-

Bitcoin hovers above critical $90,000 support level, showcasing remarkable resilience amidst December’s market turbulence.

-

Amidst institutional profit-taking, Bitcoin ETFs have seen a significant decline in inflows, indicating cautious market sentiment.

-

“The $90,000-level has become a psychological anchor,” explained analysts, highlighting both institutional and retail participant support for Bitcoin.

Bitcoin maintains its hold above $90,000, despite recent sell-offs. Key market signals suggest resilience as institutional profit-taking softens.

Bitcoin’s Resilience Above $90,000 Support

Despite the tumultuous end to December, Bitcoin’s ability to maintain its position above the $90,000 support level reflects a significant market resilience. Over the last month, sell-side pressures have been intense, yet Bitcoin’s value has shown a remarkable capacity to recover after peaking with daily outflows reaching $200 million.

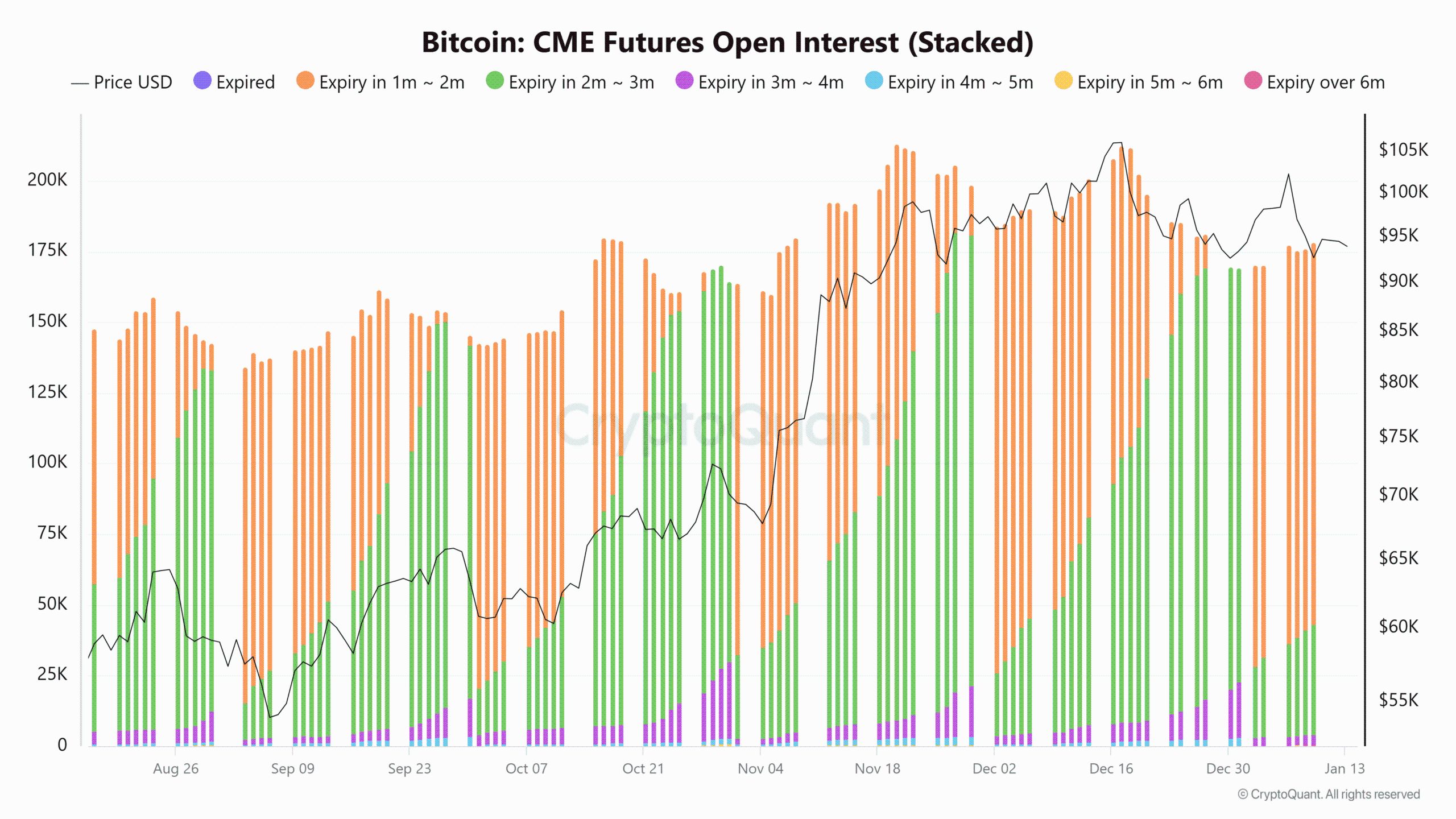

Source: Cryptoquant

As of now, institutional investors are exhibiting caution, as reflected by a 13% dip in Open Interest for Bitcoin futures since November. This indicates a strategic move to lock in profits accrued over the previous months, as unprecedented volatility in the market prompted a surge in risk-averse behavior.

Indicator Analysis: MVRV and Sell-Side Ratios

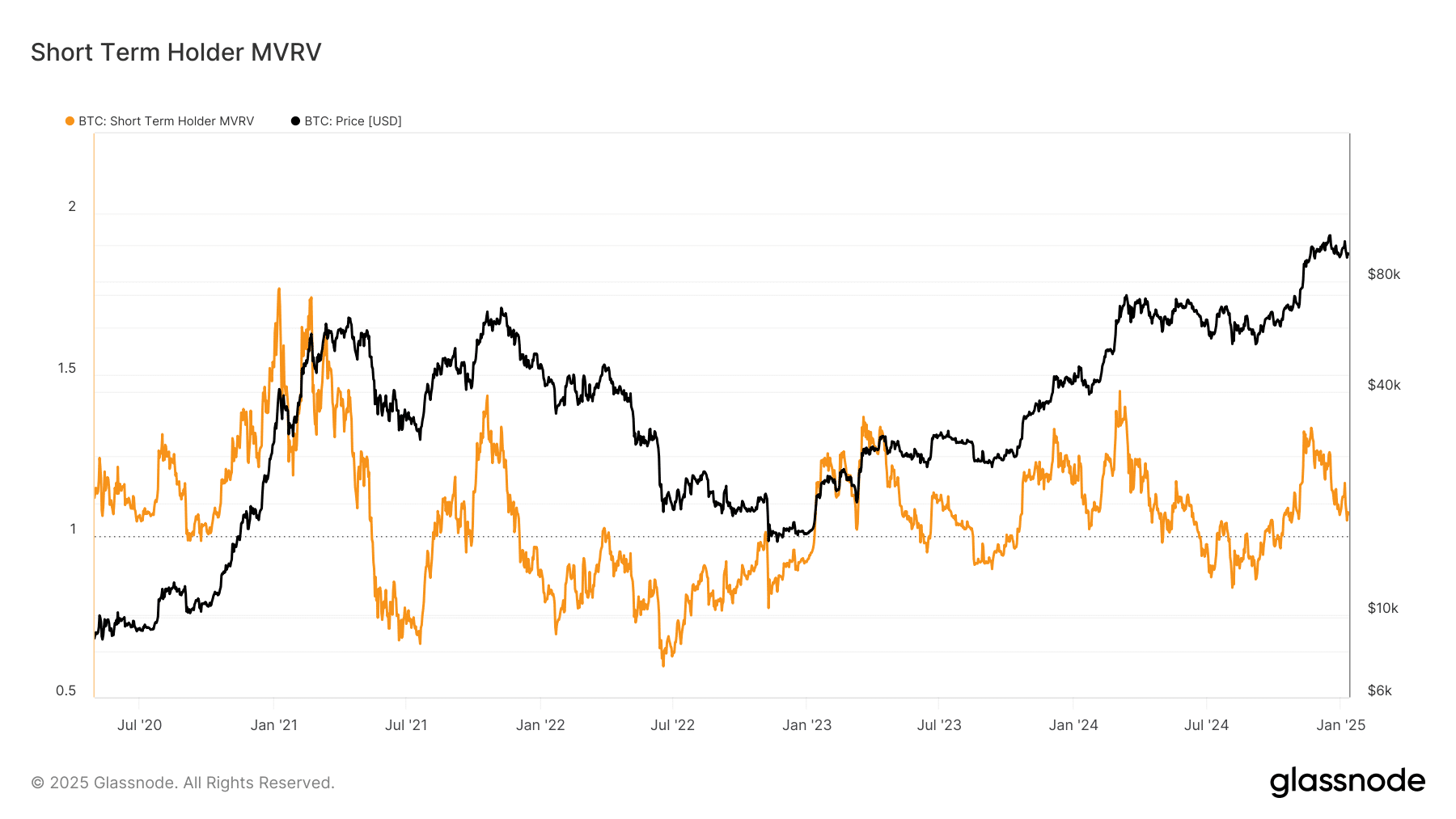

Important indicators, such as the Market Value to Realized Value (MVRV) ratio, provide insight into the current sentiment of Bitcoin holders. The STH MVRV suggests that the average cost basis for short-term holders is around $88,000, allowing them some breathing room regarding potential losses.

Source: Glassnode

Nevertheless, the narrow gap between current MVRV values indicates potential volatility if the $90,000 support is breached. Conversely, bridging this gap could reasonably stimulate fresh upward momentum for Bitcoin as short-term holders reach favorable positions.

Potential Catalysts for Future Movement

As Bitcoin consolidates its position above the crucial support line, macro-economic factors are expected to play a pivotal role in dictating its future direction. Events such as shifts in monetary policy or significant economic data releases may trigger movements in Bitcoin’s price.

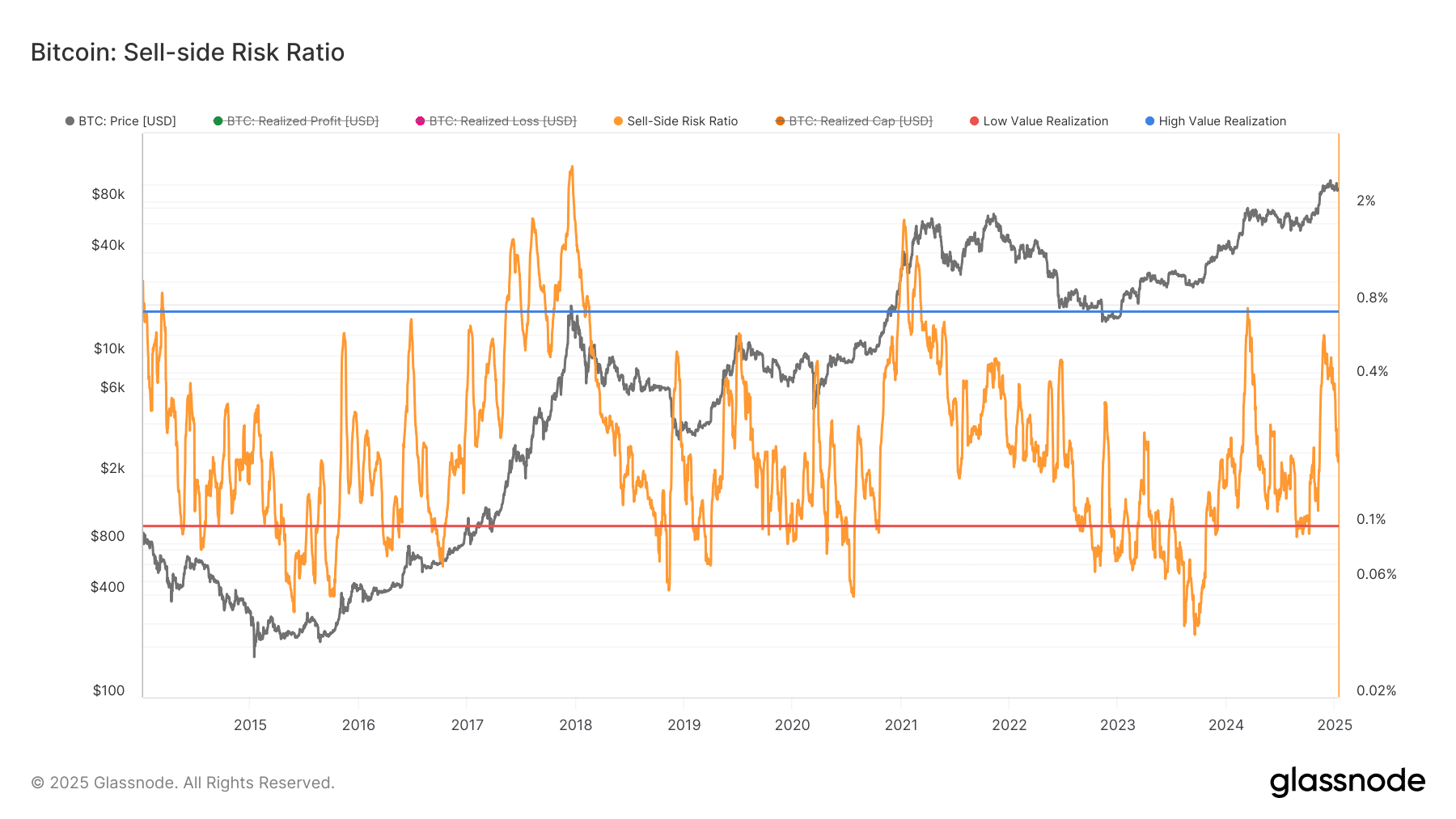

Source: Glassnode

At this juncture, Bitcoin is positioned precariously. It must gain fresh demand to avoid potential declines toward $88,000 which may reset market sentiment. The weeks ahead will be critical as they will likely define Bitcoin’s trajectory going forward.

Conclusion

In summary, Bitcoin’s ability to maintain support at $90,000 amid selling pressure reflects a significant aspect of market resilience. While institutional involvement and profit-taking weigh heavily on its progress, the upcoming macroeconomic developments may act as a catalyst for decisive movement. Investors will keenly observe the market dynamics to gauge potential future shifts in Bitcoin’s price.