XRP Has Most Bullish-Looking Chart in Entire Crypto Space, According to Analyst – Here’s Why

A widely followed cryptocurrency analyst and trader is leaning bullish on XRP .

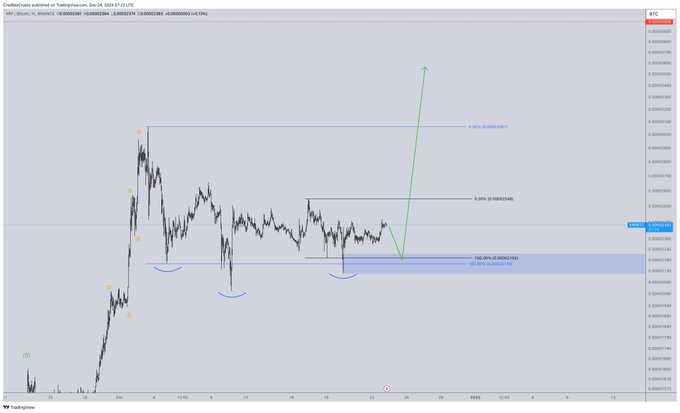

The analyst pseudonymously known as CredibleCrypto tells his 450,200 followers on the social media platform X that paired against Bitcoin ( BTC ), XRP “looks absolutely fantastic.”

The trader says he plans to enter a long position in the coming days.

Based on the analyst’s chart on the one-hour time frame, it appears he is suggesting that XRP could first trend downwards before skyrocketing by at least 65%.

It also appears that the analyst believes XRP has formed an inverse head-and-shoulders pattern in the same time frame. An inverse head-and-shoulders pattern is considered a bullish signal in technical analysis.

“Still the most bullish-looking chart in the entire space off the lows in my opinion. Just a powder keg building pressure…”

Source: CredibleCrypto/X

Source: CredibleCrypto/X

XRP is trading at 0.00002323 BTC ($2.28) at time of writing.

Next up is Ethereum ( ETH ). CredibleCrypto says that ETH is likely to trade in a range of between $3,000 and $3,800 before bottoming out at around $2,800.

Based on the pseudonymous analyst’s chart on the 12-hour time frame, he suggests Ethereum could then rally to a new all-time high above $6,000.

Source: CredibleCrypto/X

Source: CredibleCrypto/X

Ethereum is trading at $3,492 at time of writing.

Turning to the Ethereum/Bitcoin pair, the widely followed analyst says he is still targeting Ethereum to drop to around the 0.02700 BTC to 0.02800 BTC level before he can enter a long position. According to CredibleCrypto, ETH/BTC is now “grinding back down” after initially rallying.

“Would be an absolutely epic entry if we get it that will probably mark this cycles pico bottom on ETH/BTC as well.”

Source: CredibleCrypto/X

Source: CredibleCrypto/X

ETH is trading at 0.03542 BTC at time of writing.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Zaleman/INelson

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin