BlackRock Spot Ethereum ETF Leads the Pack Seeing $118M Inflows

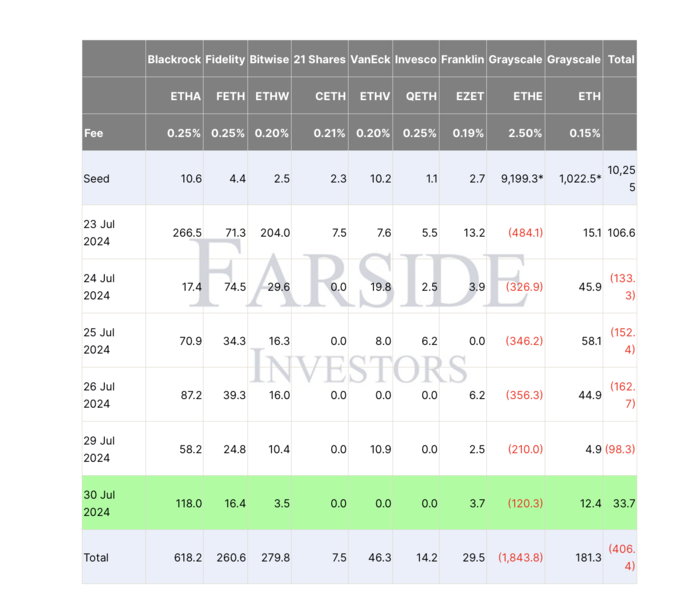

BlackRock’s iShares Ethereum Trust exchange-traded fund (ETF) saw $118 million in inflows on Tuesday, according to data shared by Fireside Investors.

Ethereum spot ETFs experienced a significant net inflow of $33.7 million on July 30, seeing the total inflows turn positive since launching. Fidelity’s Ethereum Fund (FETH) is the second favourite among investors garnering $16.4 million.

Source: Fireside Investors

Source: Fireside Investors

The nine products made their debut on July 23 and are the first ETFs to invest in Ethereum directly.

Grayscale Ethereum product trading under the ticker “ETHE” continues to bleed seeing $120.3 million in outflows. Outflows mirror previous investor behaviour seen with the Bitcoin Grayscale Trust when spot ETFs launched in January.

BlackRock’s ETH ETF Tops Charts With Record Inflows

In the first week of trading BlackRock’s iShares Ethereum Trust ETF trading under the ticker symbol “ETHA” is in the top 15 inflows of ETFs launched this year, notes Nate Geraci, president of The ETF Store, an advisory firm.

Tough Start For ETH ETFs

Ethereum spot ETFs saw a total net outflow of $ 98.2 million on July 29 and continued to have net outflows for four consecutive days. This was marked by investor withdrawals from high-fee legacy products converted to ETFs.

It is early days for the new Ethereum products which could still gather momentum.

“We believe Ethereum ETFs will attract inflows roughly a third the size of Bitcoin ETFs in the long term, aligning with the relative market caps and trading volumes of the two cryptocurrencies. While Bitcoin’s market cap is approximately 3.3 times that of Ether, the inflows into Ethereum ETFs are expected to be anywhere around 30% to 50% of those into Bitcoin ETFs,” notes Jag Kooner, head of derivatives at Bitfinex.

Kooner also notes since the launch of the Ethereum ETFs, the market has seen significantly higher volatility. Ethereum has also seen a “muted price response” and this is exactly as expected following a sell-the-news event analogous to the Bitcoin ETF launch, which also saw the BTC price fall, post-launch in January.

Ethereum is trading around $3,206 down 0.2% during press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.