BlackRock Ethereum ETF draws most inflows on first trading day

Key Takeaways

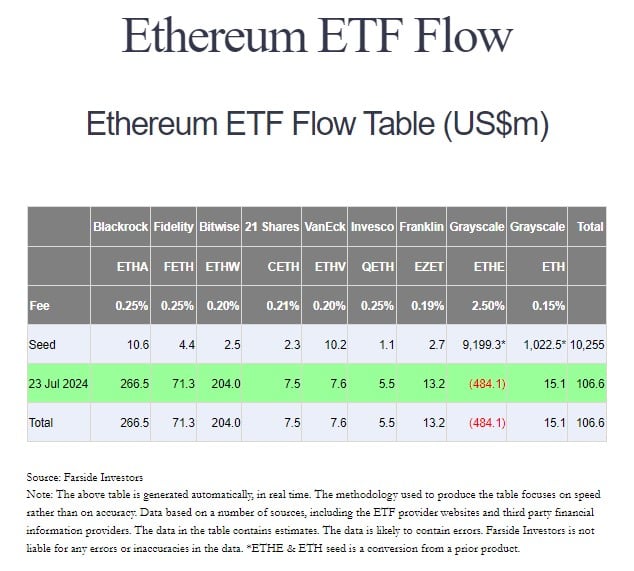

- BlackRock's iShares Ethereum Trust (ETHA) dominated with over $266 million in inflows.

- The debut of spot Ethereum ETFs overshadowed Bitcoin ETFs, with outflows of $78 million.

US spot Ethereum exchange-traded funds (ETFs) made a strong debut on Tuesday, attracting nearly $107 million in total inflows, according to data from Farside Investors. BlackRock’s iShares Ethereum Trust (ETHA) led the pack with over $266 million on its first day of trading.

Source: Farside Investors

Source: Farside Investors

The Bitwise Ethereum ETF (ETHW) and Fidelity Ethereum Fund (FETH) were also the day’s top performers, capturing $204 million and over $71 million in net inflows, respectively.

Other gains were seen in Franklin Ethereum ETF (EZET), VanEck Ethereum ETF (ETHV), 21Shares Core Ethereum ETF (CETH), Invesco Galaxy Ethereum ETF (QETH), and Grayscale Ethereum Mini Trust (ETH).

In contrast, Grayscale’s Ethereum Trust (ETHE) bled $484 million on its first day. The outflows represent 5% of the fund’s total value. As of July 2024, ETHE had over $9 billion in assets under management.

The conversion of the Grayscale Ethereum Trust to a spot ETF allowed investors to easily sell their shares, potentially leading to a large outflow. The situation likely mirrors the launch of spot Bitcoin ETFs in January, where Grayscale’s Bitcoin Trust (GBTC) also faced substantial outflows.

On the first day of trading, over $1 billion worth of shares changed hands across all the spot Ethereum products, as reported by Crypto Briefing. Grayscale’s ETHE dominated the trading volume, followed by BlackRock’s ETHA and Fidelity’s FETH.

The launch of spot Ethereum ETFs overshadowed Bitcoin ETF performance, with flows turning negative. Farside’s data reveals that US spot Bitcoin funds suffered $78 million in outflows on Tuesday, ending a 12-day inflow streak initiated on July 5.

US spot

Bitcoin ETFs ended their inflow streak – Source: Farside Investors

US spot

Bitcoin ETFs ended their inflow streak – Source: Farside Investors

BlackRock’s iShares Bitcoin Trust (IBIT) was the sole gainer of the day. IBIT saw nearly $72 million in inflows.

Meanwhile, investors withdrew approximately $80 million combined from Grayscale’s Bitcoin Trust (GBTC) and ARK Invest’s Bitcoin ETF (ARKB) yesterday. Bitwise’s BITB recorded the day’s largest asset exodus, exceeding $70 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US stocks slipped while bitcoin rallied on higher Treasury yields

Bitcoin may have traded like a safe haven asset Wednesday, but analysts warn the trend may not last

Bitcoin hits all-time high while Solana holds steady

Solana’s focus remains on fundamentals: stable usage, high yields, and expanding infrastructure

BUSDT now launched for futures trading and trading bots

The Graph to Adopt Chainlink CCIP for Cross-Chain GRT Transfers