I. Project introduction

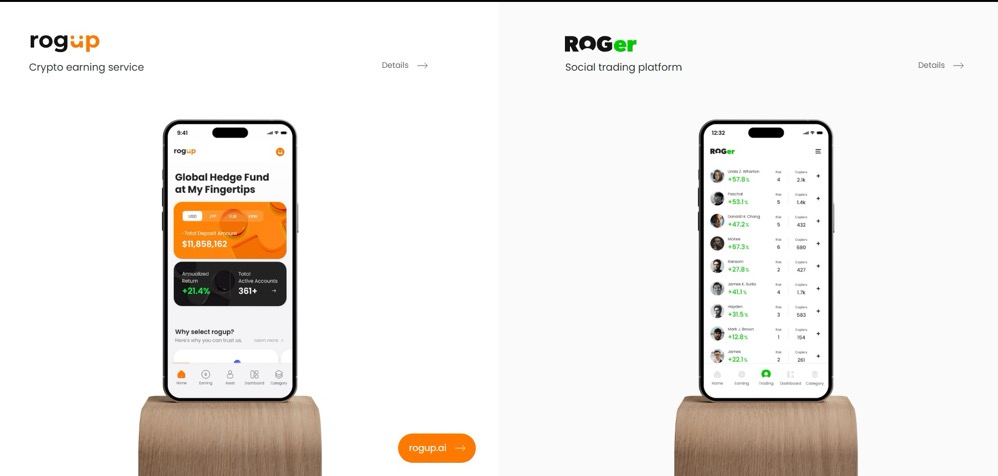

ROGin AI is a cryptocurrency project dedicated to innovating multi-asset management using blockchain and artificial intelligence technology. Its main goal is to simplify asset management, enabling users to easily manage financial assets through its innovative "Simply Earning Service" and advanced social trading platform, thus building a transparent, accessible, and resilient investment ecosystem.

1. The combination of AI and blockchain makes the business technology high, and it may be the direction of market speculation. By using AI for Data Analysis and blockchain technology to ensure the decentralized storage of data, ROGin AI has improved the security and data privacy of the platform. At the same time, as a track that has been repeatedly hyped in the circle, the project itself has the expectation of market speculation.

2. Automated trading and risk management solve users' actual pain points. The platform provides automated trading tools and risk management systems to help users make better investment decisions. With large market fluctuations and high requirements for investors' own abilities, by providing relevant tools and risk control to assist users in investment, it is conducive to solving the investment pain points of users in the market.

3. The project has the concept of education and practical services. ROGin AI provides risk-free learning and practical opportunities through the metaverse sandbox environment, and users can learn investment strategies in a virtual environment. Perhaps it can become a potential attention project for education concept funds.

4. Intellectual property protection. By authenticating the ownership of each strategy through NFT, users' creativity and strategies are protected, intellectual property rights are respected, and the richness and diversity of platform strategies are promoted.

As a

ROGIN.AI

utility token, ROG is used to pay for various services provided by

ROGIN.AI

(such as NFT purchases), and the price of ROG can also be stabilized through token staking. The project team is constantly committed to value preservation, helping the ROG financial system maintain a stable market environment.

ROG publishes 200 million (i.e. 200,000,000), of which 40% is used for token sales, 20% is allocated to teams, locked for 2 years, allocated according to predetermined time periods, 10% is used for marketing, another 10% is allocated to consultants, and the remaining 20% is provided for reserves and operations.

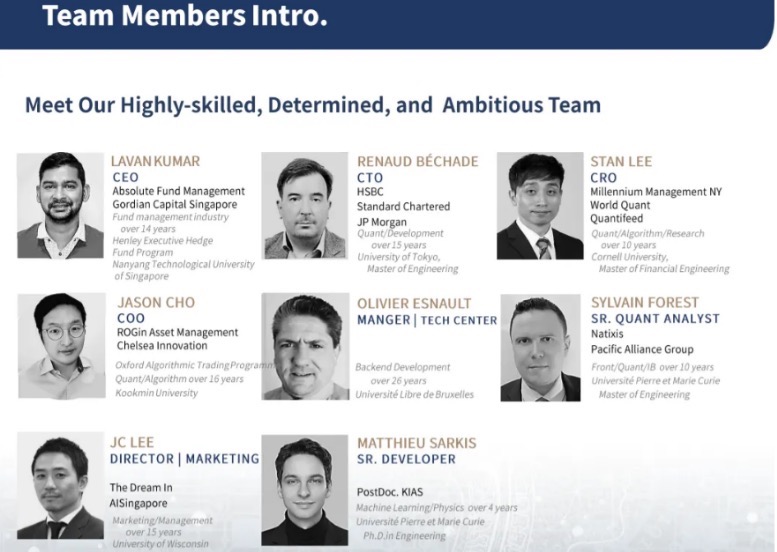

ROGin AI is led by an experienced team consisting of blockchain developers, AI experts, and senior professionals from Financial Marekt.

Rogin.AI

CEO (LAVAN KUMAR), has over 14 years of experience in the fund management industry. He has worked at Absolute Fund Management and Gordian Capital Singapore, and graduated from Nanyang Technological University in Singapore. With his expertise and leadership in fintech and asset management, Lavan Kumar has led

Rogin.AI

to achieve technological innovation and market expansion. Renaud Béchade is the Chief Technology Officer (CTO) of

Rogin.AI

. His career has covered several leading global financial institutions and has accumulated over 15 years of experience in quantitative analysis and development.

Rogin.AI

's Chief Risk Officer (CRO) is Stan Lee, who has over 10 years of experience in quantitative research and algorithmic trading. He has worked at Millennium Management New York and World Quant, focusing on quantitative analysis and research. Stan Lee has a Master's degree in Financial Engineering from Cornell University and is responsible for risk management and quantitative analysis in

Rogin.AI

.

The project previously raised early funds through ICO token pre-sale. Although the specific financing rounds and amounts have not been disclosed in detail, ROGin AI has gained some attention and trading volume in the market.

V. Market value expectations

With advanced artificial intelligence and blockchain technology, combined with a strong team background, broad market demand, diverse application scenarios, and a robust token economy model, ROGin AI has shown great development potential. ROGin AI is not only committed to providing professional investment services, but also strengthens risk management for users by providing educational services, which is highly praised by users. According to Coinmarketcap data, as of now, the market value of ROGin AI is about 18 million US dollars. Compared with the project fundamentals and the current market value of similar projects in the market, which can easily reach billions of US dollars, this market value is significantly underestimated. We have reason to believe that ROGin AI will have a huge increase in the future.

1. The cryptocurrency market is volatile, and investors need to be cautious about the risks brought by market fluctuations.

2. The regulatory environments in the cryptocurrency field are constantly changing, which may affect the development of projects.