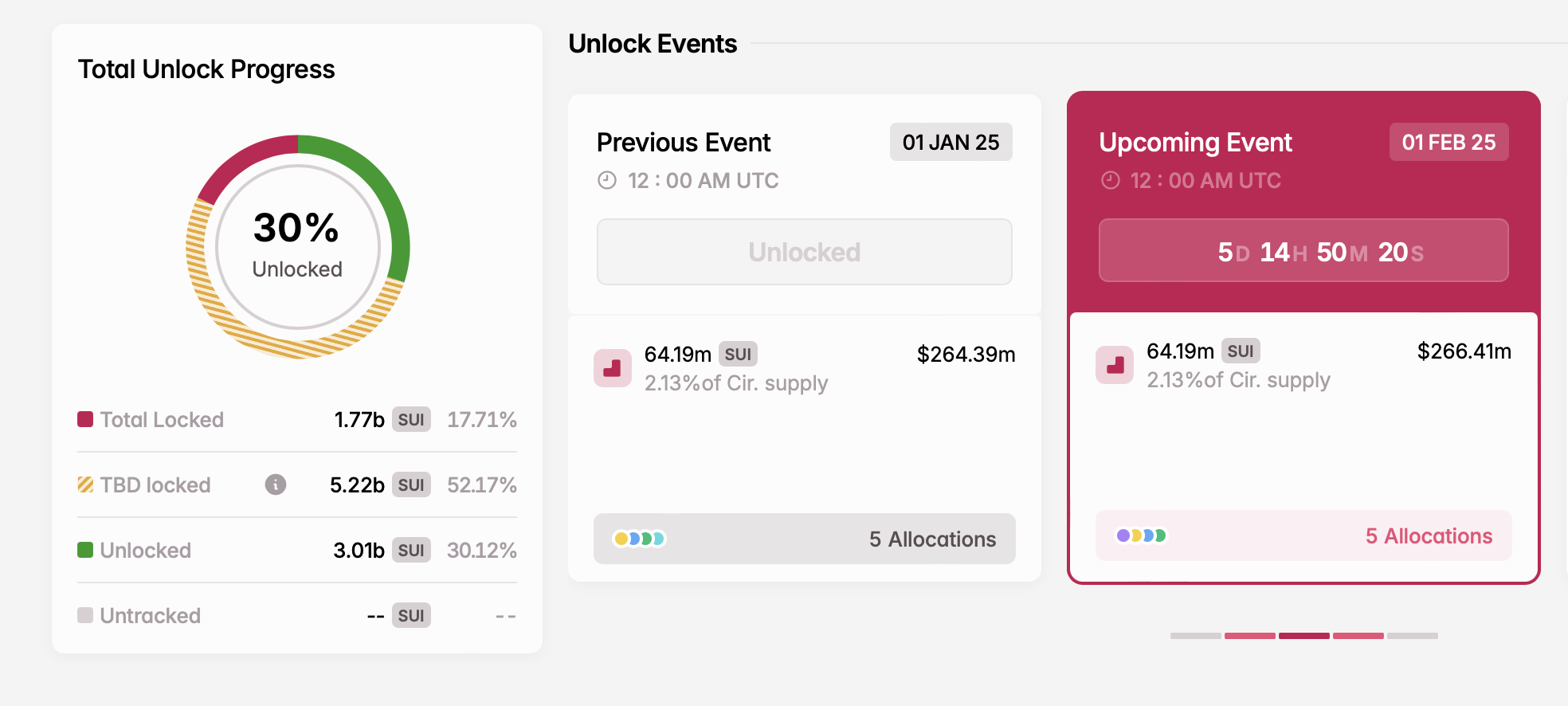

Sui (SUI)

- Unlock date: February 1

- Number of tokens unlocked: 64.19 million SUI

- Current circulating supply: 3 billion SUI

Sui is a high-performance Layer-1 blockchain built to optimize network operations and security through a Proof-of-Stake consensus mechanism. Launched in 2021 by Mysten Labs, the project was founded by former Novi Research employees who contributed to the development of the Diem blockchain and the Move programming language.

The SUI token enables governance, allowing holders to vote on proposals and shape the platform’s future. On February 1, a major token unlock will release tokens allocated to Series A and B participants, the community reserve, and the Mysten Labs treasury.

SUI Unlock. Source:

Tokenomist

SUI Unlock. Source:

Tokenomist

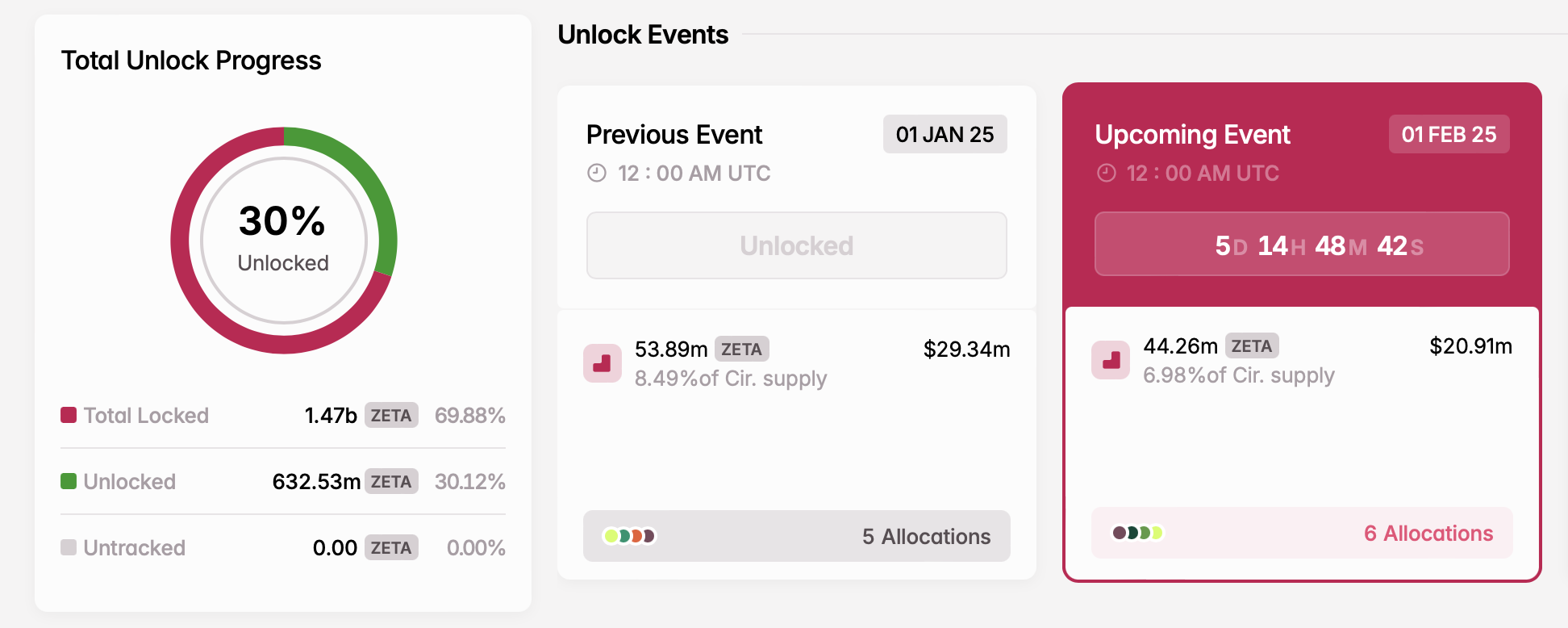

ZetaChain (ZETA)

- Unlock date: February 1

- Number of tokens unlocked: 44.26 million ZETA

- Current circulating supply: 634.37 million ZETA

ZetaChain is a decentralized blockchain platform that facilitates seamless interoperability across different blockchain networks. Its key feature allows cross-chain communication, enabling the transfer of tokens and data between blockchains like Ethereum and Binance Smart Chain.

On February 1, ZetaChain will unlock nearly 45 million ZETA tokens. These tokens will fund initiatives such as a user growth pool, an ecosystem growth fund, core contributor rewards, advisory roles, and liquidity incentives.

ZETA Unlock. Source:

Tokenomist

ZETA Unlock. Source:

Tokenomist

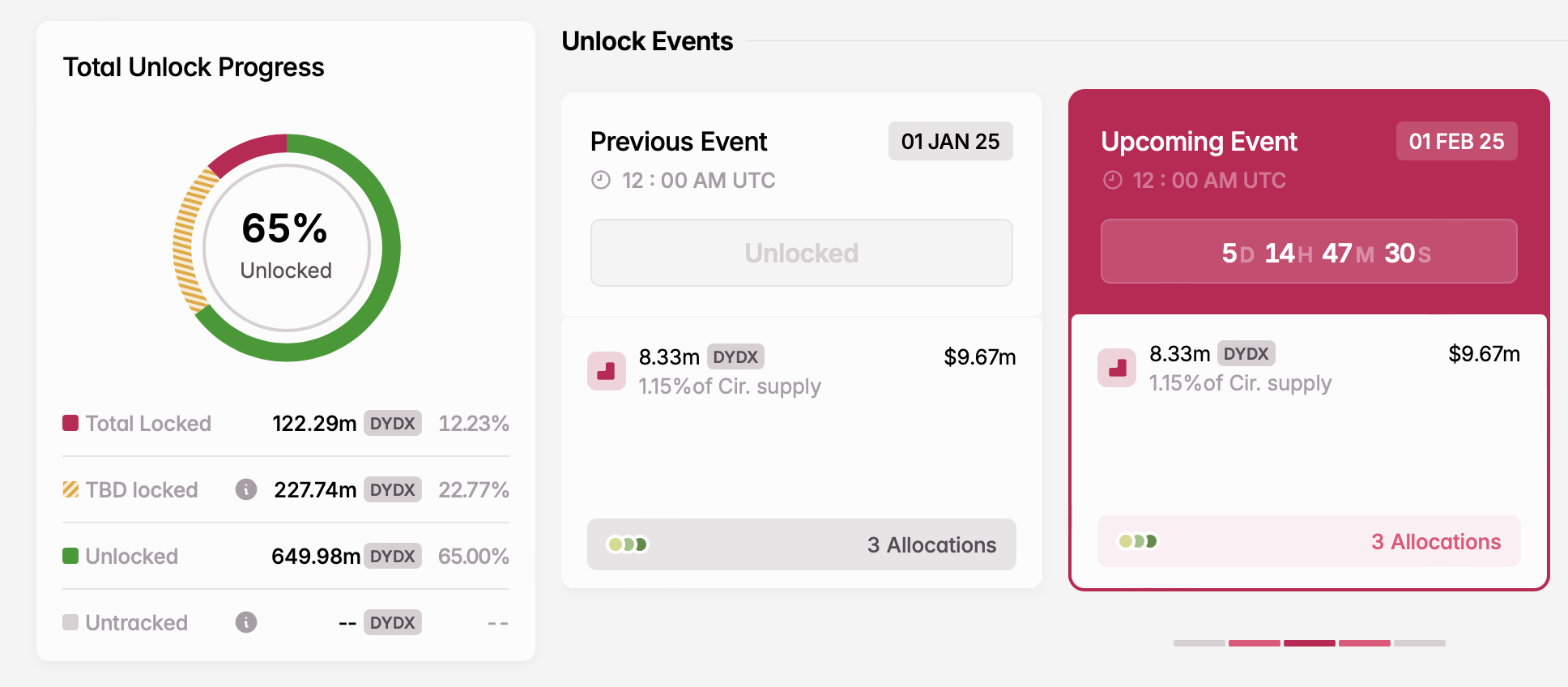

dYdX (DYDX)

- Unlock date: February 1

- Number of tokens unlocked: 8.33 million DYDX

- Current circulating supply: 722 million DYDX

In early 2023, dYdX, the largest decentralized perpetual futures trading protocol, announced changes to its initial tokenomics. According to the update, 27.7% of dYdX’s total supply will go to early investors, 26.1% to the treasury, 15.3% to the team, and 7.0% to future dYdX employees and consultants.

Most DYDX unlocked on February 1 will be distributed among founders and investors, with the remaining tokens reserved for current and future employees.

DYDX Unlock. Source:

Tokenomist

DYDX Unlock. Source:

Tokenomist

Next week’s cliff token unlocks will also include Eigen Layer (EIGEN), Celo (CELO), and Moca Network (MOCA), among others, with a total combined value exceeding $450 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu’s Focus on Privacy Aims to Draw DeFi Interest Amid Price Challenges

- Shiba Inu (SHIB) stabilizes near $0.00000851, with traders monitoring $0.000008390 support and $0.000008840 resistance amid a descending channel pattern since early 2025. - A 1.7% weekly gain contrasts with a 17.4% drop from its 14-day high, while $132.8M trading volume highlights uncertainty despite a privacy-focused Shibarium upgrade integrating Zama's FHE technology. - Technical indicators show fragile equilibrium, with bearish EMAs and $380K net outflows reinforcing distribution trends, though analys

Bitcoin News Update: Greenidge Transitions to AI as Bitcoin Mining Faces Rising Expenses and Regulatory Challenges

- Greenidge Generation , a Bitcoin miner, shifts to AI/HPC amid industry cost and regulatory pressures. - Bitcoin mining profitability declines as hashrate hits 1.16 ZH/s and hash prices fall below $35. - Companies like Bitfarms abandon Bitcoin for AI/HPC, while CleanSpark reports $766M mining revenue surge. - Regulatory scrutiny intensifies over foreign mining hardware, with BlockQuarry promoting domestic alternatives. - Energy costs and debt disputes force Tether to halt Uruguayan mining, highlighting se

Bitcoin News Update: Institutions Favor Bitcoin's Reliability as Altcoin Growth Slows

- Bitcoin's market dominance exceeds 54%, driven by waning altcoin momentum and institutional preference for stability. - Altcoin Season Index at 23 signals Bitcoin-centric trends as macroeconomic pressures and regulatory uncertainty weaken alternative cryptocurrencies. - Institutional investors prioritize Bitcoin's scalability and infrastructure, exemplified by Bhutan's Ethereum integration and Bitcoin Munari's fixed-supply presale model. - Analysts highlight Bitcoin's role as a macroeconomic barometer, w

MMT Token TGE: Is This the Dawn of a New Era for Digital Asset Foundations?

- MMT Token's 2025 TGE secured $100M valuation from Coinbase Ventures, OKX, and Jump Crypto, with 1330% price surge post-launch. - Momentum DEX on Sui reported $13B trading volume and $320M TVL, leveraging CLMM architecture and cross-chain RWAs for institutional appeal. - 55% of hedge funds now hold digital assets, driven by U.S. CLARITY Act and EU MiCA 2.0, as MMT's RWA focus bridges traditional and blockchain finance. - Despite macroeconomic risks like 34.6% post-TGE volatility, MMT's governance model an