US spot bitcoin ETFs continue net outflows, bleeding $340 million

U.S. spot bitcoin ETFs saw $338.4 million in net outflows on Tuesday.This marks the fourth straight day of net outflows from U.S. spot bitcoin funds.

U.S. spot bitcoin exchange-traded funds recorded their fourth consecutive day of net outflows on Tuesday, extending their outflow streak to four days.

According to data from SoSoValue, the 12 ETFs saw a total of $338.4 million leave the funds yesterday. During the past four days, these spot bitcoin funds reported a total of $1.52 billion in net outflows.

The net outflow streak follows 15 consecutive days of positive flows leading up to Dec. 18 that drew in over $6.7 billion.

BlackRock’s IBIT saw the largest volume of net outflows worth around $188.7 million, followed by Fidelity’s FBTC, which saw $83 million exit the fund. Ark and 21Shares’ ARKB also logged $75 million in net outflows.

The only net inflows of the day came from Bitwise’s BITB, which added $8.5 million. Seven other funds experienced zero flows for the day, with Franklin Templeton’s EZBC left unreported.

The 12 spot bitcoin ETFs traded a total of $2.16 billion on Tuesday, and their cumulative total net inflow stood at $35.5 billion.

Meanwhile, spot ether ETFs saw $53.5 million in net inflows on Tuesday. BlackRock’s ETHA led inflows with $43.9 million, while Bitwise’s ether fund had inflows of $6.2 million and Fidelity’s FETH saw $3.45 million flow into the fund.

The spot ether ETFs recorded a total trading volume of $262 million on Tuesday, with their cumulative net inflows reaching $2.51 billion.

“One year ago, there were no spot crypto ETFs — A year later, this is now a $135 bil category we have combined spot BTC ETH ETFs coming to market,” ETF Store President Nate Geraci recently wrote on X on Friday. “And that’s without a crypto-friendly SEC … 2025 could get wild.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

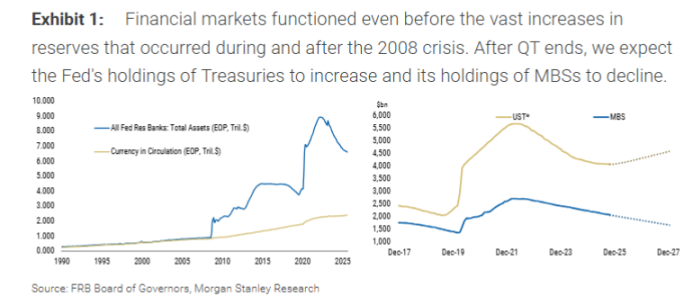

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.