FAQ about MomoAI Public Sale

In order to make the details of the MomoAI sale more clear, we've collected some questions from our communities that we hope will help you out!

-

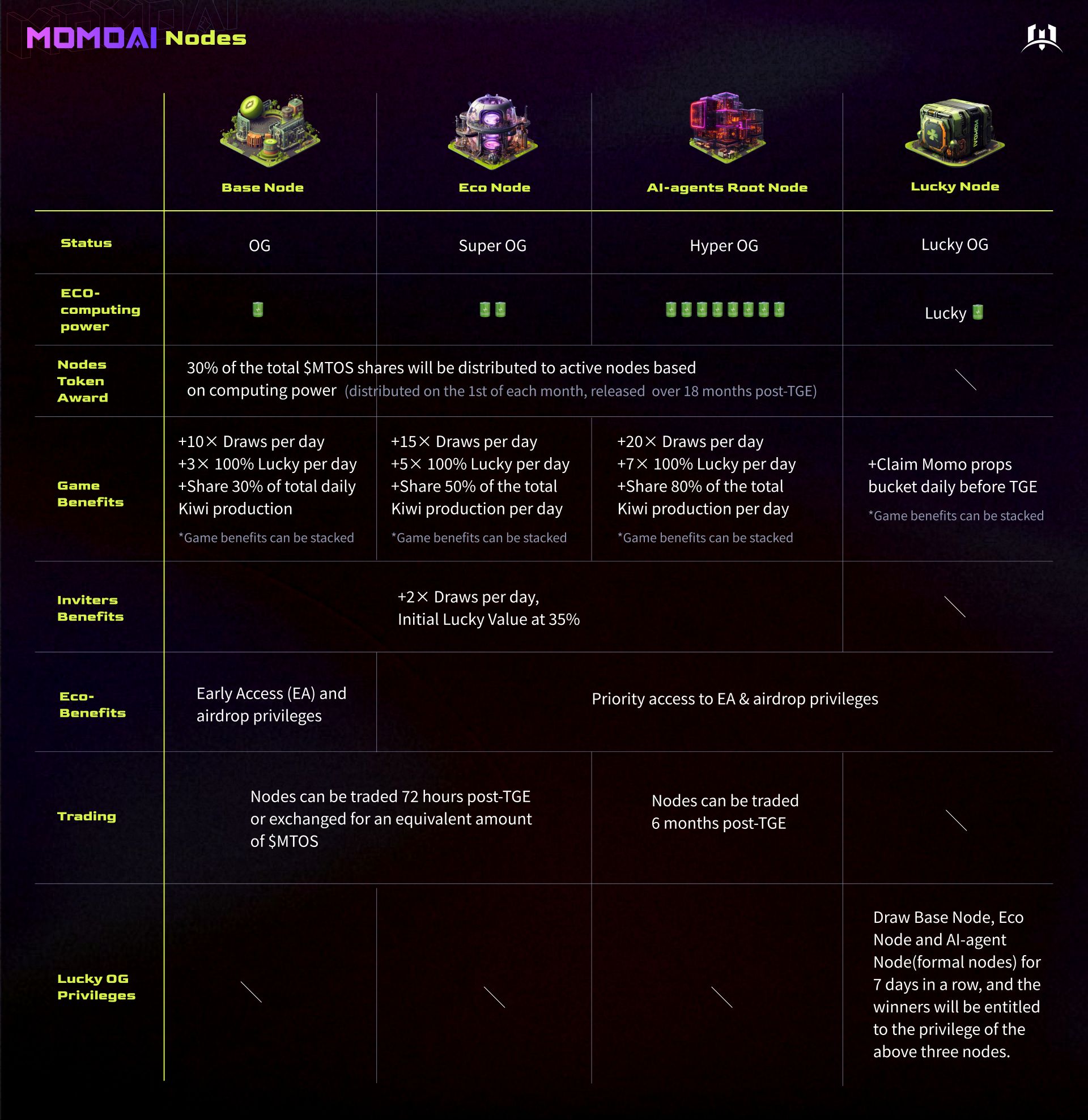

How many types of nodes will be launched on public sale? Four in total. Base Node, Eco Node, AI-agent Node and Lucky Node.

-

What is the differences between the four nodes?

-

What does Lucky Node use if I have one? Lucky node holders can draw Base Node, Eco Node, and AI-agent Node on the Lucky Node page for 7 consecutive days.

-

When does the public sale start and end? From 7:00am(UTC) on 18th to 7:00am(UTC) on 21st April.

-

What if the Lucky Node holders draw one of the above three nodes successfully? If it is successful, you can get the privilege of the three nodes directly, and your Lucky Node will be burnt. The specific

-

What are the token rewards? 30% of the total $MTOS shares will be distributed to active nodes based on computing power (distributed on the 1st of each month, released over 18 months post-TGE). Notice:

-

How to purchase the four nodes? A channel will be opened for users to purchase on both the web and app of Momo.

Web: https://mini.momo.meme/home

Tg Mini-App: https://t.me/MomoAI_bot/app -

Are these nodes refundable? Refundable: Base Node, Eco Node, and AI-agent Node Unrefundable: Lucky Node

-

What do I need to pay attention to? You can't deal on the exchange to purchase nodes, otherwise you can't get a refund and get a node.

Now we are preparing for you a QUEST event. As long as you answer the questions correctly, you have a chance to win rewards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!