Solana Hits $277 All-Time High as Open Interest Soars to $8 Billion

Solana’s price surged to $277.99, driven by the TRUMP memecoin frenzy and bullish market activity. Could new highs be ahead?

Solana (SOL) reached an all-time high (ATH) of $277.99 on January 18, driven by a surge in activity surrounding the newly launched TRUMP memecoin.

The buzz around the meme coin ahead of Donald Trump’s January 20 inauguration has fueled substantial trading activity on the Solana network, propelling SOL’s price and on-chain metrics to record levels.

Solana’s Price and Open Interest Touch New Peaks

Solana-based TRUMP has captured significant market attention since it launched unexpectedly on Saturday. This has led to a surge in activity on the Solana network, which has, in turn, driven up the value of its SOL coin.

On January 18, SOL climbed to a new all-time of $277.99. While it has since witnessed a 1% price correction, the demand for the altcoin remains high.

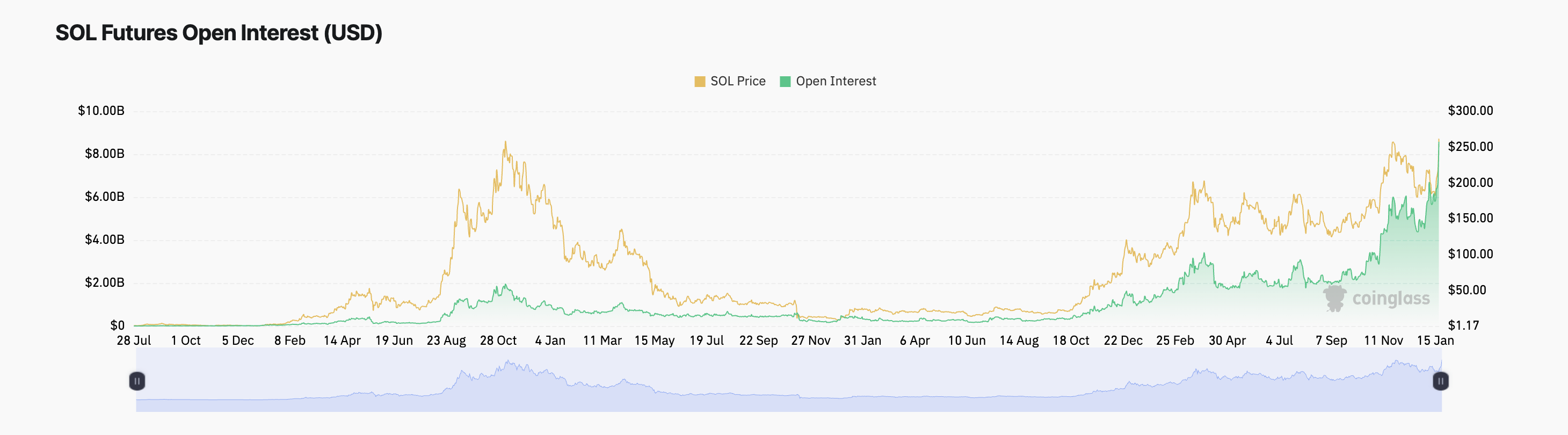

This is reflected by its open interest, which continues to grow. As of this writing, this sits at an all-time high of $8.57 billion, surging 25% over the past 24 hours.

Solana Open Interest. Source:

TradingView

Solana Open Interest. Source:

TradingView

Open interest refers to the total number of outstanding derivative contracts (such as futures or options) that have not been settled or closed. When it rises during an asset’s price rally, it indicates increasing participation and confidence among traders as more capital flows into futures contracts.

This trend is a bullish signal, suggesting that SOL’s price movement is supported by growing market activity and conviction.

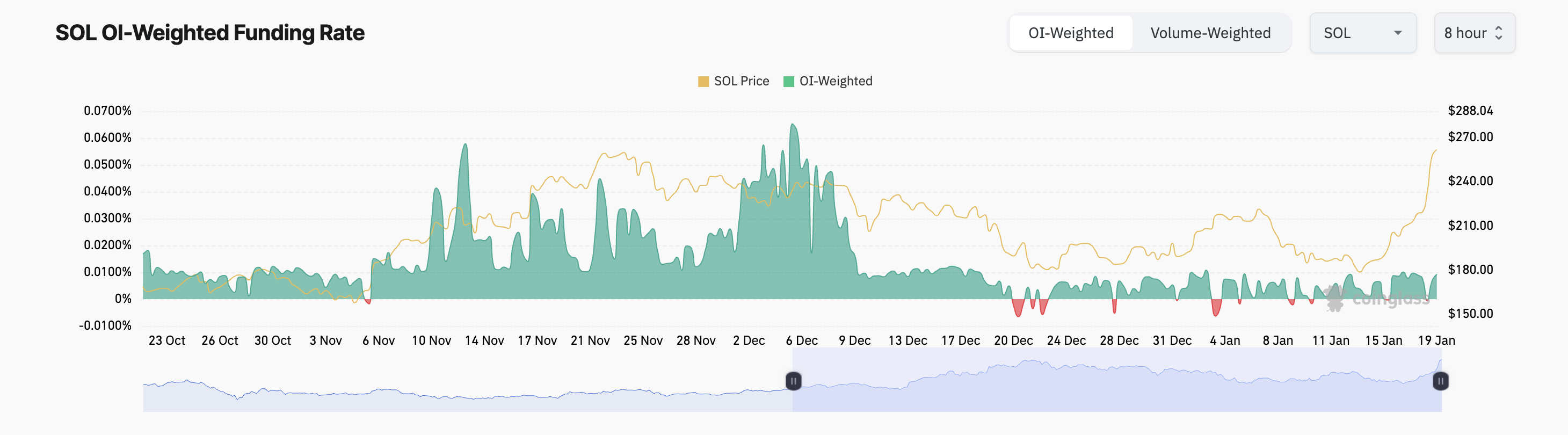

Notably, SOL’s futures traders have continued to bet on a sustained rally. This is evidenced by the coin’s positive funding rate, which is 0.0093% at press time.

Solana Funding Rate. Source:

TradingView

Solana Funding Rate. Source:

TradingView

The funding rate is a periodic fee paid between long and short traders in perpetual futures markets to keep the contract price aligned with the spot price. When it is positive, it means longs are paying shorts, indicating bullish sentiment as more traders are betting on the price increasing.

SOL Price Prediction: Coin May Rally to New Highs

On the daily chart, SOL trades just below its all-time of $277.99, which now forms a resistance level. With sustained buying pressure, the coin’s break will break above this level, flip it into a support zone, and continue its uptrend.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

However, if profit-taking activity resurfaces, this bullish projection will be invalidated. In that scenario, SOL’s price could plummet to $227.96.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.