- Bitcoin’s open interest nears extreme fear region, signaling potential price rebounds ahead.

- Funding rates turn briefly negative, reflecting bearish sentiment but average remains neutral.

- Market sentiment leans towards fear, indicating possible future price expansions in Bitcoin.

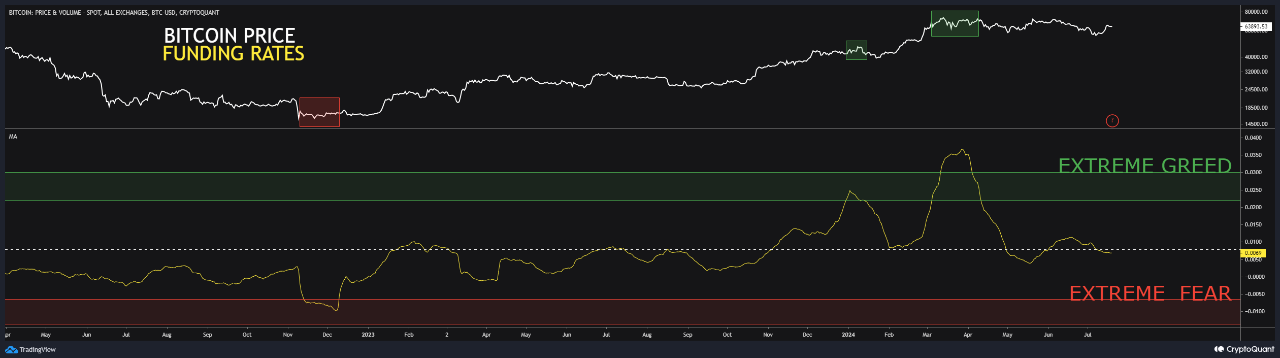

Bitcoin is currently mired in a climate of “extreme fear,” according to market sentiment analysis, as open interest plummets to concerning lows. A 25% correction from its recent peak has spooked investors, leading to a notable exodus of capital and raising questions about the market’s next move.

Open interest, a crucial indicator of market activity and sentiment , is approaching the extreme fear region. This metric’s decline signifies that many traders are closing their positions, pulling out their investments. This trend often precedes significant market movements, as reduced participation can lead to lower liquidity and higher volatility. The current open interest levels mirror the anxiety felt across the market, indicating a cautious approach by investors.

Funding rates, another critical metric, have dipped into the negative range during the recent price correction. Negative funding rates mean that short positions are paying long positions, reflecting a bearish sentiment among traders. This brief dip in funding rates underscores the market’s fear, as traders expect further price drops. However, the average funding rate remains neutral, indicating that the market is still in a state of equilibrium, with neither bullish nor bearish forces dominating.

The combination of these factors, declining open interest and negative funding rates, paints a picture of a market under pressure. Investors are wary, leading to a reduction in trading activity and heightened fear. Despite the neutral funding rates suggesting stability, the underlying sentiment leans towards caution, with market participants bracing for potential further declines.

The overall market sentiment is closer to fear-neutral than euphoria. This proximity to extreme fear rather than euphoria is crucial. Historically, markets gripped by fear often precede significant price movements. Investors tend to become overly cautious, creating potential opportunities for price rebounds and expansions. This environment could lead to further price volatility as the market navigates through this period of uncertainty.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.