Analysis: The Federal Reserve's interest rate cut has become a consensus in the crypto market, but BIS warns that policy easing may trigger inflation again

Market analysis suggests that the consensus in the cryptocurrency market is that escalating debt concerns will force the Federal Reserve and other central banks to cut interest rates, thereby stimulating more investors to flow into alternative assets such as Bitcoin. The FedWatch tool from the Chicago Mercantile Exchange shows traders expect the Fed to cut rates twice this year, each time by 25 basis points.

However, the Bank for International Settlements warns that easing policy too early could reignite inflationary pressures and force a costly policy reversal. In fact, risks of unanchored inflation expectations have not disappeared and pressure points still exist. It stated in its annual report released on Sunday: "Although financial market pricing currently only shows a small possibility of public fiscal stress, if economic momentum weakens and there is an urgent need for public expenditure both structurally and cyclically, confidence could collapse quickly. Government bond markets would be hit first but pressure might spread more widely just like before."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

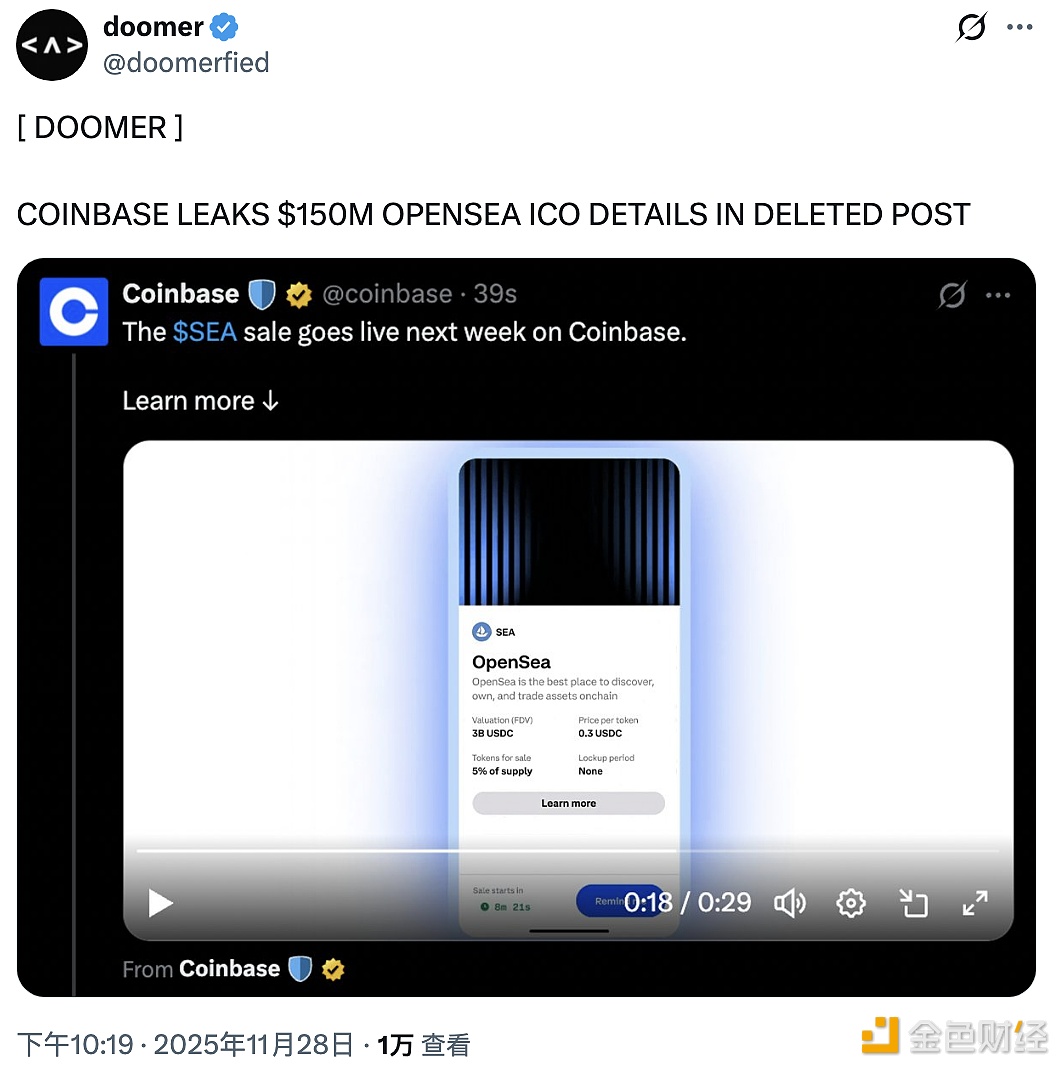

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.