Golem sends over $100 million worth of ETH to exchanges in the past month

Quick Take Golem has sent over $100 million in ether to various exchanges over the last month. The amount sent represents a significant portion of their remaining reserves of around 126,000 ETH.

Golem GLM +0.60% has sent over $100 million in ether to exchanges over the past month, representing a significant portion of the funds raised by the project during its initial coin offering in November 2016.

According to data from Arkham , thousands of ETH were sent from Golem’s main wallet to other wallets, which then sent them to various exchanges, including Binance and Coinbase with the presumed intent to sell.

In just the last three days, 26,000 ETH left Golem’s main wallet, which is worth about $79 million at the time of publication.

While not an explicit confirmation of a sale, sending ETH from a self-custodial wallet to an exchange strongly implies the intention to do so.

Golem was one of the earliest ICOs during the frenzy of token launches in 2016/2017. In its ICO, Golem raised 820,000 ETH, equivalent to around $8 million at the time. Since then, the massive increase in the price of ETH has provided Golem with a substantial treasury from which to play.

The project still has 126,000 ETH in reserve, worth about $383 million, Etherscan data shows.

Golem initially launched as a platform where users can rent out their unused computational resources to others in exchange for their token GLM, providing those in need with additional computational power for complex and demanding tasks. With the growing popularity of AI applications, Golem claims to provide “ accessible, open-source AI infrastructure ” as part of its offer to users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

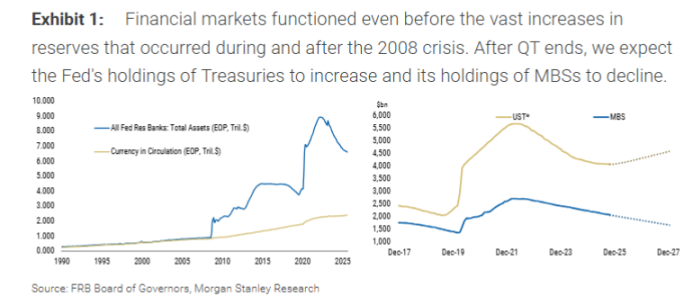

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.

Massive Whale Activity Boosts Anticipation for Pi Network’s Price Surge

In Brief A whale resumed purchases, accumulating 371 million PI coins worth over $82 million. Pi Network is strengthening infrastructure with AI and DeFi enhancements. Technical indicators suggest a possible upward move in the PI coin value.

Standard Chartered Drives New Wave of Crypto-Powered Card Payments

In Brief Standard Chartered partners with DCS to introduce the stablecoin-based DeCard in Singapore. DeCard simplifies cryptocurrency transactions for everyday purchases akin to traditional credit cards. With regulatory backing, DeCard plans to expand beyond Singapore to a global market.