Ternoa: The team is actively testing the connection between AggLaye and the test network, and plans to launch the main network in the first quarter of 2025

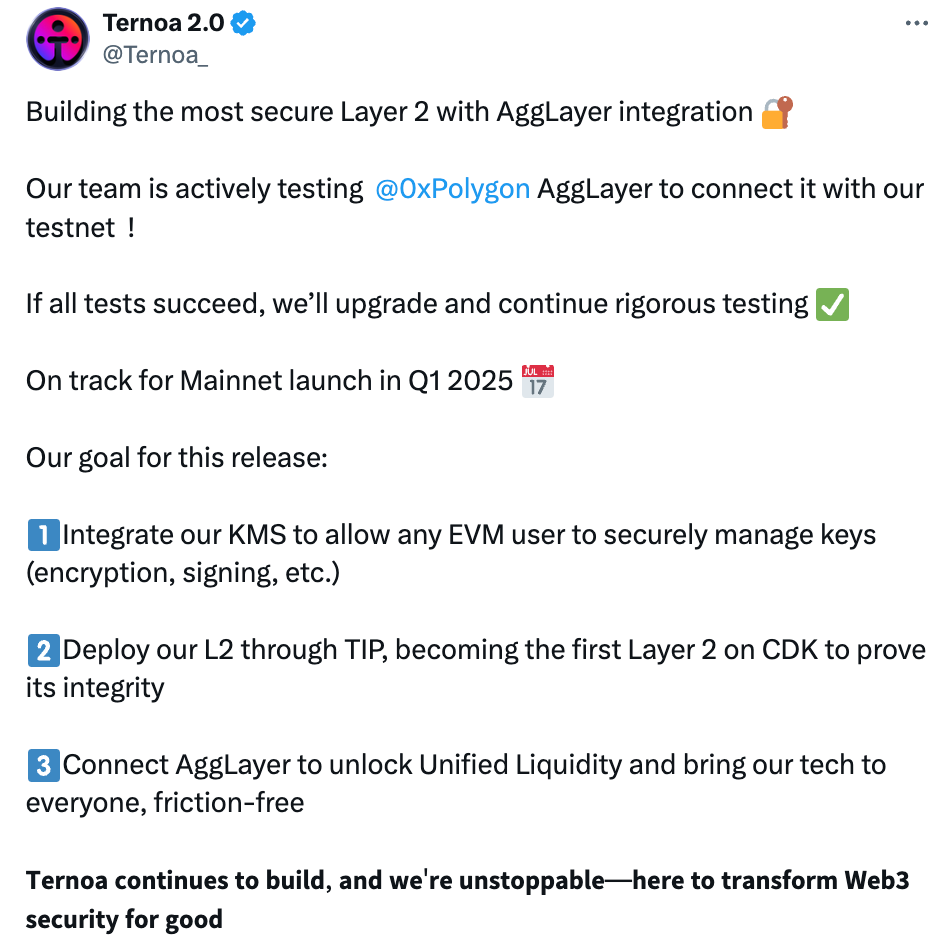

Building the most secure Layer 2 with AggLayer integration

Our team is actively testing @0xPolygon AggLayer to connect it with our testnet !

If all tests succeed, we’ll upgrade and continue rigorous testing

On track for Mainnet launch in Q1 2025

Our goal for this release:

Integrate our KMS to allow any EVM user to securely manage keys (encryption, signing, etc.)

Deploy our L2 through TIP, becoming the first Layer 2 on CDK to prove its integrity

Connect AggLayer to unlock Unified Liquidity and bring our tech to everyone, friction-free

𝗧𝗲𝗿𝗻𝗼𝗮 𝗰𝗼𝗻𝘁𝗶𝗻𝘂𝗲𝘀 𝘁𝗼 𝗯𝘂𝗶𝗹𝗱, 𝗮𝗻𝗱 𝘄𝗲'𝗿𝗲 𝘂𝗻𝘀𝘁𝗼𝗽𝗽𝗮𝗯𝗹𝗲—𝗵𝗲𝗿𝗲 𝘁𝗼 𝘁𝗿𝗮𝗻𝘀𝗳𝗼𝗿𝗺 𝗪𝗲𝗯𝟯 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆 𝗳𝗼𝗿 𝗴𝗼𝗼𝗱

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CoinShares Dismisses Tether Insolvency Fears, Reaffirms Financial Strength

Philippines Flood Control Scandal Linked to Crypto Laundering Operations

Bitwise CIO Explains Why They Launched XRP ETF

Top Cryptos to Watch for 2026 Investment Opportunities