Analysis of the 85 plunge data: Who is rebounding rapidly? Who is the weak sector?

Original | Odaily Planet Daily ( @OdailyChina )

Author|Nan Zhi ( @Assassin_Malvo )

Yesterday, the crypto market fell into a panic spiral along with the global market. BTC fell from over $600 million to $490 million, and ETH fell from over $3,000 to around $2,100. When the market generally predicted that the U.S. stock market would open with a circuit breaker, a major counterattack from the bottom was ushered in, and the crypto market also rebounded quickly.

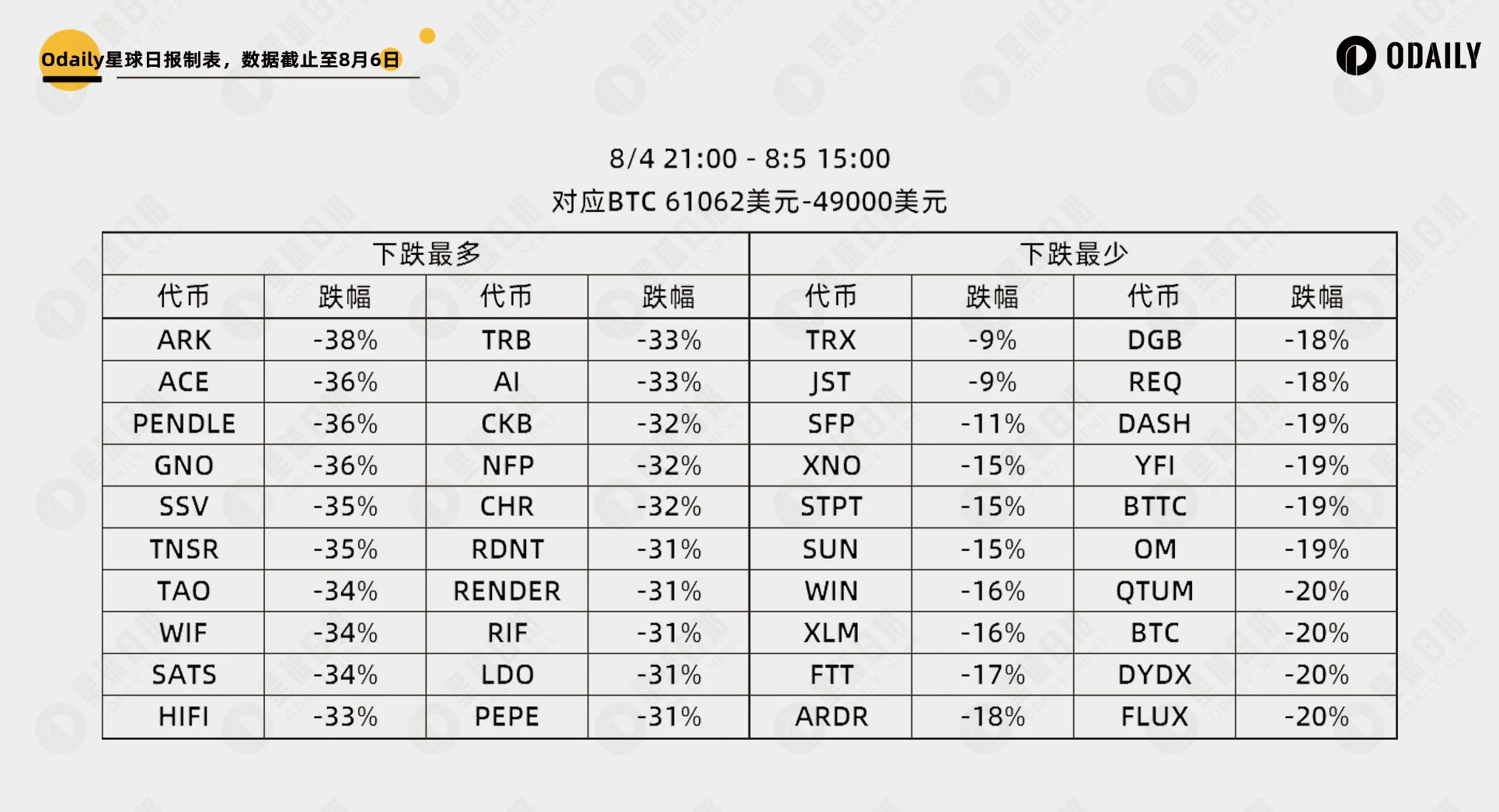

Dividing the market into the plunge period from the evening of August 4 to yesterday afternoon, and the rebound period from the opening of the US stock market to this morning, which tokens fell the most and which tokens rebounded the fastest? In this article, Odaily sorted out and analyzed the data of 249 tokens in Binances spot trading section (excluding stablecoins, gold stablecoins PAXG, and ASI) on the above two aspects, and concluded as follows:

Crash time

Taking 21:00 on August 4 as the benchmark, its opening price as the starting point of the decline, the period when Bitcoin fell to US$49,000 at 15:00 on August 5 as the statistical end point, and the lowest price during the period as the end point of the decline, the data is shown in the table below.

It can be seen that the concepts with the largest declines include LST, AI and Meme, which are:

LST: PENDLE, SSV, LDO

AI: TAO, NFP, RENDER, (AI)

Meme: WIF, PEPE, (SATS)

In the anti-fall sector, previous articles only counted the top ten, resulting in Sun Yuchens series of tokens being on the list every time. This time, it has been expanded to 20, but the tokens on the list are basically small-cap tokens, which are of little reference value.

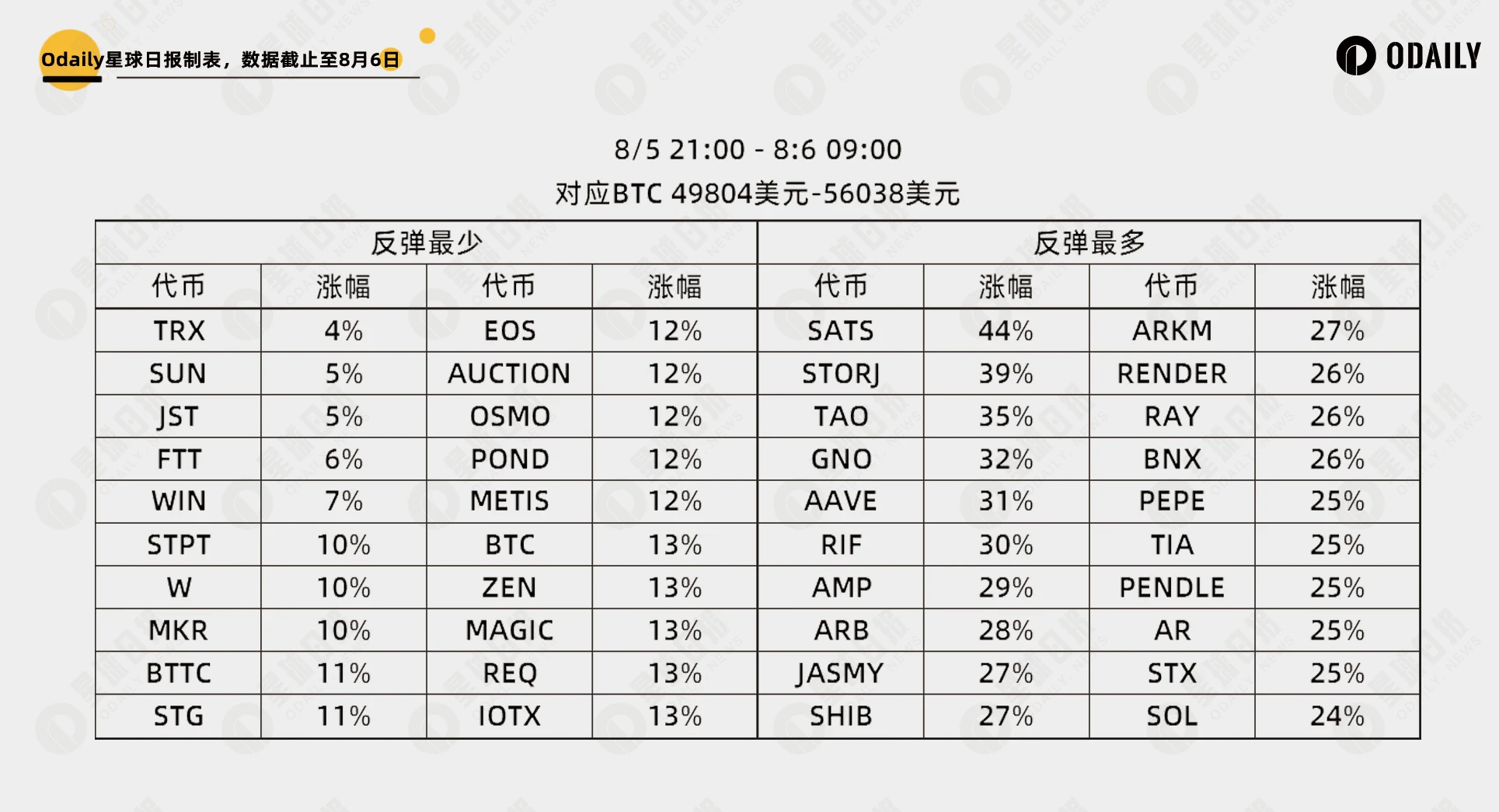

The counterattack horn sounded

Taking 21:00 on August 5 as the benchmark, its opening price as the starting point of the increase, 9:00 on August 6 as the statistical end point, and the highest price during the period as the end point of the increase, the data are shown in the following table.

In this rebound list, no matter the one with the most rebound or the least rebound, there is no obvious concept sector. However, there are several tokens that appear on the decline list, which shows that such tokens have strong elasticity. If there is another round of decline, it is worth paying attention to. These tokens are:

SATS (Bitcoin concept, some Meme attributes)

TAO (AI)

GNO(DeFi)

RIF (Bitcoin Concept)

RENDER (AI)

PEPE (Meme)

PENDLE (LST, LRT concepts)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

R3 Taps Solana to Bridge $10B+ RWAs to Public Chain

R3 partners with Solana to bring over $10B of tokenized RWAs from Corda to public blockchain infrastructure.Why Solana?

Bitcoin trader swaps $1.25B long for short as BTC price slides under $108K

What's the HYPE about? Hyperliquid's 'Solana' moment eyes 240% gains

H100 Group Soars 40% After First Bitcoin Treasury Investment

Sweden-based health tech company H100 Group AB saw its shares surge nearly 40% after announcing a $490,000 investment in Bitcoin, joining a growing wave of tech firms turning to digital assets to diversify corporate reserves.