Three Reasons Why Solana’s (SOL) Price Soared Past $160

SOL’s price surge is linked to recent crypto developments, notably involving Robinhood, Infinex, and MarginFi platforms.

Solana’s native token, SOL, surged by double digits within a 24-hour period. At the time of reporting, SOL is valued at $161 after tapping $165 earlier, with a 24-hour trading volume of $3.7 billion, marking an increase of 56.6%.

According to CoinGecko data , SOL is the fifth largest cryptocurrency, with a market cap of $73.1 billion.

Robinhood and Infinex’s Announcements

This surge in SOL’s price can be attributed to several recent developments within the crypto space, notably involving major platforms such as Robinhood, Infinex, and MarginFi.

In a May 15 announcement on Solana’s official X account, the Vlad Tenev-spearheaded firm announced that Robinhood Crypto, a digital asset trading platform, will launch a Solana-staking feature in Europe.

Just in: @RobinhoodCrypto EU now supports Solana staking, introducing their first-ever crypto staking product! 🔥

Learn more👇 https://t.co/aHXj1rgL8P

— Solana (@solana) May 15, 2024

“Robinhood Crypto is excited to announce a series of new features specifically designed for its customers in Europe, including staking, localized apps, crypto rewards for new customers, and updated Learn & Earn modules,” the company stated .

Through the Robinhood Crypto app, customers can now stake their Solana (SOL) holdings, granting them the opportunity to earn rewards while maintaining the flexibility to unstake as desired.

The company also announced a bonus program for new customers, wherein they can receive a 10% bonus on their net purchases during their initial 30 days on the platform, with bonuses disbursed in USDC stablecoins.

Infinex, a decentralized perpetual contract trading platform launched by Synthetix, has also announced its support for Solana.

Welcome @solana to the Infinex Account.

Solana support is now live.

🍊 https://t.co/SHkYi2Vdc7 pic.twitter.com/8WMwSxrJEE

— Infinex (@infinex_app) May 15, 2024

The integration of Solana into the Infinex platform opens up new opportunities for users, with the Total Value Locked (TVL) on the platform reaching 71,185,763.71 USDC since its launch. According to Infinex’s website , over 4.1 million USDC has already been locked in Solana.

Marginfi Reveals Solana’s First Liquidity Layer

In a May 15 announcement on X Marginfi, a decentralized portfolio margining protocol for trading on Solana revealed the L1 blockchain’s first Liquidity Layer.

Introducing Solana’s first Liquidity Layer

We’re excited to announce the evolution of marginfi: powering a radically new Layer for Performant DeFi

Here’s how we’re changing the game 👇 pic.twitter.com/I6rt0xD3wc

— marginfi ◼️ (@marginfi) May 15, 2024

Described as a new layer for performant DeFi, Marginfi’s Liquidity Layer offers a range of integrated, native yields, including natural staking yield through LST, native token yield through mrgnlend, and native stablecoin yield through YBX.

The surge in SOL’s price coincides with broader gains across the crypto market, which has risen by 4.7% in the last day to reach a total market capitalization of $2.5 trillion.

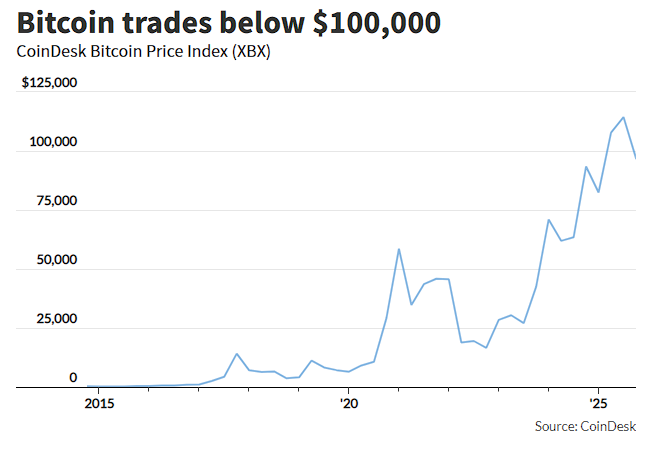

At writing time, Bitcoin (BTC) is currently trading at $66,000, marking a 5.7% increase in the last 24 hours. Ethereum (ETH) has experienced a 3.3% increase and is now trading at around $3,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Former Federal Reserve Governor Coogler faced an ethics investigation before resigning.

Nillion will gradually migrate to Ethereum.

Both gold and tech stocks have seen dip-buying, but only bitcoin remains "sluggish."

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.